Broader indices at new high; 30 smallcaps gain between 10-50%

The broader indices rallied to fresh all-time high in the volatile week ended on September 20, but underperform the main indices, which also hit record high after more than anticipated interest rate cut by Fed.

This week, the broader indices touched fresh record high, however, for the week, BSE Mid and Smallcap indices ended on a flat note, while Largecap index rose 1.5 percent.

On the other hand, BSE Sensex surged 1,653.37 points or 1.99 percent to end at 84,544.31, while the Nifty50 index added 434.5 points or 1.71 percent to finish at 25,791.

On September 20, the BSE Sensex and Nifty hits fresh high of 84,694.46 and 25,849.25, respectively.

Among sectors, Nifty Realty index surged 4.5 percent, Nifty Bank index rose 3.5 percent, Nifty Auto index up 2 percent, Nifty FMCG index gained more than 1 percent.

However, Nifty Information Technology index shed nearly 3 percent, Nifty Media index down 2.6 percent and Nifty Pharma index declined 2 percent.

During the week, foreign institutional investors (FIIs) bought equities worth Rs 11,517.92 crore, however, Domestic Institutional Investors (DII) sold equities worth Rs 633.67 crore.

"After a sideways start, the market gained momentum with a surprise 50 bps rate cut by the US FED. The apprehension of a slowdown in growth was eased slightly after the lower-than-expected US jobless claim. The data pointed to a soft landing of the US economy at the start of the rate cut cycle. However, the IT index failed to rebound, mainly due to layoffs and the depreciation of USD. Strong monsoon and festive demand cheer the auto index with an outperformance," said Vinod Nair, Head of Research, Geojit Financial Services.

"Though the global economy went through a rate-cut cycle, the BOE stuck to a cautious tone and kept the rate unchanged, citing inflation pressure. On the other hand, BoJ kept its rate unchanged as expected as the central bank adopted a wait-and-watch approach after raising the interest rate in July."

"We have seen a sectorial rotation among investors to large caps, especially in consumption, staples, auto, finance, and realty. In the short term, investors are being cautious on export-oriented sectors like pharma and IT due to depreciation in the dollar," he added.

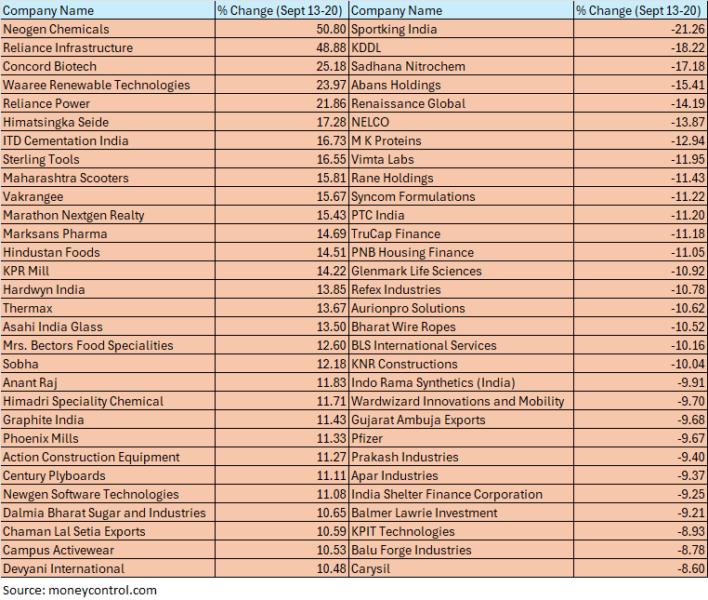

The BSE Small-cap index also ended flat but hit fresh all-time high of 57502.74. Neogen Chemicals, Reliance Infrastructure, Concord Biotech, Waaree Renewable Technologies, Reliance Power, Himatsingka Seide, ITD Cementation India, Sterling Tools, Maharashtra Scooters, Vakrangee, Marathon Nextgen Realty gained between 15-50 percent.

On the other hand, losers included Sportking India, KDDL, Sadhana Nitrochem, Abans Holdings, Renaissance Global, NELCO, M K Proteins, Vimta Labs, Rane Holdings, Syncom Formulations, PTC India, TruCap Finance.

Where is Nifty50 headed?

Hrishikesh Yedve, AVP Technical and Derivatives Research at Asit C. Mehta Investment Interrmediates Ltd.

“The domestic benchmark indices opened on a positive note, in line with global cues. Nifty started the day on a Positive note and witnessed robust buying interest and as a result it registered a fresh life time high of 25,849 and settled the day around it at 25,791. The volatility index, INDIA VIX, rose by 2.24%, settling at 12.75, indicating an increase in market volatility.

Technically, the index has settled above the previously formed doji, indicating strength. Thus, ongoing bullish momentum is like to take Nifty towards 25,900-26,000 levels. On the upside, 26,000 will act as an immediate hurdle for Nifty. On the downside, 25,500 will serve as an immediate support for Nifty followed by 15-DEMA support, which is placed near 25,300 levels. As long as Nifty stays above 25,600, a "Buy on Dips" strategy is advisable for traders

Tejas Shah, Technical Research, JM Financial & BlinkX

The Nifty index closed above the crucial resistance zone of 25,500-550 and we expect an upwards trending activity to continue and the Nifty should move towards the next psychological resistance of 26,000 either continuously from the current levels or may be after a minor dip. Support for Nifty is now seen at 25,700 and 25,500-550. On the higher side, the next psychological resistance is at 26,000 Mark. Overall, Overall, more follow-up strength can be expected in today’s trading session.

Amol Athawale, VP-Technical Research, Kotak Securities

We are of the view that, as long as market is trading above 25500/82700 the breakout texture is likely to continue. On the higher side market could move up till 26000-26200/85000-85500. On the other side, below 25500/82700 the sentiment could change. Below the same, traders may prefer to exit out from the trading long positions.Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.