PROTECTED SOURCE SCRIPT

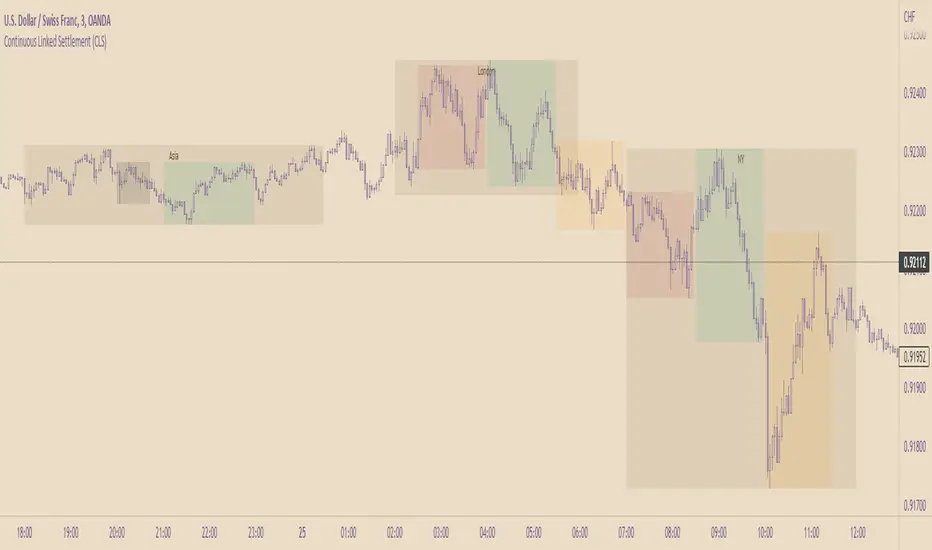

Continuous Linked Settlement (CLS)

Continuous Linked Settlement (CLS) is an international payment system which was launched in September 2002 for the settlement of foreign exchange transactions. In the conventional settlement of a foreign exchange transaction the exchange of the two currencies involved in the trade is not normally synchronous.

For one party to the trade there is therefore a risk that it will transfer the currency it has sold without receiving from the counterparty the currency it has bought (settlement risk). Even if a bank’s risk position vis-à-vis a counterparty is short-term, it may be many times greater than its capital. With CLS, an infrastructure has been created which eliminates settlement risk by means of a payment-versus-payment (PvP)2 mechanism.

For one party to the trade there is therefore a risk that it will transfer the currency it has sold without receiving from the counterparty the currency it has bought (settlement risk). Even if a bank’s risk position vis-à-vis a counterparty is short-term, it may be many times greater than its capital. With CLS, an infrastructure has been created which eliminates settlement risk by means of a payment-versus-payment (PvP)2 mechanism.

Script protégé

Ce script est publié en source fermée. Cependant, vous pouvez l'utiliser librement et sans aucune restriction – pour en savoir plus, cliquez ici.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script protégé

Ce script est publié en source fermée. Cependant, vous pouvez l'utiliser librement et sans aucune restriction – pour en savoir plus, cliquez ici.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.