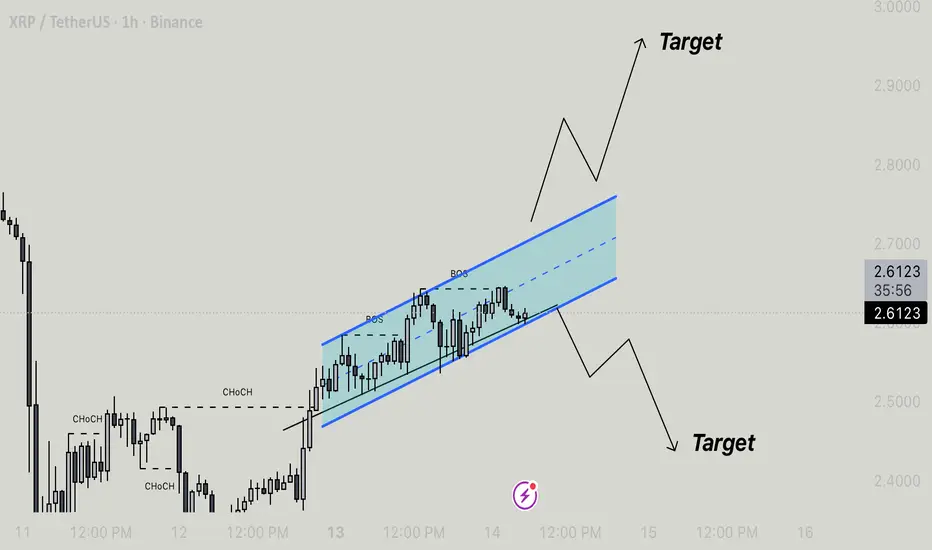

XRP/USDT is currently trading within a well-defined ascending channel, indicating a short-term bullish structure following a previous period of consolidation. The market has shown a clear change of character (CHoCH) and multiple breaks of structure (BOS) to the upside, confirming the shift from bearish to bullish momentum.

Price action is currently respecting both the upper and lower boundaries of the channel, moving in a controlled upward pattern. The midline of the channel is acting as a short-term equilibrium level, where price frequently reacts before continuing in its prevailing direction.

As the price approaches the upper boundary, a breakout above this level would suggest bullish continuation, targeting the next resistance zone around 2.80–2.90. Conversely, if the price fails to hold above the lower boundary and breaks below it, a corrective move toward 2.40–2.30 could be expected.

Overall, XRP is in a bullish corrective phase within a rising channel. Traders are watching for a decisive breakout in either direction to determine the next major move.

Price action is currently respecting both the upper and lower boundaries of the channel, moving in a controlled upward pattern. The midline of the channel is acting as a short-term equilibrium level, where price frequently reacts before continuing in its prevailing direction.

As the price approaches the upper boundary, a breakout above this level would suggest bullish continuation, targeting the next resistance zone around 2.80–2.90. Conversely, if the price fails to hold above the lower boundary and breaks below it, a corrective move toward 2.40–2.30 could be expected.

Overall, XRP is in a bullish corrective phase within a rising channel. Traders are watching for a decisive breakout in either direction to determine the next major move.

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.