OPEN-SOURCE SCRIPT

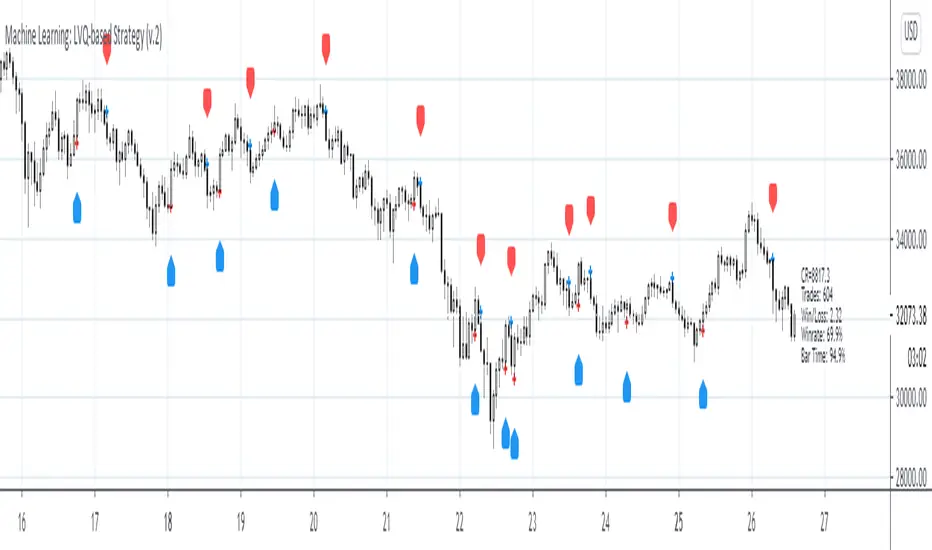

Mis à jour Machine Learning: LVQ-based Strategy

LVQ-based Strategy (FX and Crypto)

Description:

Learning Vector Quantization (LVQ) can be understood as a special case of an artificial neural network, more precisely, it applies a winner-take-all learning-based approach. It is based on prototype supervised learning classification task and trains its weights through a competitive learning algorithm.

Algorithm:

Initialize weights

Train for 1 to N number of epochs

- Select a training example

- Compute the winning vector

- Update the winning vector

Classify test sample

The LVQ algorithm offers a framework to test various indicators easily to see if they have got any *predictive value*. One can easily add cog, wpr and others.

Note: TradingViews's playback feature helps to see this strategy in action. The algo is tested with BTCUSD/1Hour.

Warning: This is a preliminary version! Signals ARE repainting.

***Warning***: Signals LARGELY depend on hyperparams (lrate and epochs).

Style tags: Trend Following, Trend Analysis

Asset class: Equities, Futures, ETFs, Currencies and Commodities

Dataset: FX Minutes/Hours+++/Days

Description:

Learning Vector Quantization (LVQ) can be understood as a special case of an artificial neural network, more precisely, it applies a winner-take-all learning-based approach. It is based on prototype supervised learning classification task and trains its weights through a competitive learning algorithm.

Algorithm:

Initialize weights

Train for 1 to N number of epochs

- Select a training example

- Compute the winning vector

- Update the winning vector

Classify test sample

The LVQ algorithm offers a framework to test various indicators easily to see if they have got any *predictive value*. One can easily add cog, wpr and others.

Note: TradingViews's playback feature helps to see this strategy in action. The algo is tested with BTCUSD/1Hour.

Warning: This is a preliminary version! Signals ARE repainting.

***Warning***: Signals LARGELY depend on hyperparams (lrate and epochs).

Style tags: Trend Following, Trend Analysis

Asset class: Equities, Futures, ETFs, Currencies and Commodities

Dataset: FX Minutes/Hours+++/Days

Notes de version

Minor fix.Notes de version

Minor edit.Notes de version

Added signal reversal. Some assets and TFs require inverting the signal. Mind this is the work in process.Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.