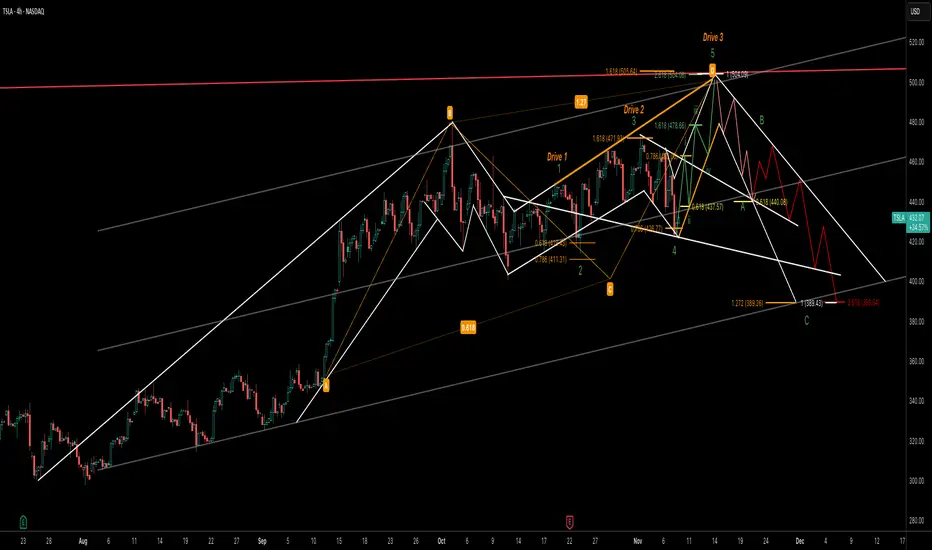

This chart highlights multiple harmonic and Elliott structures aligning for a potential bullish extension in Tesla (TSLA). A well-defined ABCD pattern and 3-Drive pattern suggest momentum building toward the $500 zone, supported by Fibonacci projections and channel resistance.

The current wave structure points to an imminent 5-wave advance, likely completing the “Drive 3” and pattern D confluence area near $500–505. Following that move, a corrective pullback (ABC) is anticipated, possibly retesting prior support near $440–400.

Key elements featured:

ABCD completion zone: around $500

3-Drive pattern: confirming exhaustion at upper trendline

Elliott 5-wave projection: short-term bullish continuation

Possible corrective phase: after the final wave up

📈 Watching for confirmation of Wave iii and potential exhaustion signals near $500 before considering downside setups.

The current wave structure points to an imminent 5-wave advance, likely completing the “Drive 3” and pattern D confluence area near $500–505. Following that move, a corrective pullback (ABC) is anticipated, possibly retesting prior support near $440–400.

Key elements featured:

ABCD completion zone: around $500

3-Drive pattern: confirming exhaustion at upper trendline

Elliott 5-wave projection: short-term bullish continuation

Possible corrective phase: after the final wave up

📈 Watching for confirmation of Wave iii and potential exhaustion signals near $500 before considering downside setups.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.