OPEN-SOURCE SCRIPT

Bitcoin ETF Flow Tracker

GM 💎

Just as tracking global liquidity flows helps us anticipate movements in crypto, I believe that monitoring institutional activity would also offer us additional edge in investing since their large-scale trades and strategic moves could result in significant changes in BTC price trends.

Hence why I created this indicator to help us track:

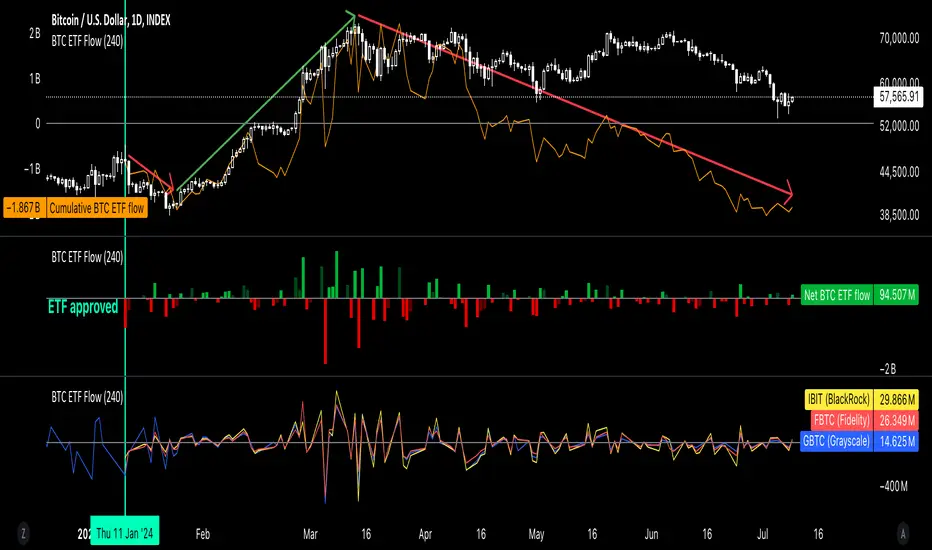

1. Total Cumulative Flow of the 8 biggest US BTC ETFs (top pane),

2. Total Net Flow of those institutions in both low and high timeframes (middle pane), and

3. Individual BTC ETF Flow (bottom pane).

*Recommended timeframes for analysis: 4H, 12H or 1D

*Color code of Total Net Flow:

Bright Green: strong positive total net flow

Dark Green: weakening positive total net flow

Bright Red: strong negative total net flow

Dark Red: weakening negative total net flow

*Top 8 biggest US BTC ETFs (in no particular order):

1. Grayscale Bitcoin Trust

2. BlackRock's iShares Bitcoin Trust

3. Fidelity Wise Origin Bitcoin Fund

4. ARK 21Shares Bitcoin ETF

5. Bitwise Bitcoin ETF

6. Invesco Galaxy Bitcoin ETF

7. VanEck Bitcoin Trust

8. Franklin Bitcoin ETF

*Recommended institutions to track: number 1, 2, 3 since they've been the most active and have had the highest flow within this space.

Just as tracking global liquidity flows helps us anticipate movements in crypto, I believe that monitoring institutional activity would also offer us additional edge in investing since their large-scale trades and strategic moves could result in significant changes in BTC price trends.

Hence why I created this indicator to help us track:

1. Total Cumulative Flow of the 8 biggest US BTC ETFs (top pane),

2. Total Net Flow of those institutions in both low and high timeframes (middle pane), and

3. Individual BTC ETF Flow (bottom pane).

*Recommended timeframes for analysis: 4H, 12H or 1D

*Color code of Total Net Flow:

Bright Green: strong positive total net flow

Dark Green: weakening positive total net flow

Bright Red: strong negative total net flow

Dark Red: weakening negative total net flow

*Top 8 biggest US BTC ETFs (in no particular order):

1. Grayscale Bitcoin Trust

2. BlackRock's iShares Bitcoin Trust

3. Fidelity Wise Origin Bitcoin Fund

4. ARK 21Shares Bitcoin ETF

5. Bitwise Bitcoin ETF

6. Invesco Galaxy Bitcoin ETF

7. VanEck Bitcoin Trust

8. Franklin Bitcoin ETF

*Recommended institutions to track: number 1, 2, 3 since they've been the most active and have had the highest flow within this space.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

🎁🎄 Christmas SALE 50% Off with code XMAS50 (ends Dec 28) at whop.com/quantalgo/

📩 DM if you need any custom-built indicators or strategies.

📩 DM if you need any custom-built indicators or strategies.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

🎁🎄 Christmas SALE 50% Off with code XMAS50 (ends Dec 28) at whop.com/quantalgo/

📩 DM if you need any custom-built indicators or strategies.

📩 DM if you need any custom-built indicators or strategies.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.