Duolingo: AI and Data Powering Scalable Growth and Competitive Moat

One of Duolingo’s DUOL most compelling strengths lies in its strategic leveraging of artificial intelligence and proprietary learner data to drive scalable growth. While many tech companies treat AI as an aspirational promise, Duolingo embeds it directly into its product development and financial strategy, transforming it into a clear competitive advantage.

With access to one of the world’s largest datasets of language learners, Duolingo can launch new verticals, such as music and chess, at an unmatched pace and precision. This data-driven personalization enables the company to deliver highly relevant learning experiences that competitors cannot easily replicate, further strengthening its user retention and engagement.

AI doesn’t just enhance the user experience; it drives significant cost efficiencies. In the latest quarter, Duolingo raised its full-year guidance, largely because AI-related expenses came in lower than expected. Gross margin improved by 130 basis points sequentially, reaching 72.4%, demonstrating that innovation is contributing to stronger profitability, not diluting it.

Most strikingly, AI has accelerated content expansion at record speed. In April, Duolingo launched 148 new language courses in a single quarter, its largest expansion ever. For context, it took over a decade to build the first 100 courses, but AI-driven tools now enable the creation of nearly 150 courses in under a year. This rapid scaling strengthens Duolingo’s brand as a leader in language education and reinforces user trust by continuously expanding learning options.

For investors, the message is clear: Duolingo is not just growing, it is transforming how educational content is built and delivered at scale. Its blend of proprietary data, AI-driven efficiency and aggressive content expansion creates a sustainable and defensible growth model. As demand for digital learning continues to rise, Duolingo is well-positioned to capture market share and deliver long-term shareholder value.

DUOL’s Price Performance, Valuation and Estimates

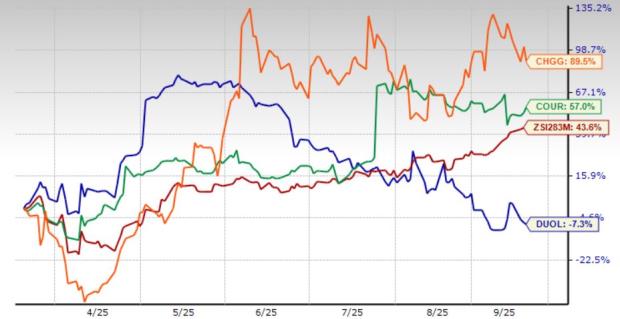

The stock has declined 7% over the past six months against the industry’s 44% growth. Meanwhile, competitors Coursera COUR and Chegg CHGG have been moving in the opposite direction. Coursera has surged 57% over the past six months, while Chegg has gained 89.5%. The contrasting trajectories of Coursera and Chegg compared with Duolingo point to significant shifts in investor sentiment within the online learning space.

Six Month Price Performance

From a valuation standpoint, SOFI trades at a forward price-to-earnings ratio of 69X, well above the industry’s 29X. It carries a Value Score of F.

The Zacks Consensus Estimate for SOFI’s 2025 earnings has been on the rise over the past 60 days.

DUOL stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research