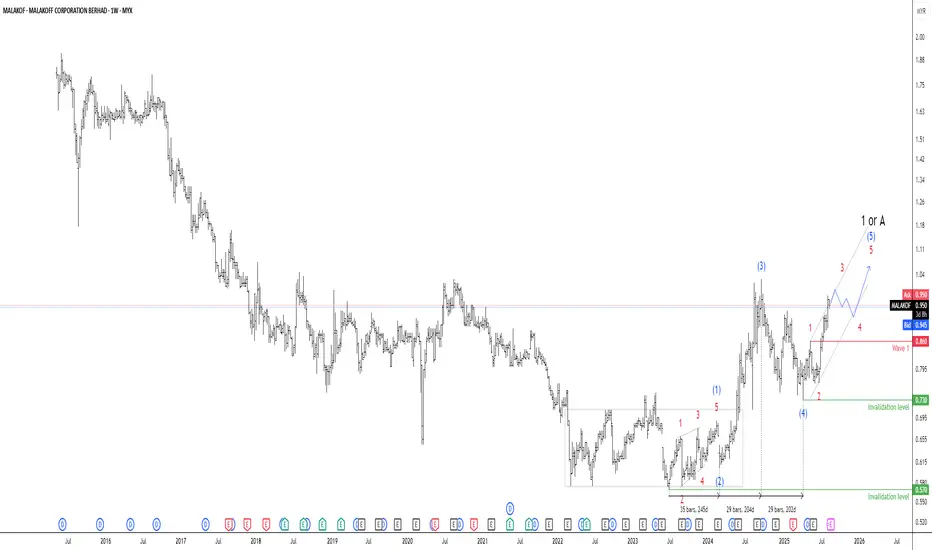

📈 Wave Structure Overview

• The chart shows a completed corrective phase, likely Wave A or 1, followed by a clear impulsive sequence: (1), (2), (3), (4), (5).

• Within that impulse, sub-waves 1–5 are well-defined, suggesting a strong Wave (3) extension — typically the most powerful leg in an Elliott sequence.

• The current price action around MYR 0.945 appears to be in the final stages of Wave (5), or possibly transitioning into a larger Wave 3 or C, depending on your primary count.

🛡️ Invalidation Zone

• RM 0.860 marks the Wave 1 level, which Wave 4 must not breach under standard Elliott Wave rules.

• A drop below RM 0.860 would invalidate the current impulsive count, suggesting that Wave (5) is either truncated or the structure is corrective rather than impulsive.

• This level serves as a critical risk management threshold for traders tracking the bullish scenario.

🔍 Interpretation

• The wave count suggests bullish continuation, especially if price holds above RM 0.860.

• The chart shows a completed corrective phase, likely Wave A or 1, followed by a clear impulsive sequence: (1), (2), (3), (4), (5).

• Within that impulse, sub-waves 1–5 are well-defined, suggesting a strong Wave (3) extension — typically the most powerful leg in an Elliott sequence.

• The current price action around MYR 0.945 appears to be in the final stages of Wave (5), or possibly transitioning into a larger Wave 3 or C, depending on your primary count.

🛡️ Invalidation Zone

• RM 0.860 marks the Wave 1 level, which Wave 4 must not breach under standard Elliott Wave rules.

• A drop below RM 0.860 would invalidate the current impulsive count, suggesting that Wave (5) is either truncated or the structure is corrective rather than impulsive.

• This level serves as a critical risk management threshold for traders tracking the bullish scenario.

🔍 Interpretation

• The wave count suggests bullish continuation, especially if price holds above RM 0.860.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.