OPEN-SOURCE SCRIPT

Stochastic + Bollinger Bands Multi-Timeframe Strategy

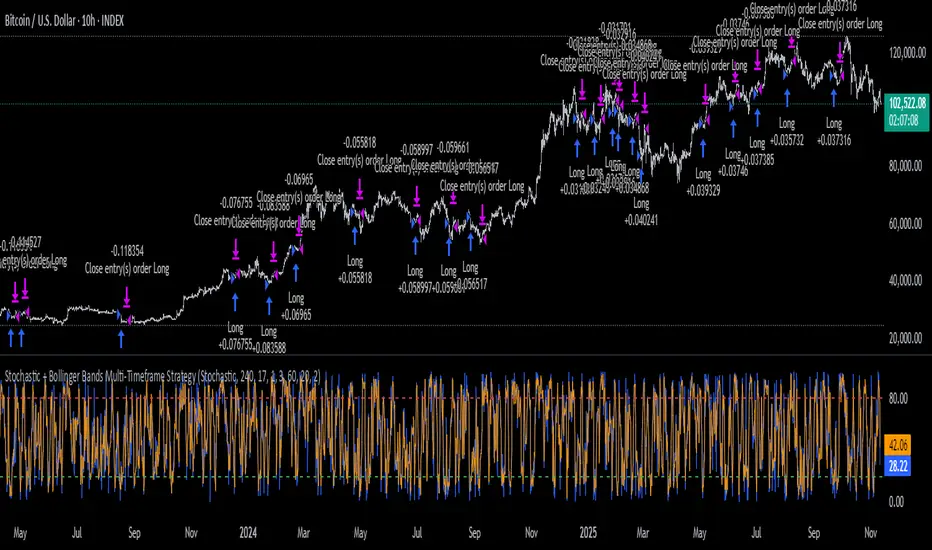

This strategy fuses the Stochastic Oscillator from the 4-hour timeframe with Bollinger Bands from the 1-hour timeframe, operating on a 10-hour chart to capture a unique volatility rhythm and temporal alignment discovered through observational alpha.

By blending momentum confirmation from the higher timeframe with short-term volatility extremes, the strategy leverages what some traders refer to as “rotating volatility” — a phenomenon where multi-timeframe oscillations sync to reveal hidden trade opportunities.

🧠 Strategy Logic

✅ Long Entry Condition:

Stochastic on the 4H timeframe:

%K crosses above %D

Both %K and %D are below 20 (oversold zone)

Bollinger Bands on the 1H timeframe:

Price crosses above the lower Bollinger Band, indicating a potential reversal

→ A long trade is opened when both momentum recovery and volatility reversion align.

✅ Long Exit Condition:

Stochastic on the 4H:

%K crosses below %D

Both %K and %D are above 80 (overbought zone)

Bollinger Bands on the 1H:

Price reaches or exceeds the upper Bollinger Band, suggesting exhaustion

→ The long trade is closed when either signal suggests a potential reversal or overextension.

🧬 Temporal Structure & Alpha

This strategy is deployed on a 10-hour chart — a non-standard timeframe that may align more effectively with multi-timeframe mean reversion dynamics.

This subtle adjustment exploits what some traders identify as “temporal drift” — the desynchronization of volatility across timeframes that creates hidden rhythm in price action.

→ For example, Stochastic on 4H (lookback 17) and Bollinger Bands on 1H (lookback 20) may periodically sync around 10H intervals, offering unique alpha windows.

📊 Indicator Components

🔹 Stochastic Oscillator (4H, Length 17)

Detects momentum reversals using %K and %D crossovers

Helps define overbought/oversold zones from a mid-term view

🔹 Bollinger Bands (1H, Length 20, ±2 StdDev)

Measures price volatility using standard deviation around a moving average

Entry occurs near lower band (support), exits near upper band (resistance)

🔹 Multi-Timeframe Logic

Uses request.security() to safely reference 4H and 1H indicators from a 10H chart

Avoids repainting by using closed higher-timeframe candles only

📈 Visualization

A plot selector input allows toggling between:

Stochastic Plot (%K & %D, with overbought/oversold levels)

Bollinger Bands Plot (Upper, Basis, Lower from 1H data)

This helps users visually confirm entry/exit triggers in real time.

🛠 Customization

Fully configurable Stochastic and BB settings

Timeframes are independently adjustable

Strategy settings like position sizing, slippage, and commission are editable

⚠️ Disclaimer

This strategy is intended for educational and informational purposes only.

It does not constitute financial advice or a recommendation to buy or sell any asset.

Market conditions vary, and past performance does not guarantee future results.

Always test any trading strategy in a simulated environment and consult a licensed financial advisor before making real-world investment decisions.

By blending momentum confirmation from the higher timeframe with short-term volatility extremes, the strategy leverages what some traders refer to as “rotating volatility” — a phenomenon where multi-timeframe oscillations sync to reveal hidden trade opportunities.

🧠 Strategy Logic

✅ Long Entry Condition:

Stochastic on the 4H timeframe:

%K crosses above %D

Both %K and %D are below 20 (oversold zone)

Bollinger Bands on the 1H timeframe:

Price crosses above the lower Bollinger Band, indicating a potential reversal

→ A long trade is opened when both momentum recovery and volatility reversion align.

✅ Long Exit Condition:

Stochastic on the 4H:

%K crosses below %D

Both %K and %D are above 80 (overbought zone)

Bollinger Bands on the 1H:

Price reaches or exceeds the upper Bollinger Band, suggesting exhaustion

→ The long trade is closed when either signal suggests a potential reversal or overextension.

🧬 Temporal Structure & Alpha

This strategy is deployed on a 10-hour chart — a non-standard timeframe that may align more effectively with multi-timeframe mean reversion dynamics.

This subtle adjustment exploits what some traders identify as “temporal drift” — the desynchronization of volatility across timeframes that creates hidden rhythm in price action.

→ For example, Stochastic on 4H (lookback 17) and Bollinger Bands on 1H (lookback 20) may periodically sync around 10H intervals, offering unique alpha windows.

📊 Indicator Components

🔹 Stochastic Oscillator (4H, Length 17)

Detects momentum reversals using %K and %D crossovers

Helps define overbought/oversold zones from a mid-term view

🔹 Bollinger Bands (1H, Length 20, ±2 StdDev)

Measures price volatility using standard deviation around a moving average

Entry occurs near lower band (support), exits near upper band (resistance)

🔹 Multi-Timeframe Logic

Uses request.security() to safely reference 4H and 1H indicators from a 10H chart

Avoids repainting by using closed higher-timeframe candles only

📈 Visualization

A plot selector input allows toggling between:

Stochastic Plot (%K & %D, with overbought/oversold levels)

Bollinger Bands Plot (Upper, Basis, Lower from 1H data)

This helps users visually confirm entry/exit triggers in real time.

🛠 Customization

Fully configurable Stochastic and BB settings

Timeframes are independently adjustable

Strategy settings like position sizing, slippage, and commission are editable

⚠️ Disclaimer

This strategy is intended for educational and informational purposes only.

It does not constitute financial advice or a recommendation to buy or sell any asset.

Market conditions vary, and past performance does not guarantee future results.

Always test any trading strategy in a simulated environment and consult a licensed financial advisor before making real-world investment decisions.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.