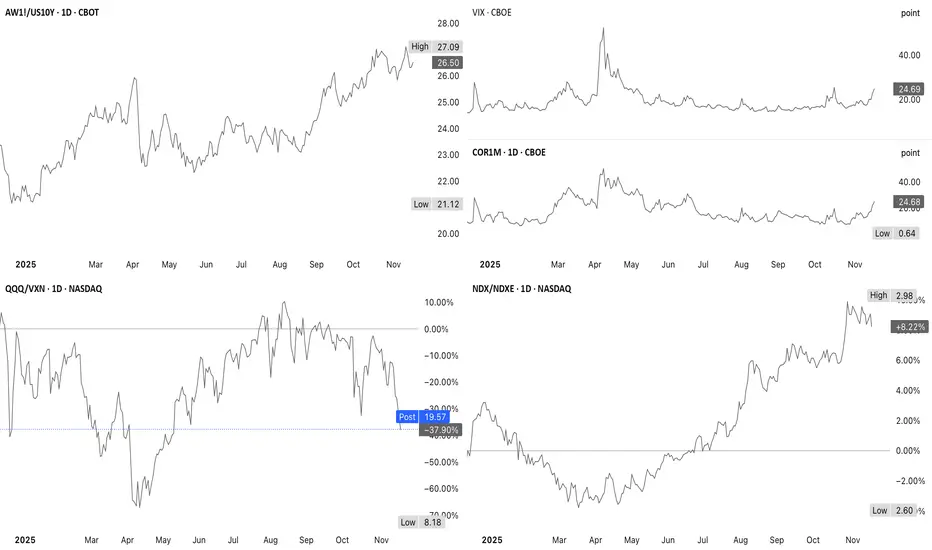

1. AW1!/US10Y shows commodities trending higher

2. VIX & COR1M shows volatility is high

3. QQQ/VXN is still extremely washed-out

4. NDX/NDXE shows breadth remains strong

This is event-driven fear layered on top of a still-healthy breadth structure

A rebound toward $610-$620 remains the more probable post-NVDA path

QQQ

QQQ  SPY

SPY  NVDA

NVDA

- A rising broad commodity index means inflationary pressure is accelerating & this tends to push yields up, which pressures tech multiples

- Higher commodity prices is a drag on QQQ

2. VIX & COR1M shows volatility is high

- COR1M ripping harder than VIX indicates front-loaded hedging & is event-driven

- After NVDA earnings, volatility normally compresses sharply unless the event is disastrous

- This is supportive for a post-event equity bounce

3. QQQ/VXN is still extremely washed-out

- QQQ underperforming implied volatility by a wide margin is historically associated with short-term exhaustion lows

- This extreme is more consistent with fear/hedging overshoot

- This favors a bounce unless VXN continues ripping

4. NDX/NDXE shows breadth remains strong

- Even with commodities rising (inflation pressure), equal-weight Nasdaq is firmly outperforming

- When inflation becomes a serious tech headwind, breadth usually collapses, not expands

- Breadth made higher highs, is still in an uptrend & turned bearish

This is event-driven fear layered on top of a still-healthy breadth structure

- NVDA event hedging elevates COR1M/VIX, QQQ dips into support ($598-$602)

- Volatility crush after earnings if NVDA isn’t disastrous results in a bounce toward $610-$620; however, rising commodities means the upside is less explosive & may fade sooner

A rebound toward $610-$620 remains the more probable post-NVDA path

I am not a licensed professional & these posts are for informational purposes only, not financial advice

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

I am not a licensed professional & these posts are for informational purposes only, not financial advice

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.