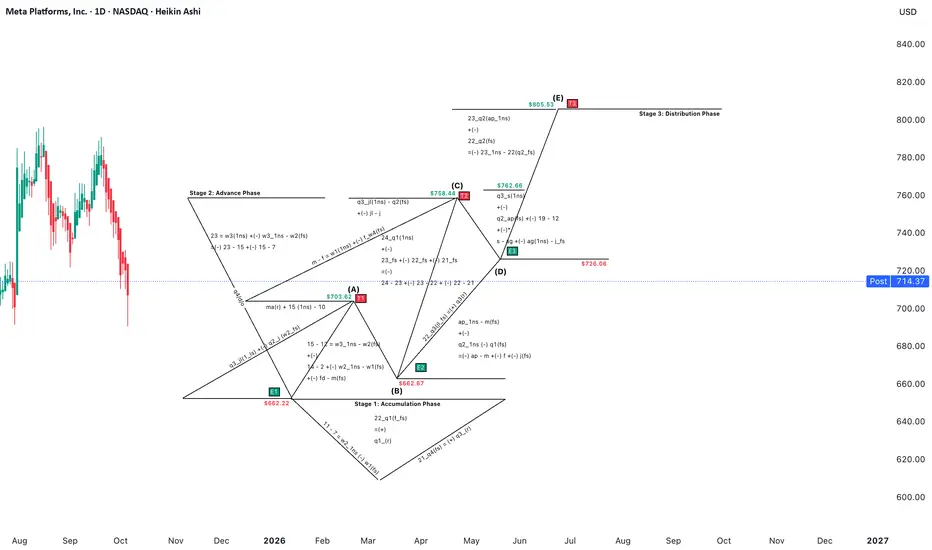

Meta Platforms, Inc. (NASDAQ: META) Forecast Model -2025 Distribution Cycle

This forecast presents a three - stage market structure built using the proprietary distribution cycle model, highlighting key accumulation, advance, and distribution phases for Meta Platforms, Inc.

Stage 1: Accumulation Phase

• Primary Support Zone: $662.22 – $662.67

• This phase defines the structural low (Point B) following compression and accumulation. It represents the foundation for the next cycle’s upward advance.

Stage 2: Advance Phase

• Initial Target (T1 - Trade 1): $703.62

• Secondary Target (T2 - Trade 2): $758.44

• The advance phase reflects breakout momentum from the accumulation base, establishing successive higher targets as liquidity expands.

Stage 3: Distribution Phase

• Expansion Level (E3 - Entry 3): $762.66

• Final Distribution Target (T3 - Trade 3): $806.53

• The distribution structure finalises around the $805–$810 zone, where exhaustion and profit-taking are expected before a potential cyclical reset.

Cycle Insights

• The forecast maintains a three - wave expansion sequence (A–B–C–D–E), with each level defined by ratio alignment and stage transition.

• Current market structure positions Meta within the lower boundary of Stage 2, preparing for advance resumption toward mid- cycle resistance near $758.44.

• The base cycle low at $662.22 remains the structural support for the ongoing 2025 distribution cycle.

This forecast maps out a complete cyclical sequence: an initial distribution at upper resistance zones, a corrective drop into the primary accumulation base, a secondary accumulation before the next advance, and a final upside move into higher distribution territory.

Disclaimer:

The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

This forecast presents a three - stage market structure built using the proprietary distribution cycle model, highlighting key accumulation, advance, and distribution phases for Meta Platforms, Inc.

Stage 1: Accumulation Phase

• Primary Support Zone: $662.22 – $662.67

• This phase defines the structural low (Point B) following compression and accumulation. It represents the foundation for the next cycle’s upward advance.

Stage 2: Advance Phase

• Initial Target (T1 - Trade 1): $703.62

• Secondary Target (T2 - Trade 2): $758.44

• The advance phase reflects breakout momentum from the accumulation base, establishing successive higher targets as liquidity expands.

Stage 3: Distribution Phase

• Expansion Level (E3 - Entry 3): $762.66

• Final Distribution Target (T3 - Trade 3): $806.53

• The distribution structure finalises around the $805–$810 zone, where exhaustion and profit-taking are expected before a potential cyclical reset.

Cycle Insights

• The forecast maintains a three - wave expansion sequence (A–B–C–D–E), with each level defined by ratio alignment and stage transition.

• Current market structure positions Meta within the lower boundary of Stage 2, preparing for advance resumption toward mid- cycle resistance near $758.44.

• The base cycle low at $662.22 remains the structural support for the ongoing 2025 distribution cycle.

This forecast maps out a complete cyclical sequence: an initial distribution at upper resistance zones, a corrective drop into the primary accumulation base, a secondary accumulation before the next advance, and a final upside move into higher distribution territory.

Disclaimer:

The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.