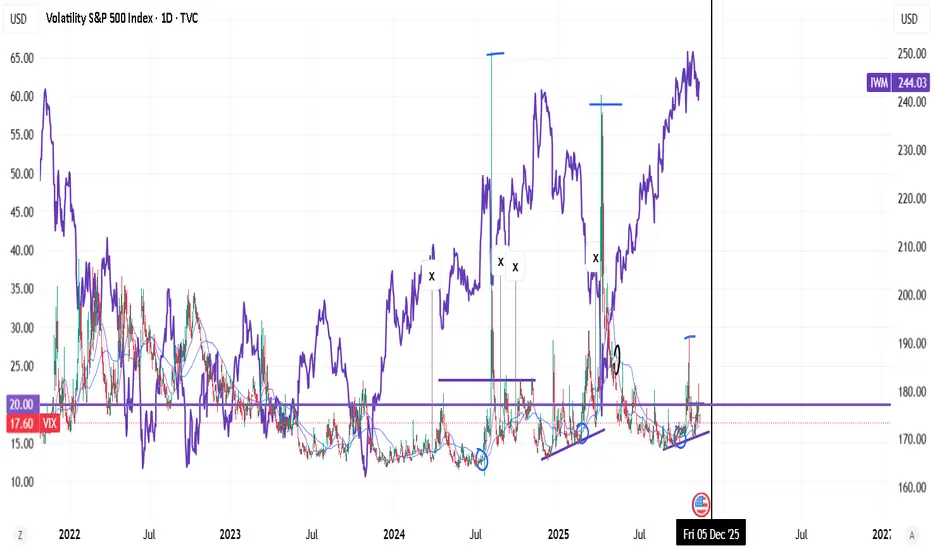

Where VIX gets 10/20/50 upswings, goes in patterns (structure). it seems it's a bad period for small caps.

Also, rising $TNX. which is the case now.

x- stands for bullish weekly macds.

Also, rising $TNX. which is the case now.

x- stands for bullish weekly macds.

Note

why does this matter?, when u get correction. You rather stick with faang or quality, not momentum stocks. You lose time. Qullamaggie said he succeeded only like 30% of times.Note

also. Peak "Lower Highs" (LHIGH) is always the start of new Risk on. Note

here's proof with $IONQ. Falling VIX and falling

Publications connexes

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Publications connexes

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.