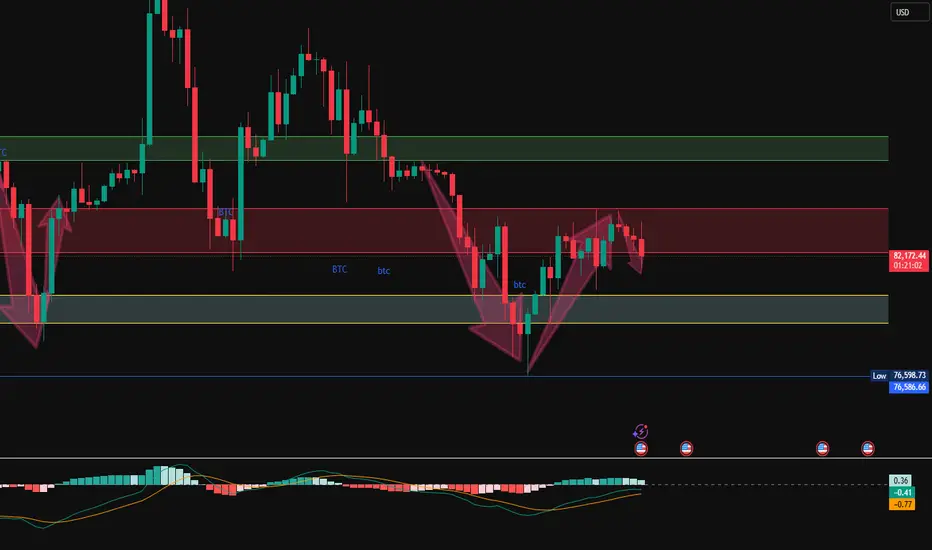

Bitcoin [BTC] has recovered significantly over the past 48 hours, increasing from lows below $76K to $84K. Despite these gains, Bitcoin risk-adjusted returns have continued to deteriorate, and as a result, Bitcoin’s Sharpe ratio has shown clear signs of weakness over the past year, indicating an increase in risk per unit of return. This reflects less efficient returns and greater market instability.

Likewise, despite the recent surge in prices, returns are becoming increasingly uncertain, a warning sign of potential market instability or price correction. Perceived market instability causes investors to sell to avoid potential losses. This behavior has become prevalent with both short-term and long-term holders. We can think of this as the net position change for long-term holders remaining negative for a sustained period of time.

Therefore, the prevailing market conditions have led to higher pressure on the ratio as Bitcoin has experienced greater seller pressure. Historically, extreme volatility has led to lower profitability for both short-term and long-term holders. However, the recent decline in the MVRV ratio provides some hopeful signs. Bitcoin MVRV is below 2, which marks a market low where buyers are beginning to re-enter the market, leading to a potential rebound.

As seen in the analysis, Bitcoin’s Sharpe ratio has been declining since March 2024. Therefore, even in cycles where BTC reaches multiple new time highs, the ratio will encounter significant pressure.

In this sense, if macroeconomic factors decrease, reducing volatility, we can see BTC price recovery. If this happens, BTC can reclaim $86K. However, if volatility continues, Bitcoin may drop below $80,000. BTCUSD

BTCUSD  BTCUSD

BTCUSD  BTCUSDT.P

BTCUSDT.P  BTCUSD

BTCUSD  BTCUSD

BTCUSD

Likewise, despite the recent surge in prices, returns are becoming increasingly uncertain, a warning sign of potential market instability or price correction. Perceived market instability causes investors to sell to avoid potential losses. This behavior has become prevalent with both short-term and long-term holders. We can think of this as the net position change for long-term holders remaining negative for a sustained period of time.

Therefore, the prevailing market conditions have led to higher pressure on the ratio as Bitcoin has experienced greater seller pressure. Historically, extreme volatility has led to lower profitability for both short-term and long-term holders. However, the recent decline in the MVRV ratio provides some hopeful signs. Bitcoin MVRV is below 2, which marks a market low where buyers are beginning to re-enter the market, leading to a potential rebound.

As seen in the analysis, Bitcoin’s Sharpe ratio has been declining since March 2024. Therefore, even in cycles where BTC reaches multiple new time highs, the ratio will encounter significant pressure.

In this sense, if macroeconomic factors decrease, reducing volatility, we can see BTC price recovery. If this happens, BTC can reclaim $86K. However, if volatility continues, Bitcoin may drop below $80,000.

This account has been restricted from publishing. Traders who continue to follow my signals and make profits can click 👉 to leave me a message. Telegram: t.me/BeckLedley

Channel: t.me/FcCygjylf

Channel entrance:t.me/FcCygjylf

Channel: t.me/FcCygjylf

Channel entrance:t.me/FcCygjylf

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

This account has been restricted from publishing. Traders who continue to follow my signals and make profits can click 👉 to leave me a message. Telegram: t.me/BeckLedley

Channel: t.me/FcCygjylf

Channel entrance:t.me/FcCygjylf

Channel: t.me/FcCygjylf

Channel entrance:t.me/FcCygjylf

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.