OPEN-SOURCE SCRIPT

Mis à jour [blackcat] L2 Ehlers Swiss Army Knife

Level: 2

Background

John F. Ehlers introuced swiss army knife (SAK)indicator in 2005.

Function

The swiss army knife (SAK)indicator does all the common functions of the usual indicators, such as smoothing and momentum generation. It also does some unusual things, such as band stop and band reject filtering. Once you program this indicator into your trading platform you can do virtually any technical analysis technique with it. This unique general indicator results from general Digital Signal Processing (DSP) concepts for discrete signal networks that appear in various forms in technical analysis .

The description of this indicator involves Z Transforms. Z Transforms are a convenient way of solving difficult difference equations in much the same way as LaPlace Transforms are used to solve differential equations in calculus. Difference equations arise from the use of sampled data, such as we have in technical analysis . That is, daily bars sample price data once a day. Intraday bars sample price data every minute, hour, or whatever. The concept is the same regardless of the sampling rate. In Z Transforms, Z^(-1) stands for one sample period of delay. For simplicity, I will always refer to daily bars as the sample rate.

It includes,

1. Exponential Moving Average ( EMA )

2. Simple Moving Average ( SMA )

3. Two Pole Gaussian Filter

4. Two Pole Butterworth Filter

5. High Pass Filter

6. Two Pole High Pass Filter

7. BandPass Filter

8.BandStop Filter

The Swiss Army Knife Indicator is a versatile approach that creates a wide variety of responses that range from smoothers to oscillators. Novel BandPass and BandStop filters can also be produced. All of this can be done with one line of code in most platforms. The various responses come from the coefficients that can be called – as functions if you prefer.

Key Signal

Filt --> swiss army knife (SAK)indicator fast line

Trigger --> swiss army knife (SAK)indicator slow line

Pros and Cons

100% John F. Ehlers definition translation, even variable names are the same. This help readers who would like to use pine to read his book.

Remarks

The 64th script for Blackcat1402 John F. Ehlers Week publication.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Background

John F. Ehlers introuced swiss army knife (SAK)indicator in 2005.

Function

The swiss army knife (SAK)indicator does all the common functions of the usual indicators, such as smoothing and momentum generation. It also does some unusual things, such as band stop and band reject filtering. Once you program this indicator into your trading platform you can do virtually any technical analysis technique with it. This unique general indicator results from general Digital Signal Processing (DSP) concepts for discrete signal networks that appear in various forms in technical analysis .

The description of this indicator involves Z Transforms. Z Transforms are a convenient way of solving difficult difference equations in much the same way as LaPlace Transforms are used to solve differential equations in calculus. Difference equations arise from the use of sampled data, such as we have in technical analysis . That is, daily bars sample price data once a day. Intraday bars sample price data every minute, hour, or whatever. The concept is the same regardless of the sampling rate. In Z Transforms, Z^(-1) stands for one sample period of delay. For simplicity, I will always refer to daily bars as the sample rate.

It includes,

1. Exponential Moving Average ( EMA )

2. Simple Moving Average ( SMA )

3. Two Pole Gaussian Filter

4. Two Pole Butterworth Filter

5. High Pass Filter

6. Two Pole High Pass Filter

7. BandPass Filter

8.BandStop Filter

The Swiss Army Knife Indicator is a versatile approach that creates a wide variety of responses that range from smoothers to oscillators. Novel BandPass and BandStop filters can also be produced. All of this can be done with one line of code in most platforms. The various responses come from the coefficients that can be called – as functions if you prefer.

Key Signal

Filt --> swiss army knife (SAK)indicator fast line

Trigger --> swiss army knife (SAK)indicator slow line

Pros and Cons

100% John F. Ehlers definition translation, even variable names are the same. This help readers who would like to use pine to read his book.

Remarks

The 64th script for Blackcat1402 John F. Ehlers Week publication.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Notes de version

OVERVIEWThe [blackcat] L2 Ehlers Swiss Army Knife indicator combines multiple Ehlers' filters into a single tool, offering traders a versatile solution for various technical analysis needs.

FEATURES

• Implements nine different filter types:

EMA (Exponential Moving Average)

SMA (Simple Moving Average)

Gauss (Gaussian Filter)

Butter (Butterworth Filter)

Smooth (Smoothed Filter)

HP (High-Pass Filter)

2PHP (Double High-Pass Filter)

BP (Band-Pass Filter)

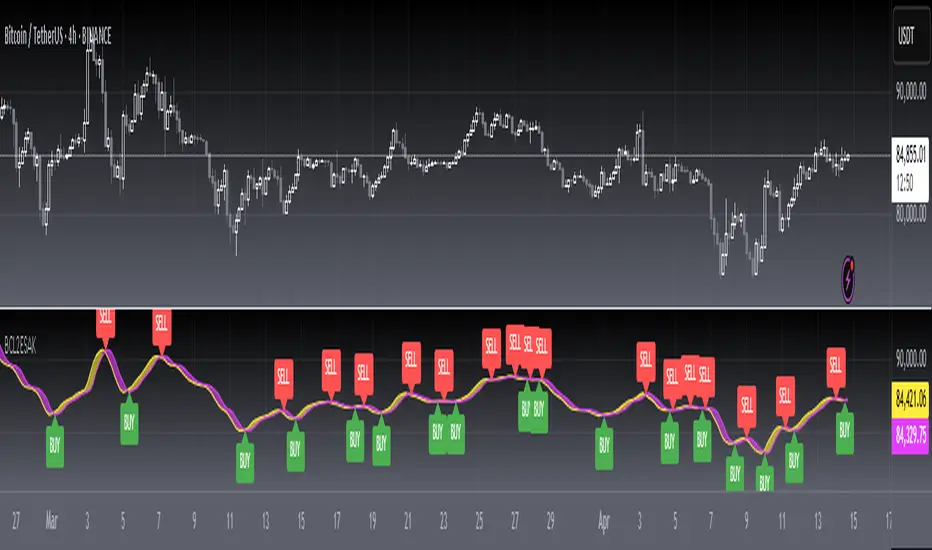

BS (Band-Stop Filter) • Adjustable Period parameter • Customizable delta1 parameter for BP and BS filters • Visual buy/sell signals • Dual-line visualization with fill area

HOW TO USE

Add the indicator to your chart

Configure inputs: • Price: Default is HL2 (High-Low midpoint) • Type: Select desired filter (default: Gauss) • Period: Default value is 20 • delta1: Default value is 0.1 (used for BP and BS filters)

Interpret signals: • Yellow line represents filtered price • Fuchsia line shows trigger level • Green labels indicate buy signals • Red labels indicate sell signals

LIMITATIONS

• Performance depends on market conditions

• Requires sufficient historical data

• Best suited for longer timeframes

NOTES

• Labels are plotted with 0.01 offset for visibility

• Each filter type uses specific coefficient calculations

• BP and BS filters require delta1 parameter adjustment

• Fill area color changes based on signal direction

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.