Universal All Assets Strategy | viResearch

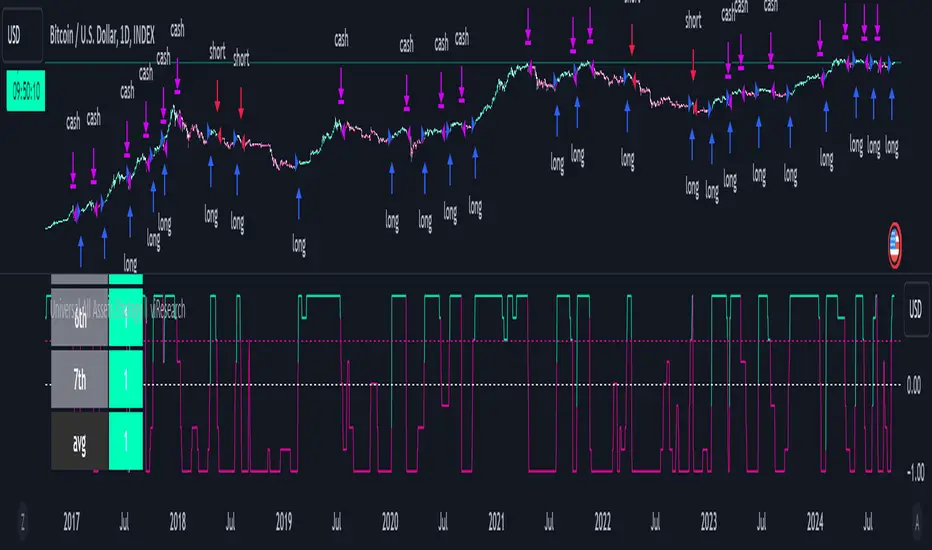

The Universal All Assets Strategy by viResearch is a sophisticated trend-following algorithm designed to operate seamlessly across various asset classes. It leverages seven unique trend-following indicators to provide robust and adaptive trading signals. The strategy dynamically adjusts to market conditions, making it suitable for equities, commodities, forex, and cryptocurrencies.

Core Methodologies and Features:

Seven Integrated Trend Indicators:

The strategy integrates seven powerful trend-following indicators. These include directional moving averages, smoothed moving averages, RSI loops, Supertrend filters, and more. When the majority of these indicators align, the strategy generates a long or short signal, ensuring that traders are capturing significant trend opportunities while minimizing noise from market fluctuations.

Universal Asset Adaptability:

Designed to work across all assets, the strategy adjusts its parameters dynamically based on the asset being traded. Whether applied to stocks, forex, or crypto, it adapts to the specific volatility and price behavior of the instrument, ensuring reliable signal generation in any market condition.

Customizable Directional Bias and Volatility Filters:

The strategy allows for an optional directional bias and incorporates volatility-based adjustments through ATR filters and standard deviation metrics. These features provide greater flexibility, allowing users to fine-tune the strategy for both trending and ranging markets.

Operational Parameters:

User-Friendly Customization:

Universal All Assets Strategy offers comprehensive customization options, including adjustable backtesting dates, starting capital settings, plotting options, and an experimental directional bias feature. These parameters can be easily tailored to meet the trader's unique needs, allowing for optimal performance across various markets and trading styles.

Seven-Trend Confirmation System:

The algorithm relies on its seven trend-following indicators to confirm market direction. If the majority of indicators generate a long signal, the strategy will initiate a long position. Conversely, a majority short signal will trigger a short position, providing strong validation for trade entries and exits.

Thoroughly Tested for Realistic Conditions:

This strategy has been rigorously backtested and forward-tested under real-world trading conditions, accounting for slippage, commissions, and various account sizes. Its robust risk management features ensure a balanced approach to trading, reducing unnecessary drawdowns and prioritizing capital preservation over time.

Concluding Remarks:

The Universal All Assets Strategy | viResearch is designed to offer traders a powerful tool for identifying and acting on market trends across multiple asset classes. With its seven-indicator confirmation system, adaptive logic, and customizable settings, this strategy is an excellent choice for traders looking for consistency and reliability in their trading approach. Whether used for long or short opportunities, this strategy provides the flexibility and precision needed to succeed in today's markets.

Script sur invitation seulement

Seuls les utilisateurs approuvés par l'auteur peuvent accéder à ce script. Vous devrez demander et obtenir l'autorisation pour l'utiliser. Celle-ci est généralement accordée après paiement. Pour plus de détails, suivez les instructions de l'auteur ci-dessous ou contactez directement viResearch.

TradingView ne recommande PAS d'acheter ou d'utiliser un script à moins que vous ne fassiez entièrement confiance à son auteur et que vous compreniez son fonctionnement. Vous pouvez également trouver des alternatives gratuites et open source dans nos scripts communautaires.

Instructions de l'auteur

Clause de non-responsabilité

Script sur invitation seulement

Seuls les utilisateurs approuvés par l'auteur peuvent accéder à ce script. Vous devrez demander et obtenir l'autorisation pour l'utiliser. Celle-ci est généralement accordée après paiement. Pour plus de détails, suivez les instructions de l'auteur ci-dessous ou contactez directement viResearch.

TradingView ne recommande PAS d'acheter ou d'utiliser un script à moins que vous ne fassiez entièrement confiance à son auteur et que vous compreniez son fonctionnement. Vous pouvez également trouver des alternatives gratuites et open source dans nos scripts communautaires.