🔎 Higher Timeframe (4H) Outlook

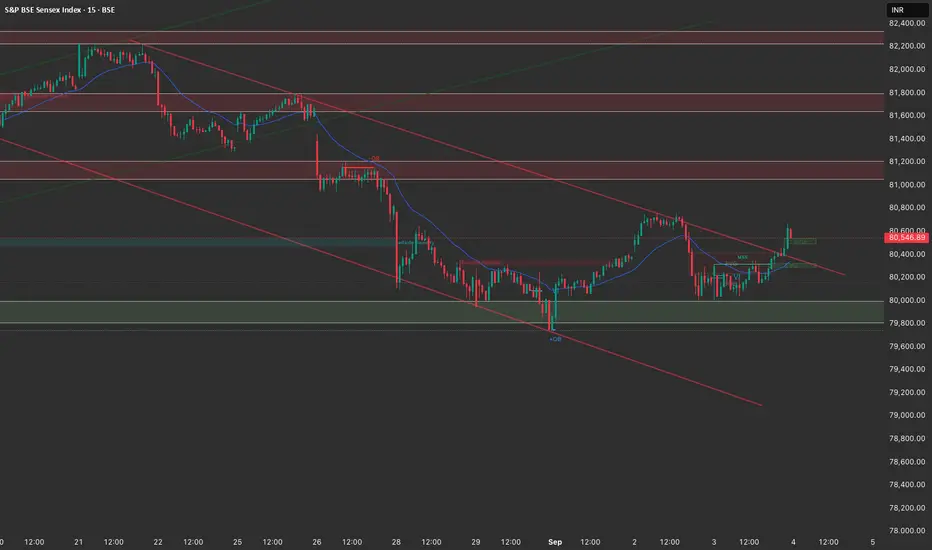

Price rebounded from the 79,800–80,000 demand zone (green box) with multiple wicks showing liquidity grab.

A descending channel breakout attempt is visible → short-term momentum turning bullish.

Overhead supply zones:

80,800–81,000 (immediate)

81,600–81,800 (major resistance + FVG)

Clean Fair Value Gap (FVG) left behind near 80,200–80,350, which may get retested before continuation.

✅ Bias (4H): Mild bullish → until 79,800 holds, upside targets are 80,800 and 81,600.

⏱ Intraday (1H) Structure

Price has broken the short-term downtrend line and reclaimed above 80,500.

Multiple FVGs:

Below current price: 80,300–80,400 → acts as intraday demand.

Above price: 80,800–81,000 → likely first magnet.

Liquidity pools visible above 81,200–81,400 (previous order block).

✅ Bias (1H): Bullish intraday → unless we break below 80,200.

🎯 Scalping / Execution (15M)

Market structure shift (MSS) confirmed after breaking the previous swing high.

Current consolidation around 80,500 after a sharp move.

OB + FVG support: 80,300–80,400 → potential re-entry area.

Next liquidity targets:

80,800 (first test/sell zone)

81,200+ if momentum continues.

📌 Trade Plan for Sensex

Long Setup

Entry: Around 80,300–80,400 (FVG / demand retest)

SL: Below 79,950 (demand invalidation)

Targets:

T1: 80,800

T2: 81,200

T3: 81,600–81,800

Short Setup (countertrend / if rejection seen)

Entry: 80,800–81,000 zone

SL: Above 81,250

Targets:

T1: 80,400

T2: 80,000

⚖️ Summary

Bias: Short-term bullish (demand at 79,800 held).

Key Support: 79,800–80,000.

Key Resistance: 80,800–81,000 → major decision point.

Strategy: Buy dips above 80,200; fade rallies only if rejection at supply.

Price rebounded from the 79,800–80,000 demand zone (green box) with multiple wicks showing liquidity grab.

A descending channel breakout attempt is visible → short-term momentum turning bullish.

Overhead supply zones:

80,800–81,000 (immediate)

81,600–81,800 (major resistance + FVG)

Clean Fair Value Gap (FVG) left behind near 80,200–80,350, which may get retested before continuation.

✅ Bias (4H): Mild bullish → until 79,800 holds, upside targets are 80,800 and 81,600.

⏱ Intraday (1H) Structure

Price has broken the short-term downtrend line and reclaimed above 80,500.

Multiple FVGs:

Below current price: 80,300–80,400 → acts as intraday demand.

Above price: 80,800–81,000 → likely first magnet.

Liquidity pools visible above 81,200–81,400 (previous order block).

✅ Bias (1H): Bullish intraday → unless we break below 80,200.

🎯 Scalping / Execution (15M)

Market structure shift (MSS) confirmed after breaking the previous swing high.

Current consolidation around 80,500 after a sharp move.

OB + FVG support: 80,300–80,400 → potential re-entry area.

Next liquidity targets:

80,800 (first test/sell zone)

81,200+ if momentum continues.

📌 Trade Plan for Sensex

Long Setup

Entry: Around 80,300–80,400 (FVG / demand retest)

SL: Below 79,950 (demand invalidation)

Targets:

T1: 80,800

T2: 81,200

T3: 81,600–81,800

Short Setup (countertrend / if rejection seen)

Entry: 80,800–81,000 zone

SL: Above 81,250

Targets:

T1: 80,400

T2: 80,000

⚖️ Summary

Bias: Short-term bullish (demand at 79,800 held).

Key Support: 79,800–80,000.

Key Resistance: 80,800–81,000 → major decision point.

Strategy: Buy dips above 80,200; fade rallies only if rejection at supply.

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.