OPEN-SOURCE SCRIPT

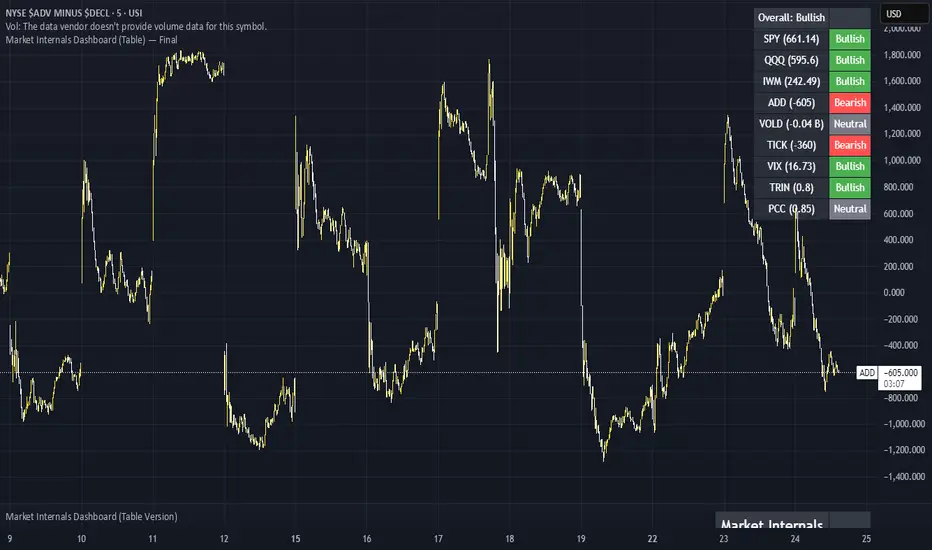

Mis à jour Market Internals Dashboard (Table) v5 - Fixed

Has a Dashboard for Market Internals and 3 Indices, very helpful

Notes de version

Here’s a breakdown for each category and the key thresholds traders watch:1.

> +1000 (NYSE): Strong upside participation → bias calls.

< –1000: Broad downside participation → bias puts.

Between –500 and +500 = choppy / indecision.

2.

Measures number of stocks upticking vs. downticking.

+800 or higher spikes → strong buying pressure.

–800 or lower spikes → strong selling pressure.

Constant readings above 0 = bullish tape.

Constant readings below 0 = bearish tape.

3.

Falling VIX intraday → risk-on, bias calls.

Rising VIX intraday → risk-off, bias puts.

<15 = complacency (strong bullish environment).

>20 = fear (bearish environment).

Watch directional change intraday, not just level.

4.

TRIN = advancing/declining volume ÷ advancing/declining issues.

<1.0 = bullish (volume favors advancers).

>1.0 = bearish (volume favors decliners).

Extreme <0.7 → very bullish, sometimes exhaustion.

Extreme >1.3–1.5 → very bearish, possible capitulation.

5. Put/Call Ratio (USI:PCC)

<0.8 = bullish sentiment (calls overweight puts).

>1.2 = bearish sentiment (puts overweight calls).

Middle ground (0.9–1.1) = neutral chop.

Note: Works best as a contrarian signal on extremes.

6. SPY, QQQ, IWM (Price vs. 20 SMA in our script)

Above 20 SMA = bullish bias.

Below 20 SMA = bearish bias.

Confirms what internals are saying.

How to Use Together

✅ Strong Call Setup:

ADD > +1000, TICK persistently > 0, TRIN < 1, VIX flat or falling, PCC < 0.8.

✅ Strong Put Setup:

ADD < –1000, TICK persistently < 0, TRIN > 1, VIX rising, PCC > 1.2.

⚠️ Neutral / Chop Zone:

ADD between –500 and +500, TICK flipping around 0, TRIN near 1, VIX flat → avoid trading until confirmation.

📈 How to Read VOLD (NYSE:VOLD)

Here are the key thresholds most pros use intraday:

VOLD Value Meaning Bias

+500M to +1B+ Strong upside volume – broad participation 📈 Call bias

+200M to +500M Moderate bullish volume 📈 Mild call bias

–200M to –500M Moderate bearish volume 📉 Mild put bias

–500M to –1B+ Strong downside volume – broad selling pressure 📉 Put bias

Near 0 Mixed or no conviction ⚠️ Chop zone – avoid trades

💡 Pro tip:

VOLD tends to trend all day once the session bias is set. If it’s above +500M early and rising, odds are the market closes bullish. Same for heavy negative VOLD.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.