PROTECTED SOURCE SCRIPT

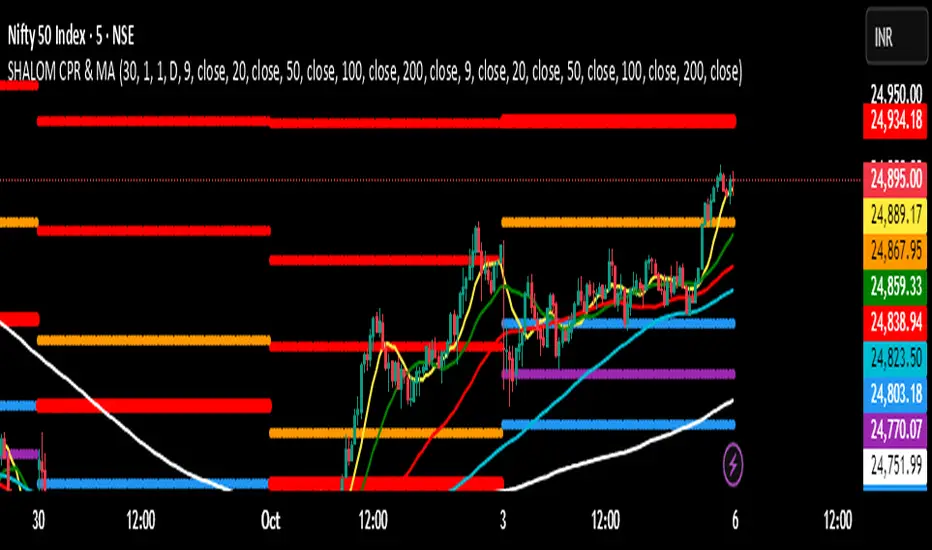

SHALOM TRADING HUB – CPR Camarilla & MA

SHALOM TRADING HUB – CPR Camarilla & MA (v4)

All-in-One Intraday & Swing Toolkit

Daily CPR (Prev Day), Weekly/Monthly Pivots, Prev Day/Week/Month High–Low, EMA/SMA pack, and Camarilla (H1–H4 & L1–L4). Plus Tomorrow CPR preview for next-session planning. 🔥

Features

Daily CPR: TC / PP / BC from previous day (value area & bias).

Floor Pivots: Daily/Weekly/Monthly R1–R4, S1–S4.

Previous High/Low: PDH/PDL, PWH/PWL, PMH/PML lines for breakout/mean-revert reads.

Camarilla Levels: H1–H4 & L1–L4 (popular 1.1 factor variant).

Moving Averages: EMA(9/20/50/100/200) & SMA(9/20/50/100/200) toggles.

Tomorrow CPR (Preview): Next session Pivot / BC / TC / R1 / S1 (D/W/M selectable).

Inputs (Settings)

Number of Daily/Weekly/Monthly pivots – show last N periods.

Show toggles – Daily CPR, Weekly/Monthly pivots, Prev H/L, Camarilla, Inner Camarilla, EMA/SMA.

Tomorrow CPR Type – D / W / M.

MA Lengths – fully customizable.

How to Use (Quick)

Trend bias: Price vs. CPR band & 20/50/200 MA stack.

Value zone: Inside TC–BC → balance; clean break & hold outside → trend continuation.

Reaction zones: Camarilla H3/L3 = bounce areas; H4/L4 = breakout/ breakdown lines.

Higher timeframe confluence: Add Weekly/Monthly pivots for swing levels.

Best Practices

Works on any timeframe; intraday (3–15m) recommended for CPR action.

Lines are derived using security(..., lookahead_on) on previous completed period → no forward repainting of those levels.

If too many lines: reduce “Number of … pivots” or turn off inner Camarilla/extra S/R.

All-in-One Intraday & Swing Toolkit

Daily CPR (Prev Day), Weekly/Monthly Pivots, Prev Day/Week/Month High–Low, EMA/SMA pack, and Camarilla (H1–H4 & L1–L4). Plus Tomorrow CPR preview for next-session planning. 🔥

Features

Daily CPR: TC / PP / BC from previous day (value area & bias).

Floor Pivots: Daily/Weekly/Monthly R1–R4, S1–S4.

Previous High/Low: PDH/PDL, PWH/PWL, PMH/PML lines for breakout/mean-revert reads.

Camarilla Levels: H1–H4 & L1–L4 (popular 1.1 factor variant).

Moving Averages: EMA(9/20/50/100/200) & SMA(9/20/50/100/200) toggles.

Tomorrow CPR (Preview): Next session Pivot / BC / TC / R1 / S1 (D/W/M selectable).

Inputs (Settings)

Number of Daily/Weekly/Monthly pivots – show last N periods.

Show toggles – Daily CPR, Weekly/Monthly pivots, Prev H/L, Camarilla, Inner Camarilla, EMA/SMA.

Tomorrow CPR Type – D / W / M.

MA Lengths – fully customizable.

How to Use (Quick)

Trend bias: Price vs. CPR band & 20/50/200 MA stack.

Value zone: Inside TC–BC → balance; clean break & hold outside → trend continuation.

Reaction zones: Camarilla H3/L3 = bounce areas; H4/L4 = breakout/ breakdown lines.

Higher timeframe confluence: Add Weekly/Monthly pivots for swing levels.

Best Practices

Works on any timeframe; intraday (3–15m) recommended for CPR action.

Lines are derived using security(..., lookahead_on) on previous completed period → no forward repainting of those levels.

If too many lines: reduce “Number of … pivots” or turn off inner Camarilla/extra S/R.

Script protégé

Ce script est publié en source fermée. Toutefois, vous pouvez l'utiliser librement et sans aucune restriction - en savoir plus ici.

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script protégé

Ce script est publié en source fermée. Toutefois, vous pouvez l'utiliser librement et sans aucune restriction - en savoir plus ici.

Clause de non-responsabilité

Les informations et les publications ne sont pas destinées à être, et ne constituent pas, des conseils ou des recommandations en matière de finance, d'investissement, de trading ou d'autres types de conseils fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.