Éducation

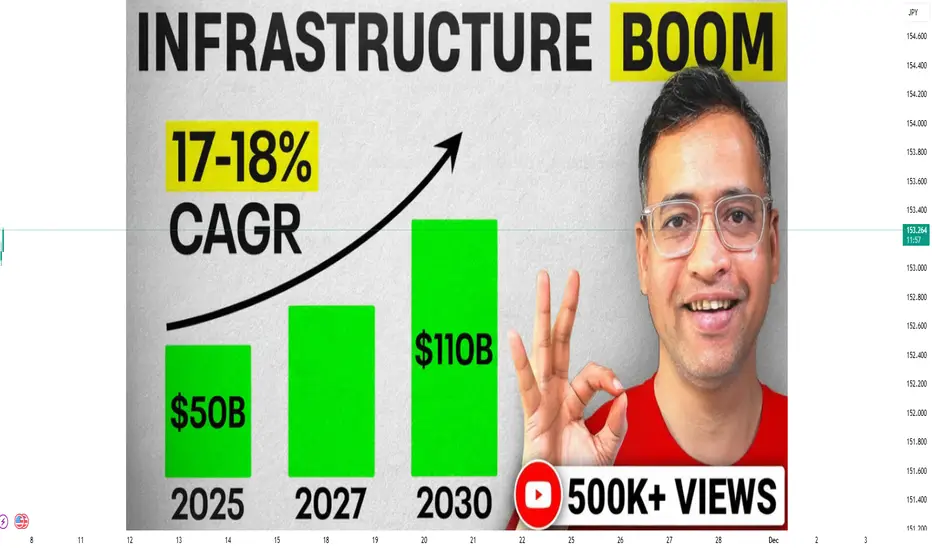

Introduction: India’s Infrastructure Revolution and Market Impac

1. The Infrastructure Revolution: A Historical Turning Point

Infrastructure has always been the backbone of economic growth. However, India’s earlier attempts at large-scale infrastructure expansion often suffered from policy bottlenecks, inadequate funding, and execution delays. The recent decade marks a fundamental shift — from fragmented planning to integrated development.

Under initiatives like the National Infrastructure Pipeline (NIP), PM Gati Shakti, and Smart Cities Mission, India is modernizing its roads, railways, ports, and energy networks with unprecedented scale and coordination. The NIP alone envisions an investment of over ₹111 lakh crore across sectors such as energy, transport, water, and social infrastructure by 2025.

This surge is not limited to government spending. Public-Private Partnerships (PPPs), sovereign wealth funds, and global investors are increasingly financing infrastructure projects, drawn by India’s growth potential and improving regulatory frameworks.

2. Policy Push: The Catalyst for Change

The infrastructure revolution owes much to strategic policy direction. The government has implemented structural reforms aimed at accelerating project execution, reducing red tape, and ensuring transparency in tendering and funding.

Some of the most influential initiatives include:

PM Gati Shakti National Master Plan (2021): A digital platform that integrates 16 ministries to ensure coordinated planning and implementation of infrastructure projects.

Bharatmala and Sagarmala Projects: Focused on improving road and port connectivity to enhance logistics efficiency.

Dedicated Freight Corridors (DFCs): Designed to ease congestion on railway lines and boost freight movement.

Smart Cities and AMRUT: Targeted towards urban transformation through improved utilities, mobility, and housing.

National Monetization Pipeline (NMP): Monetizing existing assets to fund new projects, reducing fiscal burden while attracting private capital.

Together, these programs mark a shift from infrastructure “creation” to infrastructure “optimization,” ensuring long-term economic dividends.

3. Economic Impact: A Multiplier for Growth

The infrastructure push has a ripple effect across the economy. Each rupee invested in infrastructure generates a multiplier impact of approximately 2.5 to 3 times on GDP.

Here’s how:

Employment Generation: Large-scale projects create millions of direct and indirect jobs, particularly in construction, manufacturing, and logistics sectors.

Improved Productivity: Efficient logistics and transport reduce travel time, lower costs, and boost competitiveness for businesses.

Urbanization and Real Estate Growth: Enhanced connectivity fuels urban expansion, leading to increased demand for housing, retail, and industrial spaces.

Investment Magnet: Stable infrastructure attracts foreign direct investment (FDI), especially in sectors like manufacturing, renewable energy, and technology parks.

Regional Development: Projects in tier-2 and tier-3 cities are reducing regional disparities, promoting balanced growth.

According to estimates, infrastructure could contribute nearly 10% to India’s GDP by 2030, transforming the nation into a global manufacturing and logistics hub.

4. Stock Market Impact: The Infrastructure Theme Takes Center Stage

India’s stock markets have responded positively to this infrastructure wave. Investors see this as a multi-decade opportunity across several interconnected sectors.

a. Core Infrastructure Stocks

Companies in construction, engineering, and heavy machinery — such as Larsen & Toubro, IRB Infrastructure, KNR Construction, and NBCC — are witnessing strong order inflows and improved margins.

b. Cement and Steel

Demand for building materials is soaring. Cement majors like UltraTech, ACC, and Dalmia Bharat, and steel producers like Tata Steel and JSW Steel, have benefited from the government’s spending spree.

c. Capital Goods and Equipment

Firms like Siemens, ABB India, and Cummins are riding the wave of infrastructure electrification, metro projects, and industrial automation.

d. Logistics and Transport

The development of multi-modal transport networks boosts companies in logistics and warehousing, such as Container Corporation of India, TCI Express, and Adani Ports.

e. Ancillary Sectors

Power, renewable energy, and urban development firms are integral beneficiaries of the infrastructure ecosystem. For instance, NTPC, Power Grid Corporation, and Adani Energy Solutions are vital to India’s grid modernization.

Thus, the infrastructure theme has become one of the strongest investment narratives in India’s equity market, attracting both domestic and foreign institutional investors.

5. Financing the Boom: Innovative Funding Models

Financing India’s infrastructure ambitions requires creativity beyond traditional budget allocations. To address this, the government and private sector are leveraging multiple instruments:

Infrastructure Investment Trusts (InvITs) and Real Estate Investment Trusts (REITs) are unlocking liquidity by monetizing assets like roads, power transmission lines, and commercial real estate.

Green Bonds and Masala Bonds are mobilizing international capital for sustainable projects.

Sovereign Wealth Funds and Pension Funds from countries like Canada, Singapore, and the UAE are increasingly investing in long-term Indian infrastructure assets.

Development Finance Institutions (DFIs), such as the National Bank for Financing Infrastructure and Development (NaBFID), provide specialized financing for large-scale projects.

This diversification of funding sources ensures that India’s infrastructure revolution is both financially sustainable and globally integrated.

6. Challenges on the Road Ahead

Despite remarkable progress, several challenges persist:

Execution Delays: Land acquisition, environmental clearances, and litigation can slow project timelines.

Cost Overruns: Inflation in construction materials and logistical inefficiencies can erode profitability.

Private Participation Risks: Uncertain returns and policy changes can deter private investment.

Skill Shortage: The sector still faces a lack of skilled labor, especially in high-tech construction and project management.

Environmental Concerns: Balancing rapid development with ecological sustainability remains a critical challenge.

Addressing these issues will require continued policy refinement, institutional strengthening, and technological innovation.

7. Future Outlook: India’s Infrastructure Decade

Looking ahead, the 2020s are likely to be remembered as India’s “Infrastructure Decade.” The focus is now expanding beyond traditional construction to include digital infrastructure, green mobility, renewable energy, and sustainable cities.

Digital India and 5G rollout will connect even the remotest regions, enabling inclusive growth.

Renewable energy projects, targeting 500 GW by 2030, will redefine India’s energy landscape.

High-speed rail networks and metro expansion will modernize urban transport.

Smart logistics parks and industrial corridors will make India a global manufacturing powerhouse.

With urbanization accelerating and global investors viewing India as a growth engine, infrastructure will continue to be the foundation of the nation’s economic narrative.

Conclusion: The Market’s Golden Era of Infrastructure

India’s infrastructure revolution is more than a construction story — it’s a transformation of the nation’s economic DNA. It intertwines policy reform, financial innovation, and market opportunity. As roads, railways, ports, and data highways connect the nation, they are also connecting investors to one of the most promising growth stories in the world.

The infrastructure-led growth model not only drives GDP expansion but also deepens India’s capital markets, generates employment, and enhances global competitiveness. For investors and policymakers alike, India’s infrastructure revolution represents both an opportunity and a responsibility — to build a future that is strong, sustainable, and inclusive.

In essence, this is not merely an infrastructure boom; it’s the building of “New India” — brick by brick, byte by byte, and vision by vision.

Infrastructure has always been the backbone of economic growth. However, India’s earlier attempts at large-scale infrastructure expansion often suffered from policy bottlenecks, inadequate funding, and execution delays. The recent decade marks a fundamental shift — from fragmented planning to integrated development.

Under initiatives like the National Infrastructure Pipeline (NIP), PM Gati Shakti, and Smart Cities Mission, India is modernizing its roads, railways, ports, and energy networks with unprecedented scale and coordination. The NIP alone envisions an investment of over ₹111 lakh crore across sectors such as energy, transport, water, and social infrastructure by 2025.

This surge is not limited to government spending. Public-Private Partnerships (PPPs), sovereign wealth funds, and global investors are increasingly financing infrastructure projects, drawn by India’s growth potential and improving regulatory frameworks.

2. Policy Push: The Catalyst for Change

The infrastructure revolution owes much to strategic policy direction. The government has implemented structural reforms aimed at accelerating project execution, reducing red tape, and ensuring transparency in tendering and funding.

Some of the most influential initiatives include:

PM Gati Shakti National Master Plan (2021): A digital platform that integrates 16 ministries to ensure coordinated planning and implementation of infrastructure projects.

Bharatmala and Sagarmala Projects: Focused on improving road and port connectivity to enhance logistics efficiency.

Dedicated Freight Corridors (DFCs): Designed to ease congestion on railway lines and boost freight movement.

Smart Cities and AMRUT: Targeted towards urban transformation through improved utilities, mobility, and housing.

National Monetization Pipeline (NMP): Monetizing existing assets to fund new projects, reducing fiscal burden while attracting private capital.

Together, these programs mark a shift from infrastructure “creation” to infrastructure “optimization,” ensuring long-term economic dividends.

3. Economic Impact: A Multiplier for Growth

The infrastructure push has a ripple effect across the economy. Each rupee invested in infrastructure generates a multiplier impact of approximately 2.5 to 3 times on GDP.

Here’s how:

Employment Generation: Large-scale projects create millions of direct and indirect jobs, particularly in construction, manufacturing, and logistics sectors.

Improved Productivity: Efficient logistics and transport reduce travel time, lower costs, and boost competitiveness for businesses.

Urbanization and Real Estate Growth: Enhanced connectivity fuels urban expansion, leading to increased demand for housing, retail, and industrial spaces.

Investment Magnet: Stable infrastructure attracts foreign direct investment (FDI), especially in sectors like manufacturing, renewable energy, and technology parks.

Regional Development: Projects in tier-2 and tier-3 cities are reducing regional disparities, promoting balanced growth.

According to estimates, infrastructure could contribute nearly 10% to India’s GDP by 2030, transforming the nation into a global manufacturing and logistics hub.

4. Stock Market Impact: The Infrastructure Theme Takes Center Stage

India’s stock markets have responded positively to this infrastructure wave. Investors see this as a multi-decade opportunity across several interconnected sectors.

a. Core Infrastructure Stocks

Companies in construction, engineering, and heavy machinery — such as Larsen & Toubro, IRB Infrastructure, KNR Construction, and NBCC — are witnessing strong order inflows and improved margins.

b. Cement and Steel

Demand for building materials is soaring. Cement majors like UltraTech, ACC, and Dalmia Bharat, and steel producers like Tata Steel and JSW Steel, have benefited from the government’s spending spree.

c. Capital Goods and Equipment

Firms like Siemens, ABB India, and Cummins are riding the wave of infrastructure electrification, metro projects, and industrial automation.

d. Logistics and Transport

The development of multi-modal transport networks boosts companies in logistics and warehousing, such as Container Corporation of India, TCI Express, and Adani Ports.

e. Ancillary Sectors

Power, renewable energy, and urban development firms are integral beneficiaries of the infrastructure ecosystem. For instance, NTPC, Power Grid Corporation, and Adani Energy Solutions are vital to India’s grid modernization.

Thus, the infrastructure theme has become one of the strongest investment narratives in India’s equity market, attracting both domestic and foreign institutional investors.

5. Financing the Boom: Innovative Funding Models

Financing India’s infrastructure ambitions requires creativity beyond traditional budget allocations. To address this, the government and private sector are leveraging multiple instruments:

Infrastructure Investment Trusts (InvITs) and Real Estate Investment Trusts (REITs) are unlocking liquidity by monetizing assets like roads, power transmission lines, and commercial real estate.

Green Bonds and Masala Bonds are mobilizing international capital for sustainable projects.

Sovereign Wealth Funds and Pension Funds from countries like Canada, Singapore, and the UAE are increasingly investing in long-term Indian infrastructure assets.

Development Finance Institutions (DFIs), such as the National Bank for Financing Infrastructure and Development (NaBFID), provide specialized financing for large-scale projects.

This diversification of funding sources ensures that India’s infrastructure revolution is both financially sustainable and globally integrated.

6. Challenges on the Road Ahead

Despite remarkable progress, several challenges persist:

Execution Delays: Land acquisition, environmental clearances, and litigation can slow project timelines.

Cost Overruns: Inflation in construction materials and logistical inefficiencies can erode profitability.

Private Participation Risks: Uncertain returns and policy changes can deter private investment.

Skill Shortage: The sector still faces a lack of skilled labor, especially in high-tech construction and project management.

Environmental Concerns: Balancing rapid development with ecological sustainability remains a critical challenge.

Addressing these issues will require continued policy refinement, institutional strengthening, and technological innovation.

7. Future Outlook: India’s Infrastructure Decade

Looking ahead, the 2020s are likely to be remembered as India’s “Infrastructure Decade.” The focus is now expanding beyond traditional construction to include digital infrastructure, green mobility, renewable energy, and sustainable cities.

Digital India and 5G rollout will connect even the remotest regions, enabling inclusive growth.

Renewable energy projects, targeting 500 GW by 2030, will redefine India’s energy landscape.

High-speed rail networks and metro expansion will modernize urban transport.

Smart logistics parks and industrial corridors will make India a global manufacturing powerhouse.

With urbanization accelerating and global investors viewing India as a growth engine, infrastructure will continue to be the foundation of the nation’s economic narrative.

Conclusion: The Market’s Golden Era of Infrastructure

India’s infrastructure revolution is more than a construction story — it’s a transformation of the nation’s economic DNA. It intertwines policy reform, financial innovation, and market opportunity. As roads, railways, ports, and data highways connect the nation, they are also connecting investors to one of the most promising growth stories in the world.

The infrastructure-led growth model not only drives GDP expansion but also deepens India’s capital markets, generates employment, and enhances global competitiveness. For investors and policymakers alike, India’s infrastructure revolution represents both an opportunity and a responsibility — to build a future that is strong, sustainable, and inclusive.

In essence, this is not merely an infrastructure boom; it’s the building of “New India” — brick by brick, byte by byte, and vision by vision.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Publications connexes

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Publications connexes

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.