These smallcaps gain between 10-33% as broader indices outperform

The broader indices rose between 1-2 percent and outperformed the main indices in the holiday shortened week amid buying across the sectors especially metal and banking names.

For the week, BSE Sensex index rose 780.71 points or 0.97 percent to finish at 81,207.17 and Nifty50 added 239.55 points or 0.97 percent to close at 24,894.25.

All the sectoral indices ended in the green with Nifty PSU Bank index rose more than 4 percent, Nifty Metal index gained 4 percent, Nifty Private Bank index jumped 2.5 percent, Nifty Defence Index rose 2.3 percent, Nifty Oil & Gas index added 2 percent.

"In the last truncated week, the benchmark indices witnessed a recovery from lower levels. The Nifty ended 0.97 percent higher, while the Sensex was up by 780 points. Among sectors, almost all major sectoral indices registered buying interest at lower levels, but PSU Bank and Metal indices outperformed, PSU Bank gained 4.45 , Metal index rallied 3.90 percent. During the week, the market took support near 24,600/80200 and bounced back sharply," said Amol Athawale, VP-Technical Research, Kotak Securities.

"Technically, on daily charts, it has formed a promising reversal pattern, and on weekly charts, it formed a small bullish candle, which is largely positive. We believe that 24,800–24,600/80800-80200 will act as key support zones in the near future. Above this range, the pullback formation is likely to continue on the higher side, potentially moving up to the 20-day SMA (Simple Moving Average) or 25,000/81400. Further upside may also continue, which could lift the market up to 25,150/81900."

"On the flip side, below 24,600/80200, sentiment could turn negative. Traders may prefer to exit long positions if the index falls below this level. For Bank Nifty, the 50-day and 20-day SMAs or 55,200 and 55000 will act as crucial support zones. On the higher side, the rally could continue toward 56,000–56,300. However, if it falls below the 20-day SMA at 55000, the uptrend could become vulnerable," he added.

The selling from Foreign Institutional Investors' (FIIs) continued on 12th consecutive week, as they sold equities worth Rs 8,347.25 crore, while buying from Domestic Institutional Investors (DII) continued in 24th week, as they bought equities worth Rs 13,013.40 crore.

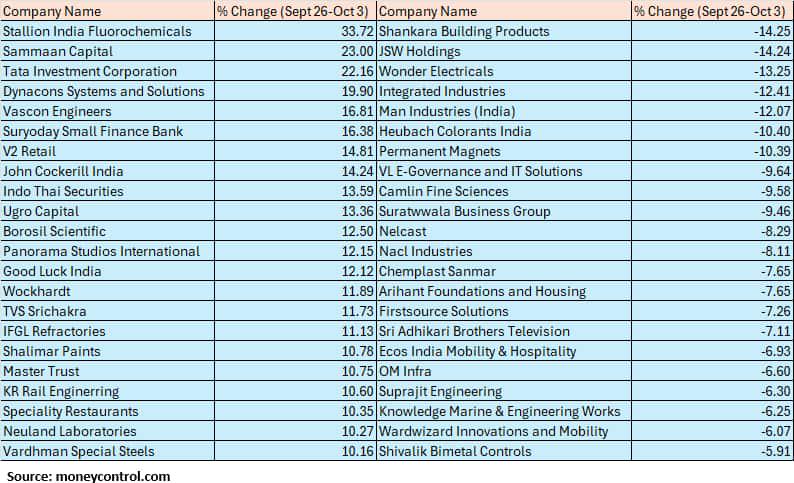

The BSE Small-cap index jumped 2 percent with Stallion India Fluorochemicals, Sammaan Capital, Tata Investment Corporation, Dynacons Systems and Solutions, Vascon Engineers, Suryoday Small Finance Bank, V2 Retail, John Cockerill India, Indo Thai Securities, Ugro Capital, Borosil Scientific, Panorama Studios International, Good Luck India, rising 12-33 percent, while Shankara Building Products, JSW Holdings, Wonder Electricals, Integrated Industries, Man Industries (India), Heubach Colorants India, Permanent Magnets fell between 10-14 percent.

Where is Nifty50 headed?

Nandish Shah - Deputy Vice President, HDFC Securities

The short-term trend of the Nifty remains positive as it is placed above its 5-day EMA. Resistances for the Nifty are now seen at 24916 and 25018, derived from 38.2% and 50% retracement of the entire fall seen from 25448 to 24587.

20 days EMA resistance coincides with 38.2% retracement, which increases the significance of 24916 level as a hurdle for Nifty. On the downside, 24747 could offer support to the Nifty.

Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities

After showing a sustainable bounce back from the lows on Wednesday, Nifty continued with follow-through upmove amidst range bound action on Friday and closed the day higher by 57 points. Nifty opened on a weak note and recovered immediately after the opening. It later shifted into a range bound action for better part of the session. Further upside was seen towards the end and finally Nifty closed at the highs.

A long bull candle was formed on the daily chart at the lows, which indicates a buy on dips opportunity in the market. This market action also confirms the formation of short-term bottom reversal around the Tuesday's low of 24600 levels.

The underlying short-term trend of Nifty is positive. The next upside target to be watched around 25200 levels by next week. Immediate support is placed at 24750.

Vinod Nair, Head of Research, Geojit Investments

Market momentum is expected to be supported by strong H2FY26 earnings and seasonal demand tailwinds, though global trade developments and U.S. policy actions could inject short-term volatility.

The Fed’s recent 25-bps rate cut, coupled with prospects of further easing, is likely to bolster FII inflows into emerging markets. Notably, India’s valuation premium over its EM peers has moderated, creating room for incremental foreign allocations and reinforcing a constructive near-term outlook.Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.