October 2nd - 6:08am EST

*Before reading this trade plan, IF, you did not read yesterdays, or the Weekly Trade Plan take the time to read it first! (You can see both posts in the related publication section) *

If my posts provide quality information that has helped you with your trading journey. Feel free to boost it for others to find and learn, also!

My daily trade plan and real-time notes that I post are intended for myself to easily be able to go back and review my plan and how I did from an execution perspective.

------------------------------------------------------------------------------------------------------------

Yesterday, we had a massive squeeze higher as retail investors where bearish due to the US Government Shut Down, while Institutions had been building positions since last week by accumulating between 6626 & 6680. 6705 was the major bull/bear line and we finally got the massive squeeze higher. We have met our initially weekly targets and now we need a pullback to find opportunities to enter higher. Over the past 2 days, most contracts that have been traded are sitting above the 6755 range. What does that mean? Institutions have been selling to retail traders as everyone does not want to have FOMO!

Will a rug pull come today or tomorrow? I have NO idea when Institutions are planning to "pull the rug" and grab liquidity. What I will focus on is the areas that I can grab points, IF/When that occurs. If you have traded ES for any length of time, when ES sells off, it sells fast, and you do not want to try and pick a bottom.

Let's discuss today's plan!

The overnight session has been distributing between the overnight low at 6755 and the high of 6775. While price can just keep going higher today. We need to be prepared to find quality setups that we can grab points from. As you know, I am a long ES trader that focuses on Failed Breakdowns. That is how Institutions accumulate. The ideal long for me, is the prior days low to flush and recover, or another well-defined area that produced a nice bounce/rally.

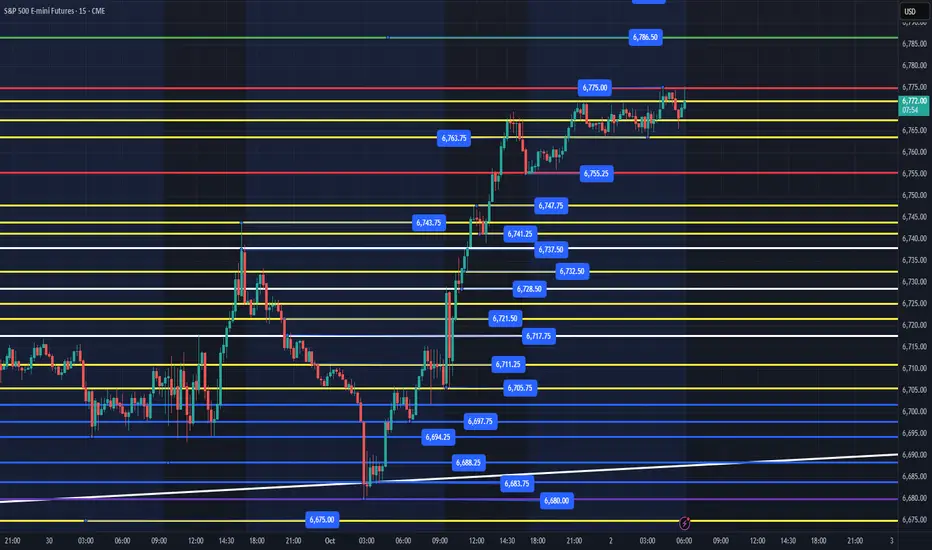

Key Support Levels - 6763, 6755, 6747, 6737, 6728, 6717, 6705, 6697, 6688, 6680

Key Resistance Levels - 6775, 6786, 6792, 6801+

While typing this Daily Trade Plan, I am hearing in the background CNBC talking head guests about how bullish they are! I do believe that Institutions will let the NYSE open and continue to sell to retail investors that could push prices up to the key resistance levels above. We need to be patient and see what price does in the first hour of the open.

The key levels that I will be looking for to grab points.

1. 6755 is a level that should have some liquidity to at least grab some points to the 6764 level.

2. 6744-46 could produce some points and any reclaim of 6755 would be bullish

2. 6737 is a level that could produce some points to retest the 6755 overnight low

3. 6728 is a level that needs to hold, or we will start to have a warning sign that price needs much lower prices.

4. 6717 is last level that price needs to hold or we could flush all the way down to retest the 6705, 6697 and 6680 levels.

IF, price rallies above 6775 (Overnight High) and then comes back into this range after the NYSE Open, and ES starts to sell off fast, DO NOT try and RUSH into grab points. Wait for it to build a base at one of the levels outlined above.

Personally, I will not be chasing price at these levels and will be patiently waiting on price to come back to one of the levels outlined for an opportunity to take some points today.

I will post an update around 10am EST.

---------------------------------------------------------------------------------------------------------------------

Couple of things about how I color code my levels.

1. Purple shows the weekly Low

2. Red shows the current overnight session High/Low (time of post)

3. Blue shows the previous day's session Low (also other previous day's lows)

4. Yellow Levels are levels that show support and resistance levels of interest.

5. White shows the trendline from the August lows

*Before reading this trade plan, IF, you did not read yesterdays, or the Weekly Trade Plan take the time to read it first! (You can see both posts in the related publication section) *

If my posts provide quality information that has helped you with your trading journey. Feel free to boost it for others to find and learn, also!

My daily trade plan and real-time notes that I post are intended for myself to easily be able to go back and review my plan and how I did from an execution perspective.

------------------------------------------------------------------------------------------------------------

Yesterday, we had a massive squeeze higher as retail investors where bearish due to the US Government Shut Down, while Institutions had been building positions since last week by accumulating between 6626 & 6680. 6705 was the major bull/bear line and we finally got the massive squeeze higher. We have met our initially weekly targets and now we need a pullback to find opportunities to enter higher. Over the past 2 days, most contracts that have been traded are sitting above the 6755 range. What does that mean? Institutions have been selling to retail traders as everyone does not want to have FOMO!

Will a rug pull come today or tomorrow? I have NO idea when Institutions are planning to "pull the rug" and grab liquidity. What I will focus on is the areas that I can grab points, IF/When that occurs. If you have traded ES for any length of time, when ES sells off, it sells fast, and you do not want to try and pick a bottom.

Let's discuss today's plan!

The overnight session has been distributing between the overnight low at 6755 and the high of 6775. While price can just keep going higher today. We need to be prepared to find quality setups that we can grab points from. As you know, I am a long ES trader that focuses on Failed Breakdowns. That is how Institutions accumulate. The ideal long for me, is the prior days low to flush and recover, or another well-defined area that produced a nice bounce/rally.

Key Support Levels - 6763, 6755, 6747, 6737, 6728, 6717, 6705, 6697, 6688, 6680

Key Resistance Levels - 6775, 6786, 6792, 6801+

While typing this Daily Trade Plan, I am hearing in the background CNBC talking head guests about how bullish they are! I do believe that Institutions will let the NYSE open and continue to sell to retail investors that could push prices up to the key resistance levels above. We need to be patient and see what price does in the first hour of the open.

The key levels that I will be looking for to grab points.

1. 6755 is a level that should have some liquidity to at least grab some points to the 6764 level.

2. 6744-46 could produce some points and any reclaim of 6755 would be bullish

2. 6737 is a level that could produce some points to retest the 6755 overnight low

3. 6728 is a level that needs to hold, or we will start to have a warning sign that price needs much lower prices.

4. 6717 is last level that price needs to hold or we could flush all the way down to retest the 6705, 6697 and 6680 levels.

IF, price rallies above 6775 (Overnight High) and then comes back into this range after the NYSE Open, and ES starts to sell off fast, DO NOT try and RUSH into grab points. Wait for it to build a base at one of the levels outlined above.

Personally, I will not be chasing price at these levels and will be patiently waiting on price to come back to one of the levels outlined for an opportunity to take some points today.

I will post an update around 10am EST.

---------------------------------------------------------------------------------------------------------------------

Couple of things about how I color code my levels.

1. Purple shows the weekly Low

2. Red shows the current overnight session High/Low (time of post)

3. Blue shows the previous day's session Low (also other previous day's lows)

4. Yellow Levels are levels that show support and resistance levels of interest.

5. White shows the trendline from the August lows

Note

9:42am - UpdateI mentioned above in my plan - "IF, price rallies above 6775 (Overnight High) and then comes back into this range after the NYSE Open, and ES starts to sell off fast, DO NOT try and RUSH into grab points. Wait for it to build a base at one of the levels outlined above."

We rallied to 6782, came back into the range and now 6755 needs to flush and reclaim as our first spot to look at getting some points. IF, price continues to flush with a big red candle on the 15 min chart. As I say, wait for a base to build and make sure you take profits level to level. IF, price reclaims 6775, that would be bullish to continue higher up the levels. Do not be a hero and try to pick any level as the "level" we find support at.

Note

10:38am - Update Price is trying to form a base here at 6756 level and IF, it clears 6764 we can test 6775. IF, price loses 6756, any reclaim of 6758 should be bullish to move up the levels. IF, price loses 6756 then we should test the 6743 level and should be a good spot for an attempt back up since it is a support from yesterday.

Note

11:10am- UpdateI took a position at 6746.75 and have a stop at 6744. I will sell 1/2 at 6756 and keep a runner with stop at 6746. We could come back and retest the 6744 level and if it holds, could show us that this is a good support. Any reclaim of 6758 is bullish back up the levels.

Note

11:25am - I have sold 1/2 position at 6752 and my stop is at 6747. I think price can continue higher but wanted to grab some points and leave a runner. We reclaimed the 6747 level and price action looked good with us holding the 6744 level on the back test. Take profits at each level. I will be closing out my runner at 6756 , IF, it gets there!Note

11:34am - UpdateMy runner stopped out at 6747. Green trade and will look for price to test lower levels as discussed in the trade plan. I could have left my runner at 6744, but didn't want to lose any points that I have gained today. IF, price loses 6744, we probably will test 6731, then 6719, IF, it does not hold. Still looking at points at the lower levels and will see price action before I do my last trade of the day. I am leaning that 6719 will a good spot!

Note

12:38pm - UpdateI am still waiting on a further pullback at the levels we discussed. Price has been trying to reclaim the 6756 level. IF, price loses 6744 then we should continue to the lower levels. IF, price can't reclaim the overnight low, I will wait patiently for the 6719 level as discussed. IF, price does reclaim 6764, I will look for a possible back test of that level to continue higher. My lean is we fade this afternoon and possibly find liquidity between 2pm-4pm to grab some points.

Note

3:20pm - UpdatePrice did rally up past 6764 and is about to back test the level. I will personally not be taking a position as I still think we sell off this afternoon into the close. I could be totally wrong, but it is not worth trying a back test trade at the end of the day. Tomorrow is the "Jobs Friday" that I have no idea what can happen due to the government shutdown. Since, 6741 will be the low of the day, any flush tomorrow/overnight and reclaim of that level will be a good spot to try for points higher. I will still be looking for 6731-33 and 6719 as key areas that we can get points in the overnight session or tomorrow. I will post my daily trade plan by 6am EST.

Publications connexes

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Publications connexes

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.