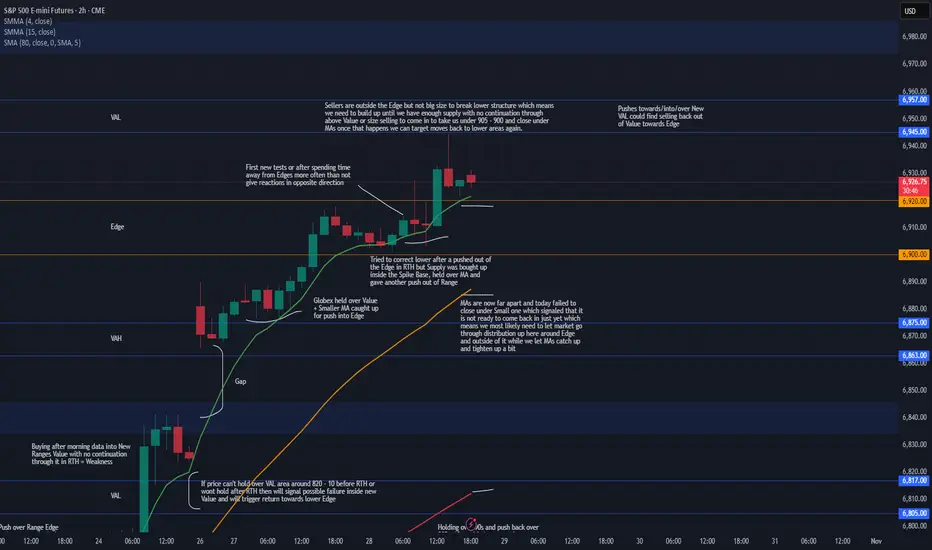

Sunday Globex gapped up and held over Value which when MAs caught up gave us pushes into upper Edge. Edge areas often act as reversal spots on first tests or after we spend time away from them which it tried to do today but we had good enough buying inside the Spike Base and smaller MA which took in the supply and gave a rotation out of Edge, as we saw price got into VAL and reversed without holding.

There really is no reason for this gap over the weekend and pretty much everyone knows it will be filled but what market showed us today is that we are not ready to come in to start the process for gap fill yet, we have no size operating up here with it being Month End and FOMC tomorrow, FOMC may shake things up BUT we may need to let market balance some up here around Edge and out of it before we can build up the supply and at the same time let MAs catch up to tighten up some to give us a better correction back in.

For now we can see price hold in and out of Edge with pushes towards above VAL and maybe even pushes into/over it BUT careful looking for too much continuation into new Value as we have sellers over the Edge and MAs are far which means any pushes towards/into/over could find their way back out of Value towards lower Edge and eventually once we have enough supply or Volume we can see a push back into/under lower Edge that wont come back out and instead either continue or start holding under to start the process to move for lower targets. For that we would need to be under 905 - 900 area or be able to catch good entry above the Edge and ride it in once market is ready for that.

To see acceptance in this new Range and see more strength we would need to see Medium MA catch up and get over the Edge to provide better support when price pushes into new Value so that it can push in and hold around VAL, until then Small MA acts as Support but it is not something to build big positions on. For now I will be focusing on reversal shorts until market can hold under Hourly MAs and under Intraday VWAP to give better continuation trades lower, I will most likely avoid longs here as they are very choppy and by waiting for good short entries eventually one of them will be the one that will take us back under the Edge and maybe even continue into lower Value so want to be ready for it unless we see strength inside this new Range and good holds over around above VAL.

We have month end coming up and FOMC tomorrow, FOMC is always important but Month end might be more of a mover this time around, being at ATHs so far extended away from MAs on Daily and GAP below we could see profit taking last few days which could give us the pressure to head back under the Edge which would also take stops to add extra pressure for when everyone will be trying to get out so will be watching for that either after FOMC or Thursday/Friday.

There really is no reason for this gap over the weekend and pretty much everyone knows it will be filled but what market showed us today is that we are not ready to come in to start the process for gap fill yet, we have no size operating up here with it being Month End and FOMC tomorrow, FOMC may shake things up BUT we may need to let market balance some up here around Edge and out of it before we can build up the supply and at the same time let MAs catch up to tighten up some to give us a better correction back in.

For now we can see price hold in and out of Edge with pushes towards above VAL and maybe even pushes into/over it BUT careful looking for too much continuation into new Value as we have sellers over the Edge and MAs are far which means any pushes towards/into/over could find their way back out of Value towards lower Edge and eventually once we have enough supply or Volume we can see a push back into/under lower Edge that wont come back out and instead either continue or start holding under to start the process to move for lower targets. For that we would need to be under 905 - 900 area or be able to catch good entry above the Edge and ride it in once market is ready for that.

To see acceptance in this new Range and see more strength we would need to see Medium MA catch up and get over the Edge to provide better support when price pushes into new Value so that it can push in and hold around VAL, until then Small MA acts as Support but it is not something to build big positions on. For now I will be focusing on reversal shorts until market can hold under Hourly MAs and under Intraday VWAP to give better continuation trades lower, I will most likely avoid longs here as they are very choppy and by waiting for good short entries eventually one of them will be the one that will take us back under the Edge and maybe even continue into lower Value so want to be ready for it unless we see strength inside this new Range and good holds over around above VAL.

We have month end coming up and FOMC tomorrow, FOMC is always important but Month end might be more of a mover this time around, being at ATHs so far extended away from MAs on Daily and GAP below we could see profit taking last few days which could give us the pressure to head back under the Edge which would also take stops to add extra pressure for when everyone will be trying to get out so will be watching for that either after FOMC or Thursday/Friday.

Note

Above VAL provided good selling last two days to bring price back inside the Edge. Todays RTH opened inside the Edge and under Hourly MAs which gave us good selling out of Edge towards VAH below, once market held under 905 - 900 area we got afternoon continuation push inside Value into the GAP but gap was not filled as we had Larger 2hr MA there right at 55 - 51 area where we tagged and bounced from end of day once selling stopped. As discussed when this was posted we needed to build up and let MAs catch up then get under them so they can push the price lower which is what we got last two days with todays selling probably end of the Month profit taking before month end and the weekend. Since we pushed away from Value today and were not able to fill the gap this tells us that market may need to build up more before we make another attempt at it. Tomorrow being month end and Friday we may not see that attempt and instead could see balancing over Value around the Edge and maybe even attempt to push out out 20s again since we should see end of the week covering BUT careful looking for too much continuation on longs or too high of moves since we still have supply above us and weakness which means they can continue being choppy and selling can be coming in at random spots, may not be strong selling to break structure and continue lower but good enough to come back in and take stops if you are long. For now we had trend change on 30m and 1hr time frames, not full trend changes on 2hr and 4hr those only got correction under Smaller/Medium MAs towards large one with 4hr Large MA still being far away down at 790s area. I will be careful and patient with entries tomorrow and most likely will continue looking for short entries but will also be aggressive to exit them on pushes lower since if we will have covering that will mean smaller moves and possibly quick bounces away so need to trade defensive. We are currently inside 915 - 875 Intraday Range with 900 - 890 +/- being its Value so we can see balancing around the Value and any pushes out of Value or its Edge over 915 - 20s could find their way back in, and selling under 890 - 885 could see longer consolidations and then pop back into Value so we could either see pushes above that will come in or instead selling under Value that wont get continuation and instead return to value at some point later in the day. For us to see lower continuation at this point we would need to build supply under 890 - 85 and then get under 875 area and be under VWAP and MAs, if not careful looking for big sells. Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.