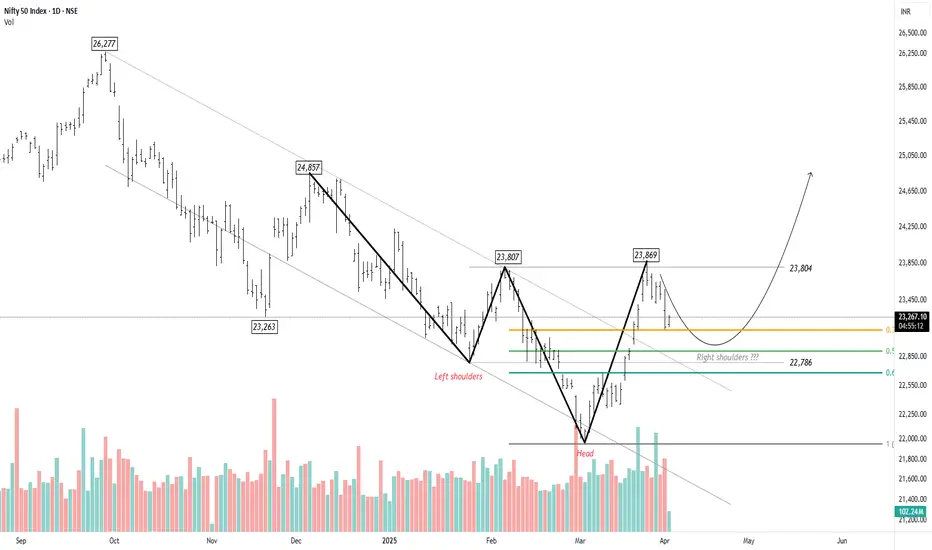

Nifty recently hit a low of 21,905, marking a key reversal point in the trend. A well-defined Head and Shoulders pattern is emerging, with the right shoulder currently forming. The ongoing pullback has retraced to the 38.2% level, but there is potential for it to extend towards the 50% mark at 22,906. However, the upward move appears to be losing momentum, with buying interest remaining subdued.

Based on the chart, the head of the pattern signifies the beginning of a new impulse wave. This appears to be the fourth wave within the larger first wave. Once Nifty completes this corrective phase, the fifth wave is expected to present a trading opportunity. If wave equality holds, Nifty could potentially rise to 24,857.

Based on the chart, the head of the pattern signifies the beginning of a new impulse wave. This appears to be the fourth wave within the larger first wave. Once Nifty completes this corrective phase, the fifth wave is expected to present a trading opportunity. If wave equality holds, Nifty could potentially rise to 24,857.

To eliminate these delays and give priority access to serious traders, we’ve launched an exclusive Premium EDU + Wave Count Group.

💰 Annual Fee: $115

BUY NOW: t.me/moneydictators/148

Lifetime Free - t.me/moneydictators

💰 Annual Fee: $115

BUY NOW: t.me/moneydictators/148

Lifetime Free - t.me/moneydictators

Publications connexes

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

To eliminate these delays and give priority access to serious traders, we’ve launched an exclusive Premium EDU + Wave Count Group.

💰 Annual Fee: $115

BUY NOW: t.me/moneydictators/148

Lifetime Free - t.me/moneydictators

💰 Annual Fee: $115

BUY NOW: t.me/moneydictators/148

Lifetime Free - t.me/moneydictators

Publications connexes

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.