OPEN-SOURCE SCRIPT

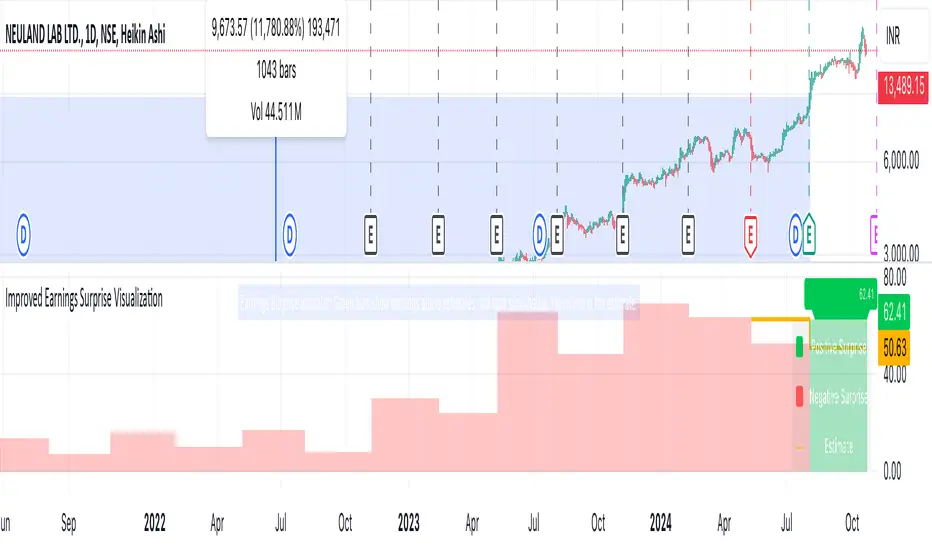

Earnings Surprise Indicator (Post-Earnings Announcement Drift)

What It Does:

- Displays a company's actual earnings vs. analysts' estimates over time

- Shows "earnings surprises" - when actual results beat or miss expectations

- Helps identify trends in a company's financial performance

How It Works:

- Green bars: Positive surprise (earnings beat estimates)

- Red bars: Negative surprise (earnings missed estimates)

- Yellow line: Analysts' earnings estimates

Correlation with Post Earnings Announcement Drift (PEAD): PEAD is the tendency for a stock's price to drift in the direction of an earnings surprise for several weeks or months after the announcement.

Why It Matters:

- Positive surprises often lead to upward price drift

- Negative surprises often lead to downward price drift

- This drift can create trading opportunities

How to Use It:

1. Spot Trends:

- Consistent beats may indicate strong company performance

- Consistent misses may signal underlying issues

2. Gauge Market Expectations:

- Large surprises may lead to significant price movements

3. Timing Decisions:

- Consider long positions after positive surprises

- Consider short positions or exits after negative surprises

4. Risk Management:

- Be cautious of reversal if the drift seems excessive

- Use in conjunction with other technical and fundamental analysis

Key Takeaways:

- Earnings surprises can be fundamental-leading indicators of future stock performance, especially when correlated with analyst projections

- PEAD suggests that markets often underreact to earnings news initially

- This indicator helps visualize the magnitude and direction of surprises

- It can be a valuable tool for timing entry and exit points in trades

- Displays a company's actual earnings vs. analysts' estimates over time

- Shows "earnings surprises" - when actual results beat or miss expectations

- Helps identify trends in a company's financial performance

How It Works:

- Green bars: Positive surprise (earnings beat estimates)

- Red bars: Negative surprise (earnings missed estimates)

- Yellow line: Analysts' earnings estimates

Correlation with Post Earnings Announcement Drift (PEAD): PEAD is the tendency for a stock's price to drift in the direction of an earnings surprise for several weeks or months after the announcement.

Why It Matters:

- Positive surprises often lead to upward price drift

- Negative surprises often lead to downward price drift

- This drift can create trading opportunities

How to Use It:

1. Spot Trends:

- Consistent beats may indicate strong company performance

- Consistent misses may signal underlying issues

2. Gauge Market Expectations:

- Large surprises may lead to significant price movements

3. Timing Decisions:

- Consider long positions after positive surprises

- Consider short positions or exits after negative surprises

4. Risk Management:

- Be cautious of reversal if the drift seems excessive

- Use in conjunction with other technical and fundamental analysis

Key Takeaways:

- Earnings surprises can be fundamental-leading indicators of future stock performance, especially when correlated with analyst projections

- PEAD suggests that markets often underreact to earnings news initially

- This indicator helps visualize the magnitude and direction of surprises

- It can be a valuable tool for timing entry and exit points in trades

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.