OPEN-SOURCE SCRIPT

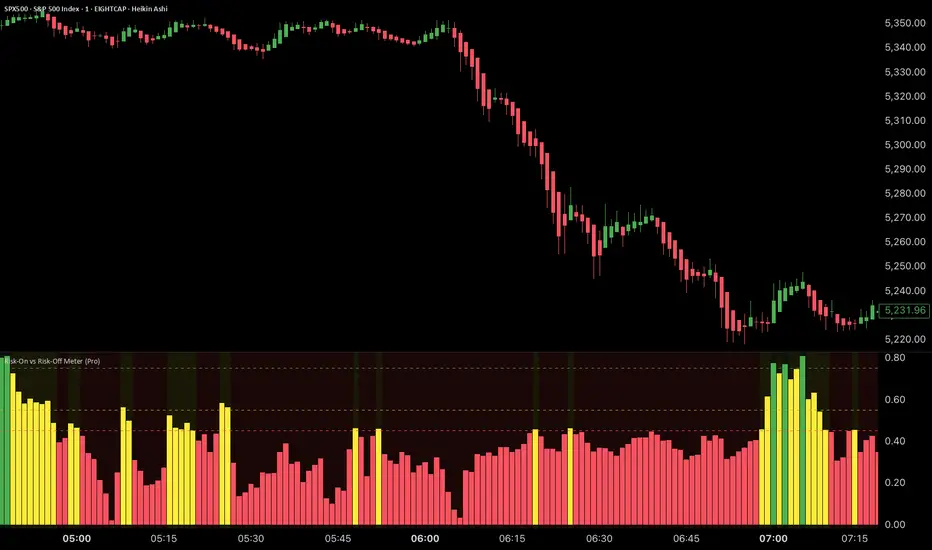

Risk-On vs Risk-Off Meter (Pro)

Risk-On vs Risk-Off Meter (Pro)

This macro-based tool analyzes capital flows across key assets to gauge overall market risk sentiment. It does not use ES, SPY, or stock data directly—making it a powerful confirmation tool for ES traders looking to align with macro forces.

🔹 Core Idea:

Tracks capital rotation between copper/gold, bonds, dollar, crude oil, VIX, and yield spreads to generate a normalized risk score (0–1). This score reflects whether macro money is flowing into risk or safety.

🔹 Use:

Use this indicator as confirmation of directional bias when scalping or day trading ES.

– Green Zone (>0.75): Risk-On environment. Favor long setups.

– Red Zone (<0.45): Risk-Off. Favor short setups or stand aside.

– Yellow Zone: Neutral, use caution.

– Divergence Alerts: Signals when ES price disagrees with macro risk trend—potential reversals or exhaustion zones.

HOT TO USE

– Combine with your existing price action or order flow signals

– Avoid trading against the macro sentiment unless strong setup

– Use divergence as a heads-up for fading or exiting trades

This gives you a macro-informed lens to validate or filter your entries.

This macro-based tool analyzes capital flows across key assets to gauge overall market risk sentiment. It does not use ES, SPY, or stock data directly—making it a powerful confirmation tool for ES traders looking to align with macro forces.

🔹 Core Idea:

Tracks capital rotation between copper/gold, bonds, dollar, crude oil, VIX, and yield spreads to generate a normalized risk score (0–1). This score reflects whether macro money is flowing into risk or safety.

🔹 Use:

Use this indicator as confirmation of directional bias when scalping or day trading ES.

– Green Zone (>0.75): Risk-On environment. Favor long setups.

– Red Zone (<0.45): Risk-Off. Favor short setups or stand aside.

– Yellow Zone: Neutral, use caution.

– Divergence Alerts: Signals when ES price disagrees with macro risk trend—potential reversals or exhaustion zones.

HOT TO USE

– Combine with your existing price action or order flow signals

– Avoid trading against the macro sentiment unless strong setup

– Use divergence as a heads-up for fading or exiting trades

This gives you a macro-informed lens to validate or filter your entries.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.