🐖 Supply & Demand Dynamics

Production Trends: The USDA forecasts 2025 U.S. pork production at 28.5 billion pounds, a 2.7% increase from 2024, driven by higher slaughter levels and improved litter rates .

Export Outlook: Pork exports are projected to rise by 3% to 7.3 billion pounds in 2025, with strong demand from Mexico and South Korea offsetting declines in China and Japan .

Domestic Demand: U.S. pork consumption remains flat, averaging 50 lbs per person annually, while beef and chicken consumption have increased .

Oklahoma Farm Report

💰 Cost & Profitability Factors

Feed Costs: Feed costs are projected to decrease by 13% in 2025, reaching a feed cost index of 87, due to lower corn and soybean meal prices .

Producer Margins: Lower feed costs and stable hog prices are expected to improve producer margins, with average hog prices projected at $65 per cwt in 2025 .

🌍 Trade & Geopolitical Considerations

Tariffs and Trade Disputes: Ongoing trade tensions, particularly with China, have led to a 125% tariff on U.S. pork exports, causing producers like Smithfield Foods to pivot to other markets .

Export Diversification: U.S. pork producers are focusing on expanding exports to countries like Mexico, South Korea, and Canada to mitigate risks associated with trade disputes .

Oklahoma Farm Report

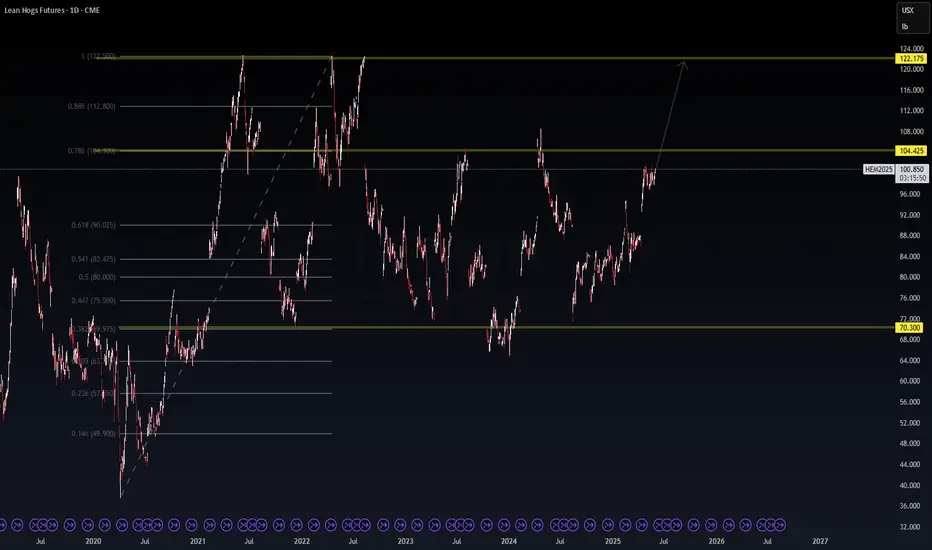

📈 Technical Analysis Recap

Breakout Confirmation: Price has broken above the descending trendline and reclaimed key Fibonacci levels (0.786 and 0.886), indicating bullish momentum.

Target Zones: Immediate target at 101.600 (1.618 Fib extension), with further targets at 101.875 (1.786), 101.975 (1.854), and 102.225 (2.0).

Support Level: Key support at 99.925; a break below this level could invalidate the bullish structure.

📊 Probability Assessment

Scenario Probability Rationale

Bullish Continuation 65% Supported by technical breakout, lower feed costs, and stable export demand.

Sideways Consolidation 25% Potential due to flat domestic demand and global trade uncertainties.

Bearish Reversal 10% Possible if key support at 99.925 fails or if export markets deteriorate further.

📌 Conclusion

The Lean Hogs Futures market exhibits a favorable setup for a bullish continuation, supported by technical indicators and macroeconomic factors such as lower feed costs and stable export demand. However, traders should remain vigilant of potential risks, including trade disputes and domestic demand stagnation.

Production Trends: The USDA forecasts 2025 U.S. pork production at 28.5 billion pounds, a 2.7% increase from 2024, driven by higher slaughter levels and improved litter rates .

Export Outlook: Pork exports are projected to rise by 3% to 7.3 billion pounds in 2025, with strong demand from Mexico and South Korea offsetting declines in China and Japan .

Domestic Demand: U.S. pork consumption remains flat, averaging 50 lbs per person annually, while beef and chicken consumption have increased .

Oklahoma Farm Report

💰 Cost & Profitability Factors

Feed Costs: Feed costs are projected to decrease by 13% in 2025, reaching a feed cost index of 87, due to lower corn and soybean meal prices .

Producer Margins: Lower feed costs and stable hog prices are expected to improve producer margins, with average hog prices projected at $65 per cwt in 2025 .

🌍 Trade & Geopolitical Considerations

Tariffs and Trade Disputes: Ongoing trade tensions, particularly with China, have led to a 125% tariff on U.S. pork exports, causing producers like Smithfield Foods to pivot to other markets .

Export Diversification: U.S. pork producers are focusing on expanding exports to countries like Mexico, South Korea, and Canada to mitigate risks associated with trade disputes .

Oklahoma Farm Report

📈 Technical Analysis Recap

Breakout Confirmation: Price has broken above the descending trendline and reclaimed key Fibonacci levels (0.786 and 0.886), indicating bullish momentum.

Target Zones: Immediate target at 101.600 (1.618 Fib extension), with further targets at 101.875 (1.786), 101.975 (1.854), and 102.225 (2.0).

Support Level: Key support at 99.925; a break below this level could invalidate the bullish structure.

📊 Probability Assessment

Scenario Probability Rationale

Bullish Continuation 65% Supported by technical breakout, lower feed costs, and stable export demand.

Sideways Consolidation 25% Potential due to flat domestic demand and global trade uncertainties.

Bearish Reversal 10% Possible if key support at 99.925 fails or if export markets deteriorate further.

📌 Conclusion

The Lean Hogs Futures market exhibits a favorable setup for a bullish continuation, supported by technical indicators and macroeconomic factors such as lower feed costs and stable export demand. However, traders should remain vigilant of potential risks, including trade disputes and domestic demand stagnation.

Note

I guess no one like pigs! WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.