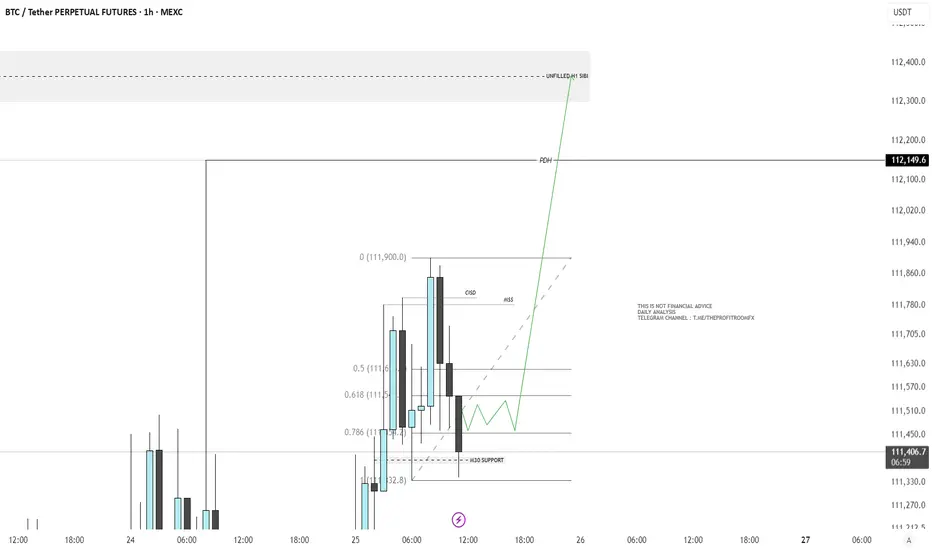

If the current H1 candle closes within the range of the previous candle, we may anticipate a potential movement toward the buy-side.

There is a notable draw on liquidity, with the Previous Daily High (PDH) and an unfilled H1 SIBI (Sell-Side Imbalance, Buy-Side Inefficiency) serving as key areas of interest.

Recently, we’ve also observed a Market Structure Shift (MSS) alongside a Change in Short-Term Direction (CISD)on the H1 timeframe.

In addition, price has shown multiple rejections from a support level formed by a M30 Fair Value Gap (FVG), reinforcing this area as a short-term accumulation zone.

Based on this structure, I expect price to accumulate between the 0.786 and 0.618 Fibonacci retracement levels, before redistributing toward our Draw On Liquidity (DOL).

Overall, my bias remains bearish, anticipating a sell opportunity after the SIBI imbalance has been filled and the PDH liquidity has been swept.

There is a notable draw on liquidity, with the Previous Daily High (PDH) and an unfilled H1 SIBI (Sell-Side Imbalance, Buy-Side Inefficiency) serving as key areas of interest.

Recently, we’ve also observed a Market Structure Shift (MSS) alongside a Change in Short-Term Direction (CISD)on the H1 timeframe.

In addition, price has shown multiple rejections from a support level formed by a M30 Fair Value Gap (FVG), reinforcing this area as a short-term accumulation zone.

Based on this structure, I expect price to accumulate between the 0.786 and 0.618 Fibonacci retracement levels, before redistributing toward our Draw On Liquidity (DOL).

Overall, my bias remains bearish, anticipating a sell opportunity after the SIBI imbalance has been filled and the PDH liquidity has been swept.

The Profit Room Fx

Telegram

t.me/theprofitroom_fx

Telegram Channel

t.me/theprofitroomfx

Email

theprofitroomfx@gmail.com

Telegram

t.me/theprofitroom_fx

Telegram Channel

t.me/theprofitroomfx

theprofitroomfx@gmail.com

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

The Profit Room Fx

Telegram

t.me/theprofitroom_fx

Telegram Channel

t.me/theprofitroomfx

Email

theprofitroomfx@gmail.com

Telegram

t.me/theprofitroom_fx

Telegram Channel

t.me/theprofitroomfx

theprofitroomfx@gmail.com

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.