OPEN-SOURCE SCRIPT

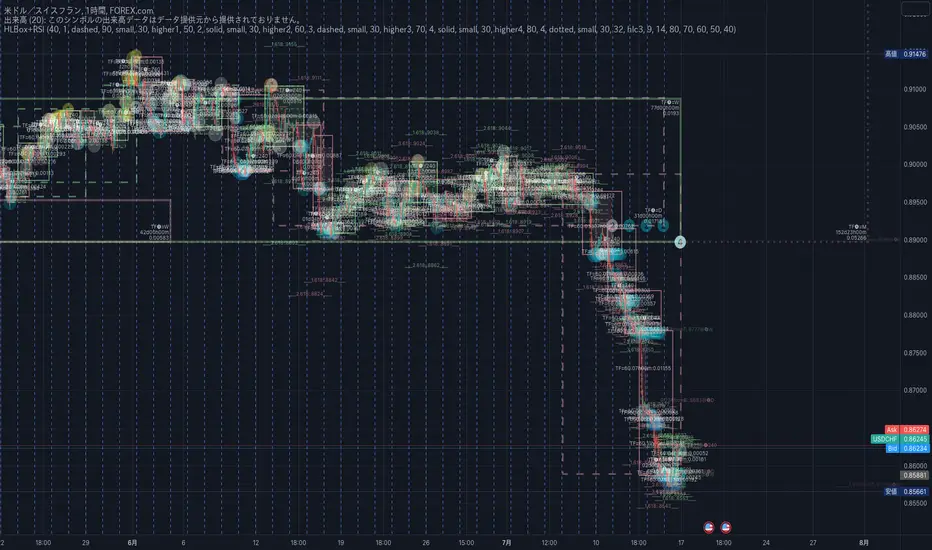

Mis à jour HighLowBox 1+3TF

Enclose in a square high and low range in each timeframe.

Shows price range and duration of each box.

In current timeframe, shows Fibonacci Scale inside(23.6%, 38.2%, 50.0%, 61.8%, 76.4%)/outside of each box.

Outside(161.8%,261.8,361.8%) would be shown as next target, if break top/bottom of each box.

Shows price range and duration of each box.

In current timeframe, shows Fibonacci Scale inside(23.6%, 38.2%, 50.0%, 61.8%, 76.4%)/outside of each box.

Outside(161.8%,261.8,361.8%) would be shown as next target, if break top/bottom of each box.

- 1st box for current timeframe.(default: Chart)

- 2nd-4th box for higher timeframes.(default: higher1,higher2,higher3)

- static timeframes can also be used.

Notes de version

Added labels for the narrow range(top/bottom) of recent price action in fibonacci level of higher timeframe range.Notes de version

Digit after decimal point is changed.(#.000->#.0000)Minor fixes for handling arrays.

Added High Low box minimap.(experimental. default:false)

Notes de version

Added 4th HTFbox(default: false).Minor color adjustment.

Fixed bugs around initial value of arrays("D" or higher timeframe's box was not shown).

Notes de version

Added RSI Signal IndicatorRSI Signals are shown at the bottom(RSI<30) or the top(RSI>70) of HighLowBox in each timeframe.

To disable RSI: uncheck RSI checkboxes from bottom part of configuration panel.

RSI Signal is color coded by RSI9 and RSI14 in each timeframe.

In case RSI<=30,

- Location: bottom of the HighLowBox

- white: only RSI9 is <=30

- aqua: RSI9 and RSI14 are <=30 and RSI9<RSI14

- blue: RSI9 and RSI14 are <=30 and RSI9>RSI14

- green: only RSI14 is <=30

In case RSI>=70,

- Location: top of the HighLowBox

- white: only RSI9 is >=70

- yellow: RSI9 and RSI14 are >=70 and RSI9>RSI14

- orange: RSI9 and RSI14 are >=70 and RSI9<RSI14

- red: only RSI14 is >=70

Notes de version

Renamed."HighLowBox 1+3TF" -> "HighLowBox HTF+RSI"

Fixes

- HighLowBox @tf4 was same as @tf3.

- Set symbol "➊➋➌➍" for tf1-4.

- Plot RSI signal if only when value is updated.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.