PROTECTED SOURCE SCRIPT

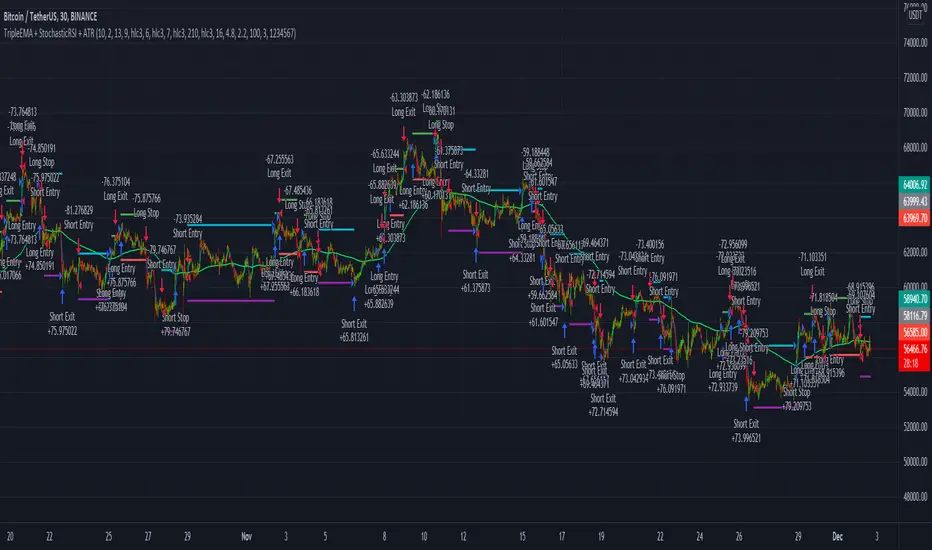

Mis à jour TripleEMA + StochasticRSI + ATR Scalping Strategy by TradeSmart

This script is one of many upcoming scripts. This one is a test for us, how it works, how you guys like this kind of stuff, and for feedback what we should change/improve at.

So feel free to comment any suggestions you have.

SCRIPT IS OPTIMIZED FOR:

BTC/USD (Coinbase) 15 minute timeframe

(Keep in mind default settings does not include trading fees, you can set it at the properties)

I recommend using this script on a trading exchange where the fees are extremely low or on an exchange where you get paid to place limit orders.

(I am not a financial avdvisor and none of this is financial advice.)

Now you can modify the following:

Stochastic RSI

3 different EMA

Length of ATR (for stop loss and take profit)

Stop Loss and Take Profit Risk to Reward ratio

Choice between Capital Risk on each trade or Risk of % of Capital

Allowing Short/Long entries only

Limit between dates

Trading days 1-7

We will update the script with more and more features taking in consideration your requests.

Hope you like it! Don't forget to let us know what we should change or improve. Thanks, and have a great day!

STRATEGY ENTRY RULES

LONG

When EMAs are lining up (meaning for ex. 400 < 13 < 7), and the Stochastic RSI crosses upwards (meaning blue line crosses orange upwards), then go long.

SHORT

When EMAs are lining down (meaning for ex. 7 < 13 < 400), and the Stochastic RSI crosses downwards (meaning blue line crosses orange downwards), then go short.

TAKE PROFIT

When price hits the exit price (calculated from stop loss with the risk ratio)

STOP LOSS

When price hits stop loss then exit the position.

QUANTITY TO BUY (Risk per Trade % or Capital %)

Risk Per Trade % attribute: we can set how much money we want to risk on one trade. Meaning that if we lose that particular position, then a Risk Per Trade % value of our equity will be lost.

Example: if you set the Risk Per Trade % to 1 % and you have a 100$ account balance, then if you loose the trade you will loose 1$ max.

Capital % we can set with how big % of our capital we want to enter into a position. Meaning that we enter with a set % of our capital.

Example: if you set the Capital % to 1 % and you have a 100$ account balance, then you will enter the position with 1$.

First Release Settings: (2021-10-25) for BTC/USD (Coinbase) 15 minute timeframe

Stochastic RSI settings: (Not displayed in the script. If you want to see it you have to add it separately.)

K: 3

D: 2

RSI Length: 6

Stochastic Length: 16

RSI Source: hlc3

EMA 1: 5

Source One: Close

EMA 2: 12

Source Two: Close

EMA 3: 215

Source Three: Close

Length of ATR: 16

Stop Loss Multiplier (risk): 3.6

Exit Price Multiplier (reward): 1

Risk Percentage: 3

Allow Long Entries: yes

Allow Short Entries: yes

Valid Trading Days: 1234567

The valid trading days of the Limit Trading Time feature. Numbers represent the days: Sunday (1), Monday (2), Tuesday (3), …, Saturday (7)

If you like this one, follow for more scripts! Thank you for your support!

Notes de version

HOTFIX: fixed bug where in some cases a long entry would fire before a short position is closedNotes de version

Updated default parameters with new optimal valuesNotes de version

- changed Exit Strategy to have options: Base Risk Multiplier, Risk to Reward Ratio

Script protégé

Ce script est publié en source fermée. Cependant, vous pouvez l'utiliser librement et sans aucune restriction – pour en savoir plus, cliquez ici.

Join our community of Smart Traders and get access to every Premium script: patreon.com/tradesmart224

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script protégé

Ce script est publié en source fermée. Cependant, vous pouvez l'utiliser librement et sans aucune restriction – pour en savoir plus, cliquez ici.

Join our community of Smart Traders and get access to every Premium script: patreon.com/tradesmart224

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.