OPEN-SOURCE SCRIPT

Combo Backtest 123 Reversal & T3 Averages

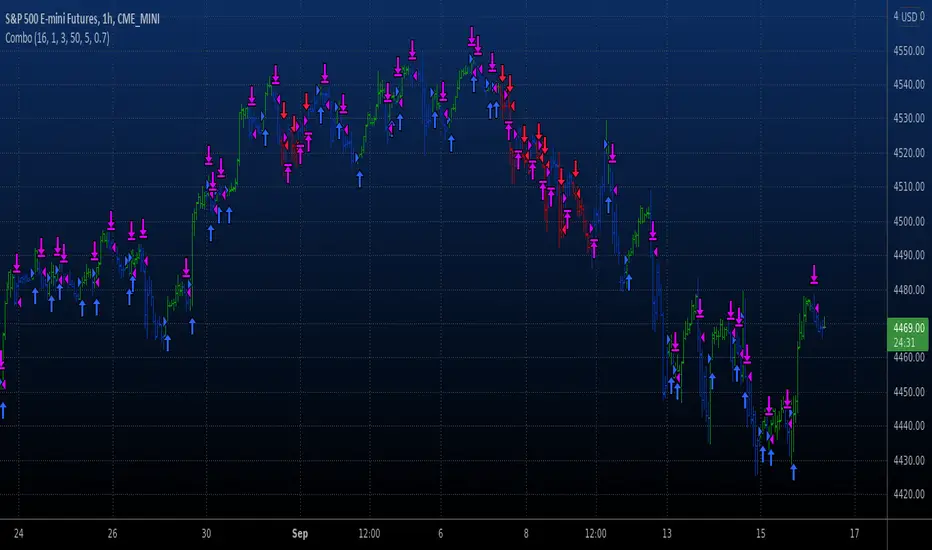

This is combo strategies for get a cumulative signal.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

This indicator plots the moving average described in the January, 1998 issue

of S&C, p.57, "Smoothing Techniques for More Accurate Signals", by Tim Tillson.

This indicator plots T3 moving average presented in Figure 4 in the article.

T3 indicator is a moving average which is calculated according to formula:

T3(n) = GD(GD(GD(n))),

where GD - generalized DEMA (Double EMA) and calculating according to this:

GD(n,v) = EMA(n) * (1+v)-EMA(EMA(n)) * v,

where "v" is volume factor, which determines how hot the moving average’s response

to linear trends will be. The author advises to use v=0.7.

When v = 0, GD = EMA, and when v = 1, GD = DEMA. In between, GD is a less aggressive

version of DEMA. By using a value for v less than1, trader cure the multiple DEMA

overshoot problem but at the cost of accepting some additional phase delay.

In filter theory terminology, T3 is a six-pole nonlinear Kalman filter. Kalman

filters are ones that use the error — in this case, (time series - EMA(n)) —

to correct themselves. In the realm of technical analysis, these are called adaptive

moving averages; they track the time series more aggres-sively when it is making large

moves. Tim Tillson is a software project manager at Hewlett-Packard, with degrees in

mathematics and computer science. He has privately traded options and equities for 15 years.

WARNING:

- For purpose educate only

- This script to change bars colors.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

This indicator plots the moving average described in the January, 1998 issue

of S&C, p.57, "Smoothing Techniques for More Accurate Signals", by Tim Tillson.

This indicator plots T3 moving average presented in Figure 4 in the article.

T3 indicator is a moving average which is calculated according to formula:

T3(n) = GD(GD(GD(n))),

where GD - generalized DEMA (Double EMA) and calculating according to this:

GD(n,v) = EMA(n) * (1+v)-EMA(EMA(n)) * v,

where "v" is volume factor, which determines how hot the moving average’s response

to linear trends will be. The author advises to use v=0.7.

When v = 0, GD = EMA, and when v = 1, GD = DEMA. In between, GD is a less aggressive

version of DEMA. By using a value for v less than1, trader cure the multiple DEMA

overshoot problem but at the cost of accepting some additional phase delay.

In filter theory terminology, T3 is a six-pole nonlinear Kalman filter. Kalman

filters are ones that use the error — in this case, (time series - EMA(n)) —

to correct themselves. In the realm of technical analysis, these are called adaptive

moving averages; they track the time series more aggres-sively when it is making large

moves. Tim Tillson is a software project manager at Hewlett-Packard, with degrees in

mathematics and computer science. He has privately traded options and equities for 15 years.

WARNING:

- For purpose educate only

- This script to change bars colors.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.