OPEN-SOURCE SCRIPT

Mis à jour Ribbon — multi-MA trend bands

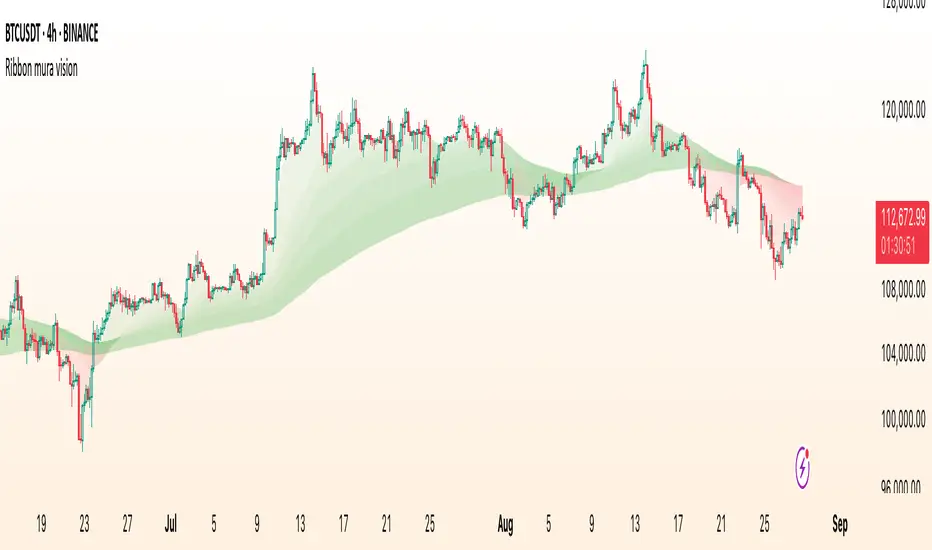

Ribbon paints five translucent bands between six moving averages to visualize trend structure and regime at a glance. You can choose the MA type (EMA/SMA/WMA), customize lengths, and switch the coloring logic between an anchor-based mode and strict alignment.

What it shows

Coloring modes

1. By EMA233 (Anchor mode)

Each band is colored Up or Down by comparing its upper MA to the anchor (the 6th MA in inputs, default length 233).

2. By Alignment

Inputs (key)

How to read it

Implementation notes

Disclaimer

This script is for educational and informational purposes only and does not constitute financial advice. Always test on historical data and manage risk appropriately.

What it shows

- Six MAs on the current timeframe (defaults: 5 / 34 / 55 / 89 / 144 / 233).

- Five bands filled between consecutive MAs:

- 5–34, 34–55, 55–89, 89–144, 144–233.

- Optional plotting of MA lines (hidden by default to keep the chart clean).

Coloring modes

1. By EMA233 (Anchor mode)

Each band is colored Up or Down by comparing its upper MA to the anchor (the 6th MA in inputs, default length 233).

- If MA > anchor → Up color (supportive regime).

- If MA < anchor → Down color (resistive regime).

2. By Alignment

- All bands share one color depending on strict ordering:

- Up if MA1 > MA2 > MA3 > MA4 > MA5 > MA6

- Down if MA1 < MA2 < MA3 < MA4 < MA5 < MA6

- Gray otherwise (no clean alignment).

Inputs (key)

- MA Type: EMA / SMA / WMA (applies to all six MAs).

- MA 1…MA 6 (anchor): lengths for each average (defaults form a classic ribbon up to 233).

- Up/Down colors: band palette.

- Base transparency / step: controls band opacity gradient (top band uses Base, each next band adds Step).

- Show MA lines + Lines transparency: optionally draw the six MA curves.

How to read it

- Directional bias: when most bands are green (anchor mode) or the whole ribbon is green (alignment mode), momentum favors the upside; red implies downside pressure.

- Quality of trend: a persistent alignment (all ordered) signals a cleaner trend. Mixed/gray suggests chop or transition.

- Pullback zones: price returning toward inner bands can mark areas to watch for continuation vs. failure.

Implementation notes

- No higher-timeframe data, no lookahead — this is a non-repainting, current-TF visualization.

- Bands still render even when MA lines are hidden (the script uses hidden plot anchors under the hood).

- This is an indicator, not a strategy — it does not open/close trades or calculate P&L.

Disclaimer

This script is for educational and informational purposes only and does not constitute financial advice. Always test on historical data and manage risk appropriately.

Notes de version

Minor updateScript open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

✅My Telegram

t.me/charyyevn

t.me/charyyevn

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

✅My Telegram

t.me/charyyevn

t.me/charyyevn

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.