OPEN-SOURCE SCRIPT

Mis à jour Montosca's Volume Delta

Volume Delta Montosca - Indicator Summary

Volume Delta Montosca is a specialized Pine Script indicator for TradingView designed to analyze buying and selling pressure within each candle. It focuses on identifying high-impact volume events combined with strong directional dominance.

Key Features

1. Volume Delta Visualization

Displays volume bars split into Buy Volume (Blue) and Sell Volume (Red).

Includes centered text labels inside the bars showing the exact percentage of buy and sell volume for clear readability.

2. Signal Generation Logic (Triangles)

The indicator generates Buy (Blue Triangle) and Sell (Red Triangle) signals based on two strict criteria that must be met simultaneously:

Criterion A: Significant Volume (SMA Filter)

The current candle's volume must exceed a dynamic threshold.

This threshold is calculated using a Simple Moving Average (SMA) of the volume (e.g., 20 periods) multiplied by a user-defined Adjustment Factor (e.g., 150%).

Example: If the factor is 150%, the volume must be 1.5x higher than the average.

Criterion B: Directional Dominance

The candle must show strong internal conviction.

The Buy Percentage (for long signals) or Sell Percentage (for short signals) must exceed a specific Dominance Threshold (e.g., 70%).

3. Simplified Analysis

Alerts: Integrated alert conditions for both Buy and Sell signals for automated trading or notifications.

Volume Delta Montosca is a specialized Pine Script indicator for TradingView designed to analyze buying and selling pressure within each candle. It focuses on identifying high-impact volume events combined with strong directional dominance.

Key Features

1. Volume Delta Visualization

Displays volume bars split into Buy Volume (Blue) and Sell Volume (Red).

Includes centered text labels inside the bars showing the exact percentage of buy and sell volume for clear readability.

2. Signal Generation Logic (Triangles)

The indicator generates Buy (Blue Triangle) and Sell (Red Triangle) signals based on two strict criteria that must be met simultaneously:

Criterion A: Significant Volume (SMA Filter)

The current candle's volume must exceed a dynamic threshold.

This threshold is calculated using a Simple Moving Average (SMA) of the volume (e.g., 20 periods) multiplied by a user-defined Adjustment Factor (e.g., 150%).

Example: If the factor is 150%, the volume must be 1.5x higher than the average.

Criterion B: Directional Dominance

The candle must show strong internal conviction.

The Buy Percentage (for long signals) or Sell Percentage (for short signals) must exceed a specific Dominance Threshold (e.g., 70%).

3. Simplified Analysis

Alerts: Integrated alert conditions for both Buy and Sell signals for automated trading or notifications.

Notes de version

Volume Delta Montosca - Indicator SummaryVolume Delta Montosca is a specialized Pine Script indicator for TradingView designed to analyze buying and selling pressure within each candle. It focuses on identifying high-impact volume events combined with strong directional dominance.

Key Features

1. Volume Delta Visualization

Displays volume bars split into Buy Volume (Blue) and Sell Volume (Red).

Includes centered text labels inside the bars showing the exact percentage of buy and sell volume for clear readability.

2. Signal Generation Logic (Triangles)

The indicator generates Buy (Blue Triangle) and Sell (Red Triangle) signals based on two strict criteria that must be met simultaneously:

Criterion A: Significant Volume (SMA Filter)

The current candle's volume must exceed a dynamic threshold.

This threshold is calculated using a Simple Moving Average (SMA) of the volume (e.g., 20 periods) multiplied by a user-defined Adjustment Factor (e.g., 150%).

Example: If the factor is 150%, the volume must be 1.5x higher than the average.

Criterion B: Directional Dominance

The candle must show strong internal conviction.

The Buy Percentage (for long signals) or Sell Percentage (for short signals) must exceed a specific Dominance Threshold (e.g., 70%).

3. Simplified Analysis

Alerts: Integrated alert conditions for both Buy and Sell signals for automated trading or notifications.

Notes de version

Volume Delta Montosca - Indicator SummaryVolume Delta Montosca is a specialized Pine Script indicator for TradingView designed to analyze buying and selling pressure within each candle. It focuses on identifying high-impact volume events combined with strong directional dominance.

Key Features

1. Volume Delta Visualization

Displays volume bars split into Buy Volume (Blue) and Sell Volume (Red).

Includes centered text labels inside the bars showing the exact percentage of buy and sell volume for clear readability.

2. Signal Generation Logic (Triangles)

The indicator generates Buy (Blue Triangle) and Sell (Red Triangle) signals based on two strict criteria that must be met simultaneously:

Criterion A: Significant Volume (SMA Filter)

The current candle's volume must exceed a dynamic threshold.

This threshold is calculated using a Simple Moving Average (SMA) of the volume (e.g., 20 periods) multiplied by a user-defined Adjustment Factor (e.g., 150%).

Example: If the factor is 150%, the volume must be 1.5x higher than the average.

Criterion B: Directional Dominance

The candle must show strong internal conviction.

The Buy Percentage (for long signals) or Sell Percentage (for short signals) must exceed a specific Dominance Threshold (e.g., 70%).

3. Simplified Analysis

Alerts: Integrated alert conditions for both Buy and Sell signals for automated trading or notifications.

Notes de version

1. Indicator SummaryVolume Delta Montosca is an advanced volume analysis tool for TradingView designed to identify high-probability trading opportunities by combining Volume Analysis and Price Action (Fair Value Gaps).

It operates as a system of two synchronized indicators:

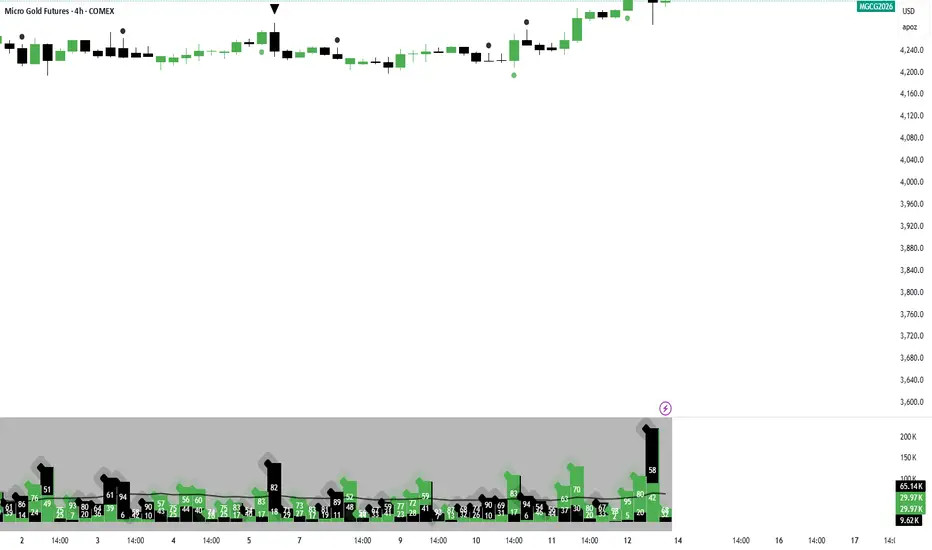

Main Chart Indicator (Top): Displays visual signals directly on the price chart. It shows Buy (Blue Triangles) and Sell (Red Triangles) signals when specific volume and price structure conditions are met. It also colors the candle bodies to represent volume intensity and visualizes "Volume Candles".

Bottom Pane Indicator (Bottom): Provides a detailed breakdown of volume data. It displays Volume Bars split into Buy/Sell portions, with centered text labels showing the exact percentage dominance (e.g., "80" for 80% buy volume). It also includes a visual Diamond marker for peak volume and an average line threshold.

Core Strategy: The indicator generates a signal ONLY when three strict conditions align:

Volume Spike: The current candle's volume is significantly higher than the recent average (SMA).

Directional Dominance: The candle has strong internal buying or selling pressure (e.g., >70% of the volume is buying).

FVG Inversion (Filter): The candle must break through a specific market structure known as a Fair Value Gap (FVG). A Buy signal requires breaking a resistance (Bearish FVG), and a Sell signal requires breaking a support (Bullish FVG).

2. How to Adjust Settings

You can customize the indicator's behavior through its settings menu. Here is a breakdown of each section:

Signal Logic

These settings control when a Buy or Sell triangle appears.

Volume Average Length (Default: 20):

Sets the "lookback period" for calculating the average volume.

Adjustment: Increase to 50 or 100 for a smoother, longer-term average. Decrease to 10 for a more reactive average.

Average Adjustment Factor % (Default: 100):

This is your "Volume Filter". It sets how much higher than the average the current volume must be.

100%: Volume must just exceed the average line.

150%: Volume must be 1.5 times larger than the average (stricter).

200%: Volume must be double the average (very strict, fewer signals).

Buy/Sell Dominance % (Default: 80):

This is your "Strength Filter".

Adjustment: Setting it to 80 means a Buy signal only triggers if 80% of the volume in that candle was buying. Lowering it to 60% will give more signals but they might be weaker.

FVG Filter (Internal)

These settings control the Price Action filter.

Use FVG Filter for Signals? (Default: Checked):

Checked: Signals appear only if they break an FVG structure. This is the recommended safer mode.

Unchecked: Signals appear purely based on Volume and Dominance, ignoring market structure.

FVG Lookback Range (Default: 10):

Defines how far back in history the indicator looks for an FVG to break.

Adjustment: A value of 10 means it looks for FVGs created in the last 10 candles. Increasing this to 50 or 100 allows the indicator to react to older support/resistance levels.

Visuals

Volume on Candles (Paint Candles):

Checked: Colors the body of the candles on the main chart (Blue/Red) based on volume dominance.

Show Signal Triangles?:

Toggles the Blue/Red triangles on/off.

Show Diamonds (Top)?:

(Bottom Indicator only) Shows a diamond marker on top of the volume bar.

Show Average Line?:

(Bottom Indicator only) Displays the gray line representing the volume threshold.

Quick Setup Guide

Add "Volume Delta - Signals & FVG (Main Chart)" to your main chart area.

Add "Volume Delta - Bottom Ultimate" to your bottom pane area.

Ensure Settings Match: Make sure Volume Average Length, Adjustment Factor, Dominance %, and FVG Lookback are identical in both indicators to ensure the signals on the chart match the data in the bottom pane.

Hope this helps you master the indicator! Let me know if you need any other adjustments.

Notes de version

Volume Delta Montosca (Modified) - Indicator GuideOverview

This technical indicator combines Volume Spread Analysis (VSA) concepts with Fair Value Gap (FVG) mechanics to identify high-probability trading setups. It estimates buying and selling pressure within each candle and filters signals based on volume dominance and price structure breaks (FVG Inversions).

Key Features

1. Volume Delta Calculation

The script estimates the split between buying and selling volume for every candle based on price action (High, Low, Close) relative to the total Volume.

Buy Volume: Calculated based on upward movement within the candle range.

Sell Volume: The remainder of the total volume.

Dominance: The percentage of volume attributed to buyers vs. sellers.

2. Visual Signal Categorization

The indicator distinguishes between two types of market conditions using distinct symbols:

Base Signal (Circle ●):

Condition: High relative volume + High directional dominance.

Meaning: Significant interest in that direction, but lacks a structural breakout confirmation (FVG inversion).

Strong Signal (Triangle ▲/▼):

Condition: High relative volume + High directional dominance + Inversion of an opposing FVG.

Meaning: High-conviction move. The volume surge successfully broke through a structural support/resistance zone (Fair Value Gap), validating the momentum.

3. Candle Painting

The main chart candles are colored to reflect the dominant volume side (Blue for Buy dominance, Red for Sell dominance).

The body size is adjusted visually to represent the intensity of the volume delta.

Signal Logic Breakdown

A. Volume Threshold

A candle must first qualify as a "High Volume" candle.

Formula: Current Volume > SMA(Volume) * Adjustment Factor

Example: If the average volume is 10k and the factor is 100%, the candle must have >10k volume.

B. Dominance Threshold

The buying or selling percentage must exceed a user-defined threshold (default 80%).

This filters out indecisive candles (dojis or neutral bars).

C. FVG Inversion (The Filter)

For Strong Signals, the price must "invert" a Fair Value Gap:

Buy Signal: Price closes above a previous Bearish FVG (breaking resistance).

Sell Signal: Price closes below a previous Bullish FVG (breaking support).

Settings & Inputs

Signal Logic

Volume Average Length: Lookback period for the volume SMA (Default: 20).

Average Adjustment Factor (%): Multiplier for the volume threshold. Higher values require more extreme volume spikes to trigger signals.

Buy/Sell Dominance %: Minimum percentage of buy/sell volume required to consider a candle dominant (Default: 80%).

FVG Filter (Internal)

FVG Lookback Range: How far back the script looks for an FVG to be inverted (Default: 10 bars).

Visuals

Show Signal Shapes: Toggles the triangles and circles on the chart.

Paint Candles: Toggles the coloring of the main price candles.

How to Read the Chart

Blue Triangle: Strong Buy. High buy volume broke a bearish structure.

Blue Circle: Base Buy. High buy volume detected, but no specific structure break.

Red Triangle: Strong Sell. High sell volume broke a bullish structure.

Red Circle: Base Sell. High sell volume detected, but no specific structure break.

Notes de version

1. Core Concept: Estimated Volume DeltaSince standard TradingView charts do not always provide tick-by-tick "Ask vs. Bid" volume data, this script estimates buying and selling pressure based on the Price Action of the candle:

Formula: It assumes that if the Close is closer to the High, there was more buying pressure.

Buy Volume = Total Volume * (Close - Low) / (High - Low)

Sell Volume: The remaining volume is considered Sell Volume.

2. Dominance Logic

The indicator calculates the percentage of Buyers vs. Sellers for every bar.

Dominance Threshold: You have a setting (default 80%).

If Buyers control >80% of the volume, the bar is considered Buy Dominant (and vice versa for Sellers).

3. Signal Generation Hierarchy

The script generates signals based on two levels of confirmation:

Level 1: Base Signal (Weak/Standard)

Condition:

High Volume: Current Volume is greater than the Volume SMA (20-period average).

Dominance: The Buy or Sell percentage exceeds the threshold (e.g., 80%).

Visual: Shown as a small Circle below/above the bar.

Level 2: Strong Signal (FVG Inversion)

This incorporates Smart Money Concepts (SMC).

Condition:

All "Base Signal" conditions are met (High Vol + Dominance).

FVG Inversion: The price must have broken/inverted an opposing Fair Value Gap (FVG).

Example (Strong Buy): High Buying Volume + Invalidation of a previous Bearish FVG.

Visual: Shown as a Triangle. This implies that not only is there volume, but market structure is shifting by respecting/disrespecting specific institutional zones.

4. Visual Representation (Histogram)

The histogram in the bottom pane is designed to show the "battle" within the candle:

Solid Bars: The script stacks the volumes. It draws the Total Volume using the Dominant Color (e.g., Blue), and then overlays the Minority Volume (e.g., Red) at the bottom.

Labels: It prints the exact percentage of Buying vs. Selling pressure inside the bar.

Diamond: A diamond symbol at the top of the bar marks the total volume peak.

5. Main Chart Visuals

Candle Painting: If enabled, it modifies the body of the candles on the main chart to reflect the volume pressure (e.g., a candle might look Red due to price drop, but be painted Blue if the volume calculation suggests hidden buying pressure).

In essence, it is a Volume Spread Analysis (VSA) tool combined with ICT/SMC Market Structure breaks.

Notes de version

1. Core Concept: Estimated Volume DeltaSince standard TradingView charts do not always provide tick-by-tick "Ask vs. Bid" volume data, this script estimates buying and selling pressure based on the Price Action of the candle:

Formula: It assumes that if the Close is closer to the High, there was more buying pressure.

Buy Volume = Total Volume * (Close - Low) / (High - Low)

Sell Volume: The remaining volume is considered Sell Volume.

2. Dominance Logic

The indicator calculates the percentage of Buyers vs. Sellers for every bar.

Dominance Threshold: You have a setting (default 80%).

If Buyers control >80% of the volume, the bar is considered Buy Dominant (and vice versa for Sellers).

3. Signal Generation Hierarchy

The script generates signals based on two levels of confirmation:

Level 1: Base Signal (Weak/Standard)

Condition:

High Volume: Current Volume is greater than the Volume SMA (20-period average).

Dominance: The Buy or Sell percentage exceeds the threshold (e.g., 80%).

Visual: Shown as a small Circle below/above the bar.

Level 2: Strong Signal (FVG Inversion)

This incorporates Smart Money Concepts (SMC).

Condition:

All "Base Signal" conditions are met (High Vol + Dominance).

FVG Inversion: The price must have broken/inverted an opposing Fair Value Gap (FVG).

Example (Strong Buy): High Buying Volume + Invalidation of a previous Bearish FVG.

Visual: Shown as a Triangle. This implies that not only is there volume, but market structure is shifting by respecting/disrespecting specific institutional zones.

4. Visual Representation (Histogram)

The histogram in the bottom pane is designed to show the "battle" within the candle:

Solid Bars: The script stacks the volumes. It draws the Total Volume using the Dominant Color (e.g., Blue), and then overlays the Minority Volume (e.g., Red) at the bottom.

Labels: It prints the exact percentage of Buying vs. Selling pressure inside the bar.

Diamond: A diamond symbol at the top of the bar marks the total volume peak.

5. Main Chart Visuals

Candle Painting: If enabled, it modifies the body of the candles on the main chart to reflect the volume pressure (e.g., a candle might look Red due to price drop, but be painted Blue if the volume calculation suggests hidden buying pressure).

In essence, it is a Volume Spread Analysis (VSA) tool combined with ICT/SMC Market Structure breaks.

Notes de version

1. Core Concept: Estimated Volume DeltaSince standard TradingView charts do not always provide tick-by-tick "Ask vs. Bid" volume data, this script estimates buying and selling pressure based on the Price Action of the candle:

Formula: It assumes that if the Close is closer to the High, there was more buying pressure.

Buy Volume = Total Volume * (Close - Low) / (High - Low)

Sell Volume: The remaining volume is considered Sell Volume.

2. Dominance Logic

The indicator calculates the percentage of Buyers vs. Sellers for every bar.

Dominance Threshold: You have a setting (default 80%).

If Buyers control >80% of the volume, the bar is considered Buy Dominant (and vice versa for Sellers).

3. Signal Generation Hierarchy

The script generates signals based on two levels of confirmation:

Level 1: Base Signal (Weak/Standard)

Condition:

High Volume: Current Volume is greater than the Volume SMA (20-period average).

Dominance: The Buy or Sell percentage exceeds the threshold (e.g., 80%).

Visual: Shown as a small Circle below/above the bar.

Level 2: Strong Signal (FVG Inversion)

This incorporates Smart Money Concepts (SMC).

Condition:

All "Base Signal" conditions are met (High Vol + Dominance).

FVG Inversion: The price must have broken/inverted an opposing Fair Value Gap (FVG).

Example (Strong Buy): High Buying Volume + Invalidation of a previous Bearish FVG.

Visual: Shown as a Triangle. This implies that not only is there volume, but market structure is shifting by respecting/disrespecting specific institutional zones.

4. Visual Representation (Histogram)

The histogram in the bottom pane is designed to show the "battle" within the candle:

Solid Bars: The script stacks the volumes. It draws the Total Volume using the Dominant Color (e.g., Blue), and then overlays the Minority Volume (e.g., Red) at the bottom.

Labels: It prints the exact percentage of Buying vs. Selling pressure inside the bar.

Diamond: A diamond symbol at the top of the bar marks the total volume peak.

5. Main Chart Visuals

Candle Painting: If enabled, it modifies the body of the candles on the main chart to reflect the volume pressure (e.g., a candle might look Red due to price drop, but be painted Blue if the volume calculation suggests hidden buying pressure).

In essence, it is a Volume Spread Analysis (VSA) tool combined with ICT/SMC Market Structure breaks.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.