When traders try to improve their results, they often jump straight to indicators, new setups, or refined entries.

But here’s the uncomfortable truth:

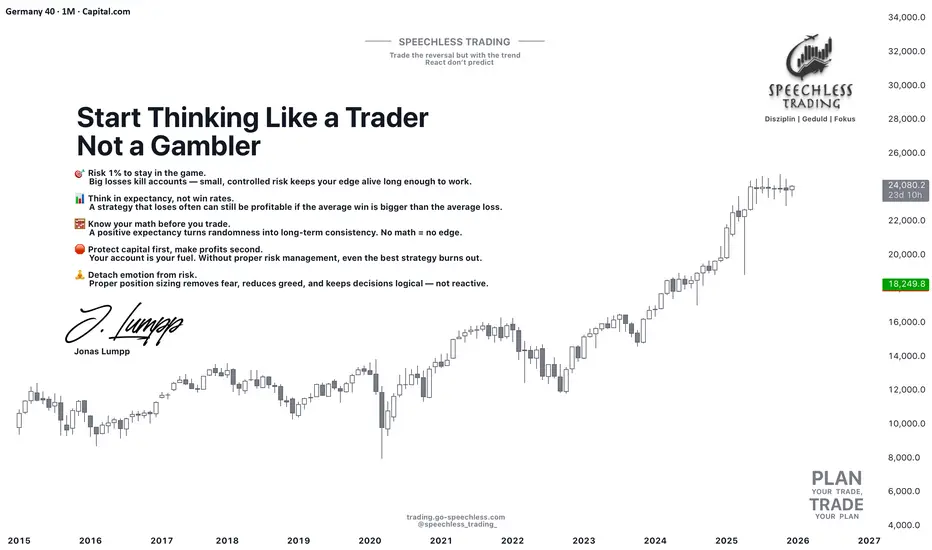

Most traders don’t fail because of their strategy — they fail because they don’t control their risk.

Let’s break down the two fundamentals that separate professionals from the 95%:

1️⃣ The 1% Rule: Your Built-In Survival System

Most beginners risk 5–20% per trade.

Professionals risk a maximum of 1%. Why?

Because the goal isn’t to win every trade — the goal is to stay in the game long enough for your edge to play out.

Risking only 1% means:

✔ A losing streak won’t destroy your account

✔ Your emotions stay stable and rational

✔ Your system has room to unfold statistically

✔ You avoid the #1 account killer: overexposure

Here’s the key mindset shift:

Risk management is not about fear — it’s about increasing your probability of long-term profitability.

2️⃣ Positive Expectancy: The Math Behind Winning Traders

Most traders judge a setup based on the last one or two trades.

Professionals evaluate it based on expectancy — the average profit per trade across a large sample.

Here’s a simple example:

Win rate: 40%

Average win: +60 pips

Average loss: –30 pips

Expectancy =

(0.4 × 60) – (0.6 × 30) = +6 pips per trade

Meaning:

You can lose more trades than you win — and still be profitable.

This is the principle beginners never understand.

A system with positive expectancy + 1% risk per trade becomes extremely powerful.

You stop caring about individual losses and start thinking in probabilities, not emotions.

The Truth Most Traders Miss

➡️ Risk management is the strategy.

➡️ Expectancy matters more than your win rate.

➡️ Risking 1% won’t make you rich fast — but it will prevent you from blowing up.

➡️ Trading becomes easier when you remove the illusion of certainty.

If traders spent more time understanding expectancy and risk instead of chasing “perfect setups,” half of their frustration would disappear overnight.

Thanks for reading — and have a disciplined start to your trading week!

If you found this post valuable, let me know in the comments.

I might create a full series on applied risk management and expectancy modeling.

Jonas Lumpp

Speechless Trading

Disclaimer: This tutorial is for educational purposes only and does not constitute financial advice. Its goal is to help traders develop a professional mindset, improve risk management, and make more structured trading decisions.

But here’s the uncomfortable truth:

Most traders don’t fail because of their strategy — they fail because they don’t control their risk.

Let’s break down the two fundamentals that separate professionals from the 95%:

1️⃣ The 1% Rule: Your Built-In Survival System

Most beginners risk 5–20% per trade.

Professionals risk a maximum of 1%. Why?

Because the goal isn’t to win every trade — the goal is to stay in the game long enough for your edge to play out.

Risking only 1% means:

✔ A losing streak won’t destroy your account

✔ Your emotions stay stable and rational

✔ Your system has room to unfold statistically

✔ You avoid the #1 account killer: overexposure

Here’s the key mindset shift:

Risk management is not about fear — it’s about increasing your probability of long-term profitability.

2️⃣ Positive Expectancy: The Math Behind Winning Traders

Most traders judge a setup based on the last one or two trades.

Professionals evaluate it based on expectancy — the average profit per trade across a large sample.

Here’s a simple example:

Win rate: 40%

Average win: +60 pips

Average loss: –30 pips

Expectancy =

(0.4 × 60) – (0.6 × 30) = +6 pips per trade

Meaning:

You can lose more trades than you win — and still be profitable.

This is the principle beginners never understand.

A system with positive expectancy + 1% risk per trade becomes extremely powerful.

You stop caring about individual losses and start thinking in probabilities, not emotions.

The Truth Most Traders Miss

➡️ Risk management is the strategy.

➡️ Expectancy matters more than your win rate.

➡️ Risking 1% won’t make you rich fast — but it will prevent you from blowing up.

➡️ Trading becomes easier when you remove the illusion of certainty.

If traders spent more time understanding expectancy and risk instead of chasing “perfect setups,” half of their frustration would disappear overnight.

Thanks for reading — and have a disciplined start to your trading week!

If you found this post valuable, let me know in the comments.

I might create a full series on applied risk management and expectancy modeling.

Jonas Lumpp

Speechless Trading

Disclaimer: This tutorial is for educational purposes only and does not constitute financial advice. Its goal is to help traders develop a professional mindset, improve risk management, and make more structured trading decisions.

For further questions and comments::

Whatsapp:

wa.me/message/QTFPLGKOMKANE1

Unsere kostenloser Discord Server:

mee6.xyz/i/lvbW2ClmUW

Whatsapp:

wa.me/message/QTFPLGKOMKANE1

Unsere kostenloser Discord Server:

mee6.xyz/i/lvbW2ClmUW

Publications connexes

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

For further questions and comments::

Whatsapp:

wa.me/message/QTFPLGKOMKANE1

Unsere kostenloser Discord Server:

mee6.xyz/i/lvbW2ClmUW

Whatsapp:

wa.me/message/QTFPLGKOMKANE1

Unsere kostenloser Discord Server:

mee6.xyz/i/lvbW2ClmUW

Publications connexes

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.