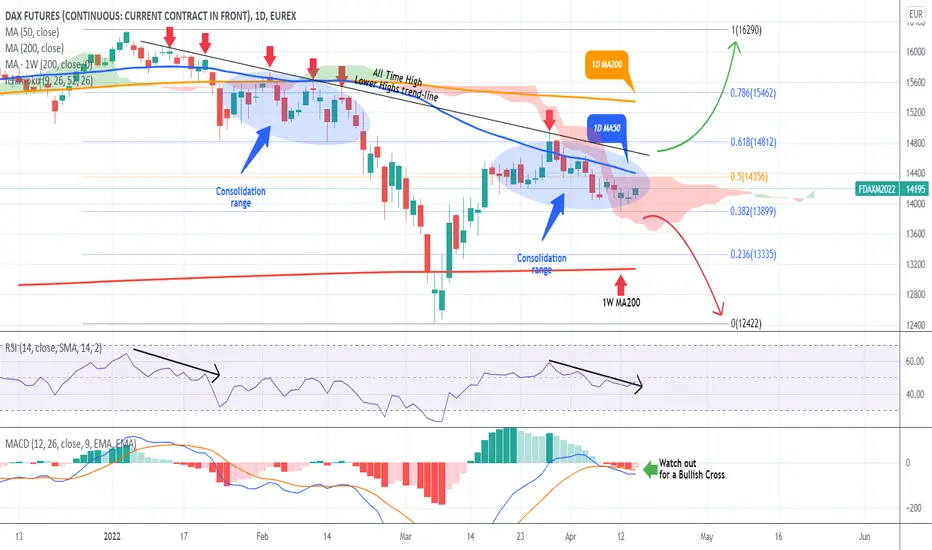

Not much have changed on the German stock market (DAX) as the price is still consolidating within the All Time High Lower Highs trend-line of January (Resistance) and the 0.382 Fibonacci retracement level (Support).

Being below the 1D MA50 (blue trend-line) as well, scalpers may find some value trading the 1D MA50 - 0.382 Fib Zone but a lower risk trade lies on the break-out, either above the Lower Highs trend-line (bullish targeting the 1D MA200 (orang trend-line) and then the All Time High) or below the 0.382 Fib (bearish towards the 0.236 Fib/ 1W MA200 (red trend-line) and then the March lows.

While the 1D RSI favors the downside, keep an eye on the MACD for a Bullish Cross, which will shift the sentiment upwards. Also on a longer-term horizon, this looks like an Inverse Head and Shoulders on a declining trend with the ATH Lower Highs trend-line as the Resistance to break. And that is typically a bottom pattern calling for a trend reversal to the upside.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

Being below the 1D MA50 (blue trend-line) as well, scalpers may find some value trading the 1D MA50 - 0.382 Fib Zone but a lower risk trade lies on the break-out, either above the Lower Highs trend-line (bullish targeting the 1D MA200 (orang trend-line) and then the All Time High) or below the 0.382 Fib (bearish towards the 0.236 Fib/ 1W MA200 (red trend-line) and then the March lows.

While the 1D RSI favors the downside, keep an eye on the MACD for a Bullish Cross, which will shift the sentiment upwards. Also on a longer-term horizon, this looks like an Inverse Head and Shoulders on a declining trend with the ATH Lower Highs trend-line as the Resistance to break. And that is typically a bottom pattern calling for a trend reversal to the upside.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.