OPEN-SOURCE SCRIPT

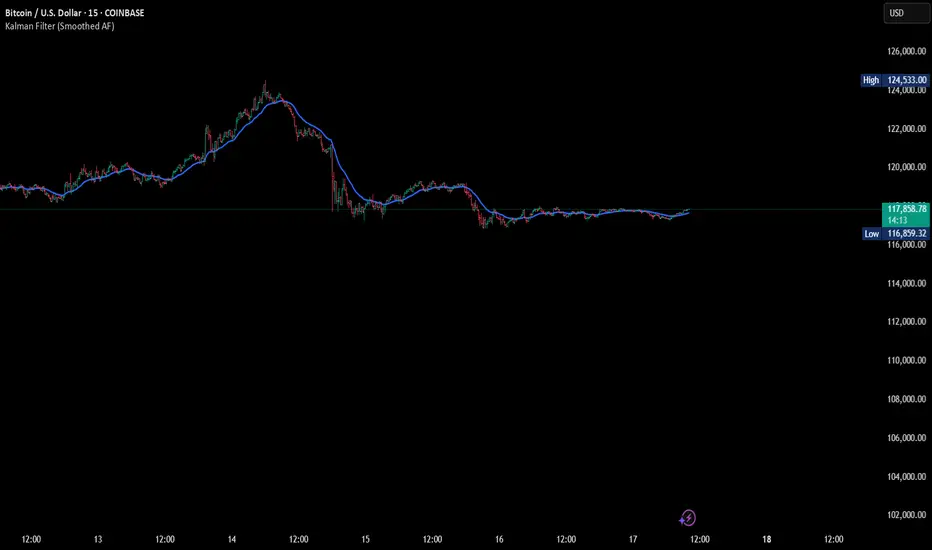

Kalman Filter (Smoothed)

The Kalman Filter is a recursive statistical algorithm that smooths noisy price data while adapting dynamically to new information. Unlike simple moving averages or EMAs, it minimizes lag by balancing measurement noise (R) and process noise (Q), giving traders a clean, adaptive estimate of true price action.

🔹 Core Features

Real-time recursive estimation

Adjustable noise parameters (R = sensitivity to price, Q = smoothness vs. responsiveness)

Reduces market noise without heavy lag

Overlay on chart for direct comparison with raw price

🔹 Trading Applications

Smoother trend visualization compared to traditional MAs

Spotting true direction during volatile/sideways markets

Filtering out market “whipsaws” for cleaner signals

Building blocks for advanced quant/trading models

⚠️ Note: The Kalman Filter is a state-space model; it doesn’t predict future price, but smooths past and present data into a more reliable signal.

🔹 Core Features

Real-time recursive estimation

Adjustable noise parameters (R = sensitivity to price, Q = smoothness vs. responsiveness)

Reduces market noise without heavy lag

Overlay on chart for direct comparison with raw price

🔹 Trading Applications

Smoother trend visualization compared to traditional MAs

Spotting true direction during volatile/sideways markets

Filtering out market “whipsaws” for cleaner signals

Building blocks for advanced quant/trading models

⚠️ Note: The Kalman Filter is a state-space model; it doesn’t predict future price, but smooths past and present data into a more reliable signal.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.