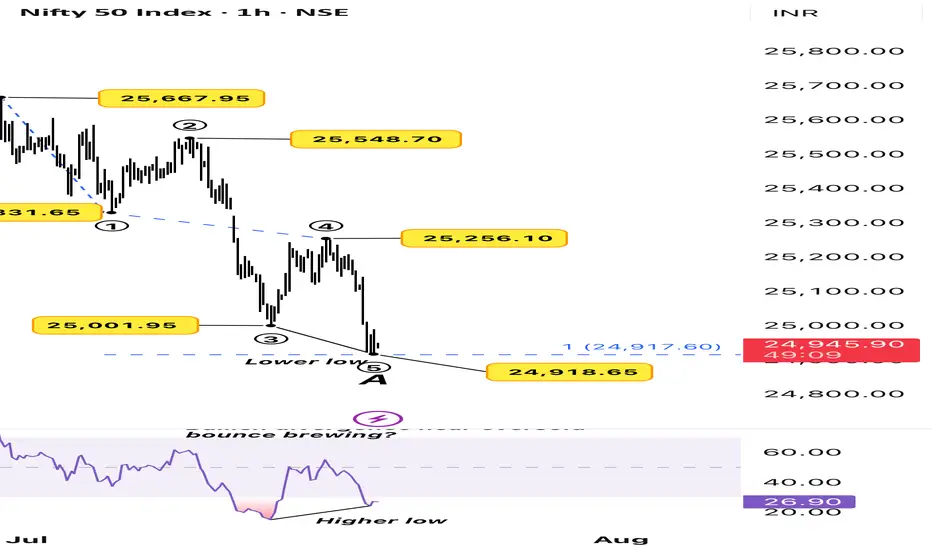

The Nifty 50 has completed a 5-wave impulse on the 1-hour timeframe, with Wave ⑤ tagging a fresh lower low at 24,918, just under the previous swing.

While price made a lower low, RSI made a higher low, forming a bullish divergence just above the oversold zone. This often indicates weakening bearish momentum and a potential for a short-term bounce or a larger correction depending on the context.

We now have:

• ✅ A completed 5-wave(wave A) decline

• ✅ Price at a key support zone

• ✅ RSI divergence adding confluence

If this structure holds, we may have completed wave A and be entering Wave B of correction.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

While price made a lower low, RSI made a higher low, forming a bullish divergence just above the oversold zone. This often indicates weakening bearish momentum and a potential for a short-term bounce or a larger correction depending on the context.

We now have:

• ✅ A completed 5-wave(wave A) decline

• ✅ Price at a key support zone

• ✅ RSI divergence adding confluence

If this structure holds, we may have completed wave A and be entering Wave B of correction.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

WaveXplorer | Elliott Wave insights

📊 X profile: @veerappa89

📊 X profile: @veerappa89

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

WaveXplorer | Elliott Wave insights

📊 X profile: @veerappa89

📊 X profile: @veerappa89

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.