INVITE-ONLY SCRIPT

ORB with Shorty Targets

Mis à jour

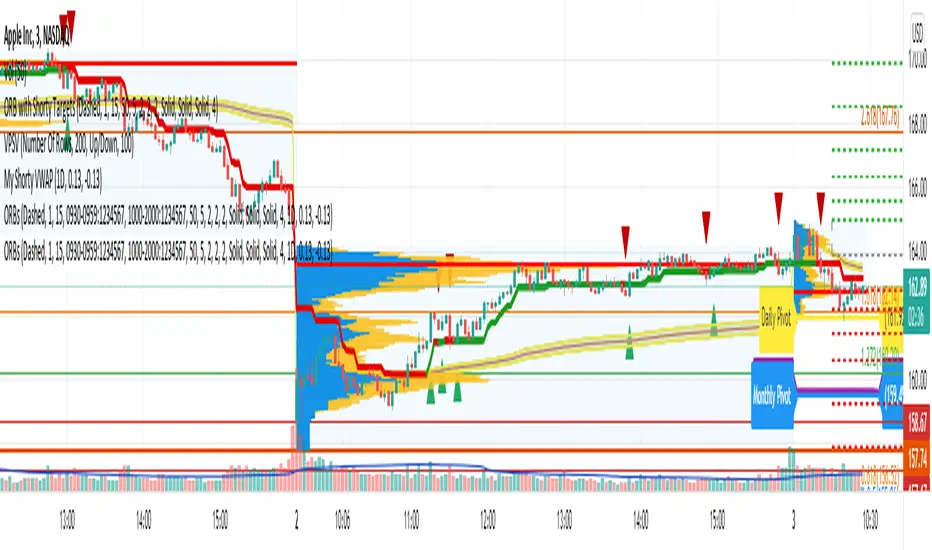

The ORBS indicator study utilizes the theory of an Opening Range Breakout occurring on a security. The indicator uses data collected from the first thirty minute session of the trading day to create fibonacci retracements at specific positions. The 'session' high and low are derived from the first thirty minutes and used as a basis to plot these values. Fibonacci retracement lines are plotted at key positions above and below the high/low values pulled during the opening 'session'. These fibonacci retracement lines are plotted at: 0 (ORB high); 1.272; 1.618; 2.00; 2.175; 2.618; and 3.236. Levels in-between these values are known as 'ranges'. Upper lines are shown green in color and indicate key levels at which the price may react within the market. No guarantees are given nor implied - ORBs is simply a tool to help plot out key fibonacci levels at specific levels accurately and completely.

This will only work on 3min or 5mins and it is intended for intraday trading only.

ORH - opening range high

ORL - opening range low

OR50% - mid between ORH and ORL aka 50% fib

The way i use ORBS:

1. ORH break - i go long on 3min or 5 min close above ORH. I use heiken-ashi candles.

2. ORL breal - i will short on 3min or 5 min close below ORL

3. Double bottoms on reclaims of ORL - i will go long with SL being the ORL

4. Double tops on ORH considering market is weak i will short with SL being the ORH

Trendbar:

Trendbar use combo of CCI and ATR to help figure out the trend the stock is in. Stock moving below the trendbar indicates it is loosing the trend dependent on what time-frame you are using it.

Pivots:

Shorty Pivots are a collection of daily/weekly/ monthly pivots indicator that allows for plotting a daily, weekly, and monthly line on a chart. The values are pulled from the three separate resolutions (daily, weekly, and monthly), and shown on the chart each day. Calculations pulled from each respective high/low/close (divided by 3.0) for the session values.

Settings:

Show Daily/Weekly/Monthly Pivot - Shows/Hides each respective pivot .

Pivot Colors - Change the color of each pivot .

Pivot Width - Line width of the plotted pivot .

Line Style - Choose Solid, Dashed, or Dotted to view different styled lines.

Label Text Color - Choose the label text color if it clashes with your chosen line color(s).

Extend Pivot Lines to Right Offset: This allws you to extend each pivot line to the right by an offset of X bars.

Day Session Timeframe - Ignore this setting.

Pivot Adjustment Timeframe - Ignore this setting.

Notes de version

Ensured pivots are not recalculating by changing time frames or candle types.Notes de version

Added the VWAP Cloud to be part of the script.Notes de version

Added ability to plot past days.Notes de version

Added Prior Day High/Low/Open/Close Levels (See Pivots Section in Options)Notes de version

Update to remove prior linesNotes de version

Update to correct prior day linesNotes de version

Update to correct price on prior day labelsNotes de version

Update to include more VWAP Cloud optionsNotes de version

Minor update for time sessionNotes de version

04-21-2022 Updated VWAP cloud fills and added alerts for TrendBar crossover/under.Notes de version

Adding Alerts for TrendBarNotes de version

RollbackNotes de version

05-12-2022 Updated ORBs to include a new momo trendbar along with a new calculation method. Defaults to new trendbar over original and there's an option to toggle between the two in the settings: "Show Original Trendbar?".Notes de version

05-12-2022 Update 2 - Updated to allow both the original and new trendbar(s) to be used simultaneously. Also allows alerts for the new trendbar arrows (set up in TV alerts).Notes de version

05-23-2022 Minor UpdateNotes de version

Minor update.Notes de version

Added Failed AuctionsNotes de version

Added IBH/LNotes de version

Automatically adjust time for ES etc.Notes de version

01-27-23 - Adding Stopping Volume to ORBs (See Options)Notes de version

Minor update to address futures ticker timeNotes de version

Updated to included additional futures contractsNotes de version

Updated to address offset time issues.Script sur invitation seulement

L'accès à ce script est limité aux utilisateurs autorisés par l'auteur et nécessite généralement un paiement. Vous pouvez l'ajouter à vos favoris, mais vous ne pourrez l'utiliser qu'après avoir demandé et obtenu l'autorisation de son auteur. Contactez simpletrader77 pour plus d'informations, ou suivez les instructions de l'auteur ci-dessous.

TradingView ne suggère pas de payer pour un script et de l'utiliser à moins que vous ne fassiez confiance à 100% à son auteur et que vous compreniez comment le script fonctionne. Dans de nombreux cas, vous pouvez trouver une bonne alternative open-source gratuite dans nos Scripts communautaires.

Instructions de l'auteur

″If you any more questions reach out to me via twitter (simpletrader77 aka shorty)

Vous voulez utiliser ce script sur un graphique ?

Avertissement: veuillez lire avant de demander l'accès.

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.