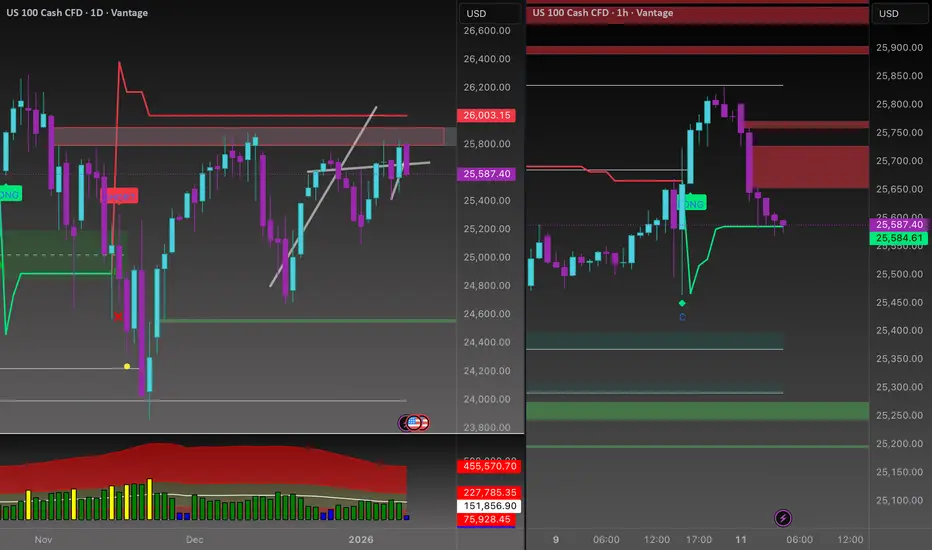

Higher timeframe structure remains distributional, with price sitting in premium territory.

• Daily OG supply active at 25,950 – 26,050

• No daily acceptance above 26,050

• Upside lacks displacement and follow-through

• HTF context favors sell-side positioning

Above here is not trend continuation, it’s liquidity hunting.

• 1H OG supply: 25,720 – 25,820

• Strong rejection and structure breakdown below 25,720

• Bullish move shows exhaustion, not accumulation

• Sell-side liquidity stacked below 25,500

This is how smart money sells into strength.

Primary Bias: Bearish below 25,720

Expectation:

• Pullbacks into 25,650 – 25,750 are sell opportunities

• Target: liquidity sweep toward 25,400 – 25,300

• Extended downside opens 25,150 if momentum accelerates

Invalidation / Cancellation:

• Clean 1H close and acceptance above 25,820

• Daily close above 26,050 cancels the sell idea completely

Until that happens, rallies are for selling, not chasing.

Publications connexes

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Publications connexes

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.