OPEN-SOURCE SCRIPT

Mis à jour FACTOR MONITOR

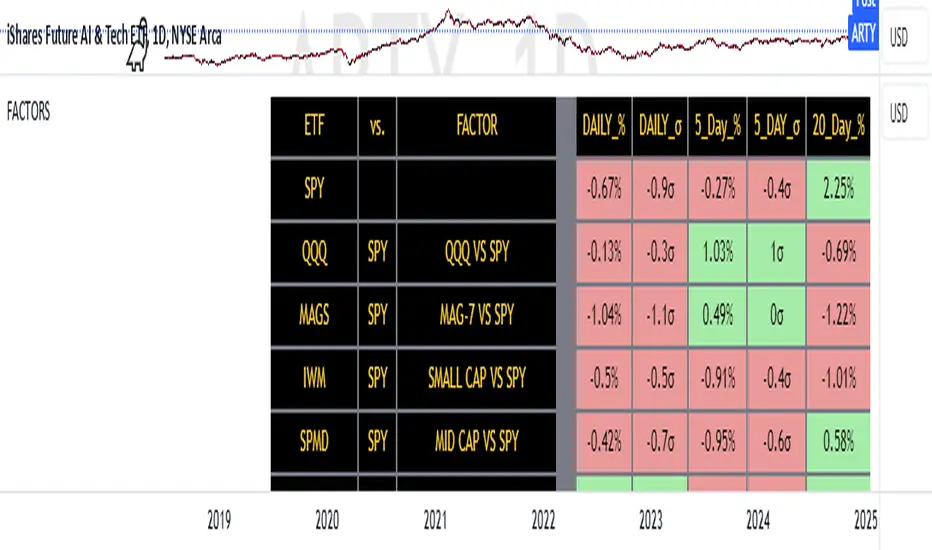

The Factor Monitor is a comprehensive designed to track relative strength and standard deviation movements across multiple market segments and investment factors. The indicator calculates and displays normalized percentage moves and their statistical significance (measured in standard deviations) across daily, 5-day, and 20-day periods, providing a multi-timeframe view of market dynamics.

Key Features:

Real-time tracking of relative performance between various ETF pairs (e.g., QQQ vs SPY, IWM vs SPY)

Standard deviation scoring system that identifies statistically significant moves

Color-coded visualization (green/red) for quick interpretation of relative strength

Multiple timeframe analysis (1-day, 5-day, and 20-day moves)

Monitoring of key market segments:

Style factors (Value, Growth, Momentum)

Market cap segments (Large, Mid, Small)

Sector relative strength

Risk factors (High Beta vs Low Volatility)

Credit conditions (High Yield vs Investment Grade)

The tool is particularly valuable for:

Identifying significant factor rotations in the market

Assessing market breadth through relative strength comparisons

Spotting potential trend changes through statistical deviation analysis

Monitoring sector leadership and market regime shifts

Quantifying the magnitude of market moves relative to historical norms

Key Features:

Real-time tracking of relative performance between various ETF pairs (e.g., QQQ vs SPY, IWM vs SPY)

Standard deviation scoring system that identifies statistically significant moves

Color-coded visualization (green/red) for quick interpretation of relative strength

Multiple timeframe analysis (1-day, 5-day, and 20-day moves)

Monitoring of key market segments:

Style factors (Value, Growth, Momentum)

Market cap segments (Large, Mid, Small)

Sector relative strength

Risk factors (High Beta vs Low Volatility)

Credit conditions (High Yield vs Investment Grade)

The tool is particularly valuable for:

Identifying significant factor rotations in the market

Assessing market breadth through relative strength comparisons

Spotting potential trend changes through statistical deviation analysis

Monitoring sector leadership and market regime shifts

Quantifying the magnitude of market moves relative to historical norms

Notes de version

Just changed colors around to make more readableNotes de version

Updated MAGS exchangeScript open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.