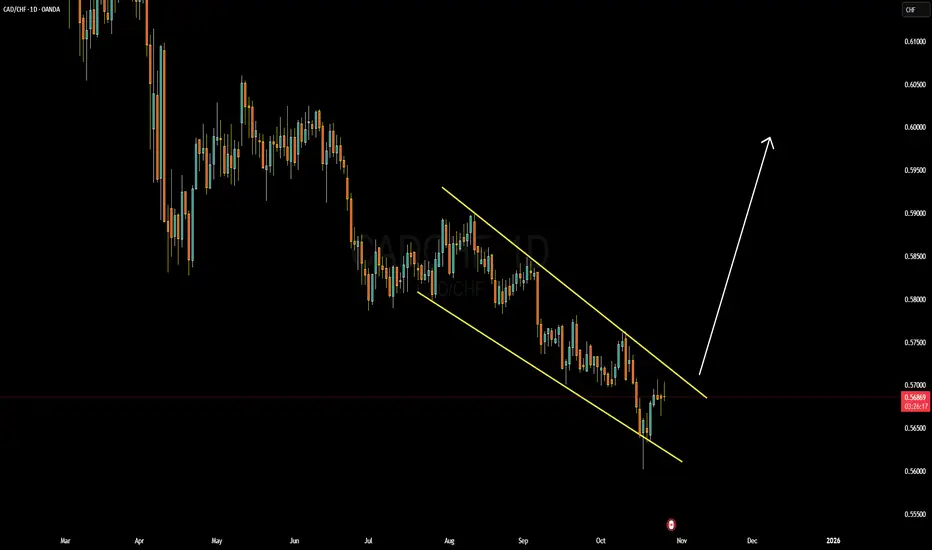

CADCHF is currently trading within a well-defined descending channel on the daily timeframe, signaling a prolonged bearish trend. However, the recent price action near the lower boundary of the channel suggests potential exhaustion of selling pressure and a possible reversal setup. The pair has bounced strongly from the lower trendline, and if price breaks above the upper boundary of this channel around the 0.5700–0.5720 zone, it could confirm a bullish breakout. This would open the door for a potential recovery toward 0.5900 and possibly 0.6000 in the coming weeks, offering attractive buy-side opportunities for swing traders.

Fundamentally, the Canadian dollar is gaining underlying strength due to rising oil prices and stable economic performance, while the Swiss franc remains under slight pressure as risk sentiment improves globally. The Bank of Canada’s firm stance on controlling inflation continues to support CAD, whereas the Swiss National Bank maintains a cautious policy approach, limiting CHF’s upside. With commodity demand increasing and global markets showing risk-on momentum, CADCHF could see renewed bullish energy if the technical breakout aligns with these macroeconomic factors.

Traders should watch for a clear daily close above 0.5720 for confirmation of a breakout from the falling channel. As long as the pair stays above 0.5650, the bullish scenario remains valid. This setup offers a potential reversal opportunity from a prolonged downtrend, positioning CADCHF for a profitable upside move in the medium term.

Fundamentally, the Canadian dollar is gaining underlying strength due to rising oil prices and stable economic performance, while the Swiss franc remains under slight pressure as risk sentiment improves globally. The Bank of Canada’s firm stance on controlling inflation continues to support CAD, whereas the Swiss National Bank maintains a cautious policy approach, limiting CHF’s upside. With commodity demand increasing and global markets showing risk-on momentum, CADCHF could see renewed bullish energy if the technical breakout aligns with these macroeconomic factors.

Traders should watch for a clear daily close above 0.5720 for confirmation of a breakout from the falling channel. As long as the pair stays above 0.5650, the bullish scenario remains valid. This setup offers a potential reversal opportunity from a prolonged downtrend, positioning CADCHF for a profitable upside move in the medium term.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.