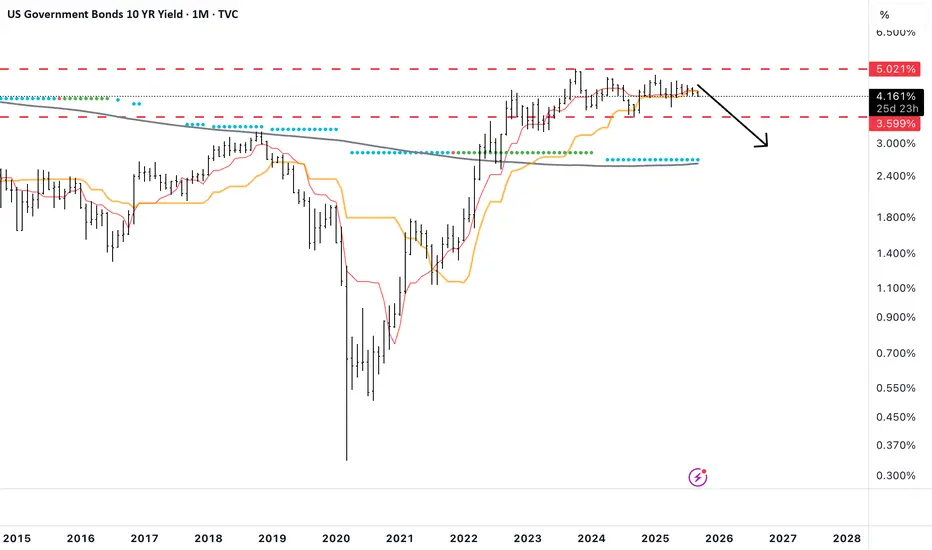

Yields are sniffing out the recession that is already in motion

Everyone keeps talking about how rates cuts are going to push long term yields higher because that is what happened last September, etc, etc.

IMO the bond market is realizing that the US Economy is already in a very weak state and it will adjust accordingly.

It's highly doubtful that rates will "crash" but the 10 year could hit 2.5-2.7% (near the 200 SMA) and it would still be in an overall long term bullish structure.

IMO the bond market is realizing that the US Economy is already in a very weak state and it will adjust accordingly.

It's highly doubtful that rates will "crash" but the 10 year could hit 2.5-2.7% (near the 200 SMA) and it would still be in an overall long term bullish structure.

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.