OPEN-SOURCE SCRIPT

Mis à jour TTP QFL Optimiser

This tool is designed to help finding the best take profit and stop loss levels when trading with QFL bases (Quick Fingers Luc).

You can use it to see the average drawdown among all historic bases broken for an asset and then find the drawdowns that are more frequent using the percentile parameters provided.

For example, by knowing that 98% of the bases got broken with a drawdown of up to 5% can become extremely useful for deciding where to place your take profit or stop loss levels.

It supports QFL 1H, 2H and 4H but make sure to set the chart timeframe to a lower timeframe than QFL to obtain valid results.

Two percentiles are provided to be able to evaluate potential TP and SL at the same time.

Steps:

- Load an asset in the 15min TF

- Select the QFL version: 1H more deals / lower quality vs 4H less deals/ better quality

- Find a percentile that triggers enough deals (example: 70) and then another percentile that doesn't get hit too much (example: 98)

- Confirm the values p1 and p2 provided in the table and the white and grey lines for the results of which drawdown percentages correspond to such selection of percentiles

Once having p1 and p2 use your backtesting and forward testing tools to confirm and adjust accordingly.

You can use it to see the average drawdown among all historic bases broken for an asset and then find the drawdowns that are more frequent using the percentile parameters provided.

For example, by knowing that 98% of the bases got broken with a drawdown of up to 5% can become extremely useful for deciding where to place your take profit or stop loss levels.

It supports QFL 1H, 2H and 4H but make sure to set the chart timeframe to a lower timeframe than QFL to obtain valid results.

Two percentiles are provided to be able to evaluate potential TP and SL at the same time.

Steps:

- Load an asset in the 15min TF

- Select the QFL version: 1H more deals / lower quality vs 4H less deals/ better quality

- Find a percentile that triggers enough deals (example: 70) and then another percentile that doesn't get hit too much (example: 98)

- Confirm the values p1 and p2 provided in the table and the white and grey lines for the results of which drawdown percentages correspond to such selection of percentiles

Once having p1 and p2 use your backtesting and forward testing tools to confirm and adjust accordingly.

Notes de version

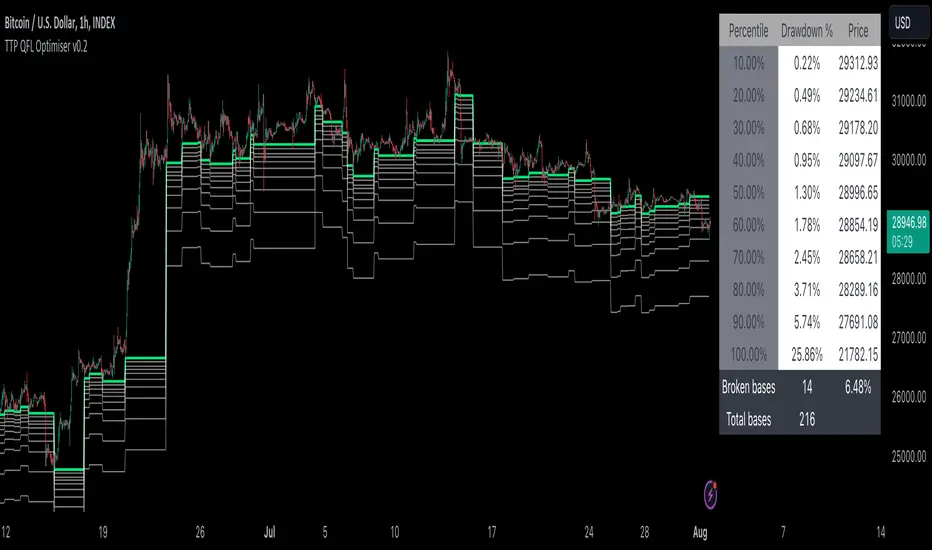

Added Percentile bands. It offers 10 percentiles, 10% groups.- What is the distribution of drawdowns from each version of QFL bases broken?

- What percentage of bases have been broken and price still doesn't manage to recover above the base?

You can work with the two supported modes:

- Percentile bands, divide all drawdowns from base broken in 10 percentiles 10%, 20%, 30%....100%. Bands are drawn and a table displayed with all gathered statistics

- Twin percentile, the user picks 2 custom percentiles and a table is shown with data

Notes de version

small bugNotes de version

bug fixScript open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Join our membership to gain access to the private scripts.

patreon.com/c/thetradingparrot

patreon.com/c/thetradingparrot

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Join our membership to gain access to the private scripts.

patreon.com/c/thetradingparrot

patreon.com/c/thetradingparrot

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.