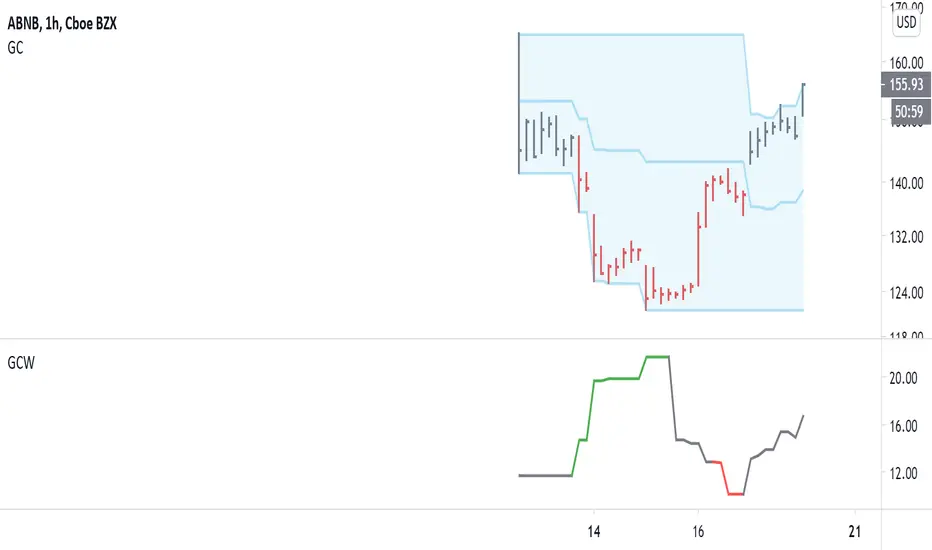

Gregoire Channel Width

This serves two purposes:

1) Volatility adjusted position sizing

2) Options buying/selling

-----------------

The formula for volatility adjusted position size is: (account value * risk) / (GC Width / Entry price).

For example, let's say we have a $15,000 account size and want to risk 2% on a TQQQ trade. The GC Width is $8.77 and entry is $167.59.

That gives us a position size of: (15,000 * 0.02) / (8.77 / 167.59) = $5,732.84. Our stop would be around the middle of the channel, in this case.

We use this so we avoid getting blown out in fast-moving markets, yet still make enough for slow moving markets. Too much risk destroys accounts!

-----------------

The green and red colors indicate areas to buy and sell options. RED = sell options, GREEN = buy options.

Options are priced according to volatility. We want to buy them when volatility is low, and sell them when volatility is high. These can also be used as take-profit areas: we buy options on the green and close for profit on the red areas, etc.

Changed color scheme: GREEN means expansion, RED means contraction.

Script sur invitation seulement

Seuls les utilisateurs approuvés par l'auteur peuvent accéder à ce script. Vous devrez demander et obtenir l'autorisation pour l'utiliser. Celle-ci est généralement accordée après paiement. Pour plus de détails, suivez les instructions de l'auteur ci-dessous ou contactez directement gregoirejohnb.

TradingView ne recommande PAS d'acheter ou d'utiliser un script à moins que vous ne fassiez entièrement confiance à son auteur et que vous compreniez son fonctionnement. Vous pouvez également trouver des alternatives gratuites et open source dans nos scripts communautaires.

Instructions de l'auteur

Clause de non-responsabilité

Script sur invitation seulement

Seuls les utilisateurs approuvés par l'auteur peuvent accéder à ce script. Vous devrez demander et obtenir l'autorisation pour l'utiliser. Celle-ci est généralement accordée après paiement. Pour plus de détails, suivez les instructions de l'auteur ci-dessous ou contactez directement gregoirejohnb.

TradingView ne recommande PAS d'acheter ou d'utiliser un script à moins que vous ne fassiez entièrement confiance à son auteur et que vous compreniez son fonctionnement. Vous pouvez également trouver des alternatives gratuites et open source dans nos scripts communautaires.