OPEN-SOURCE SCRIPT

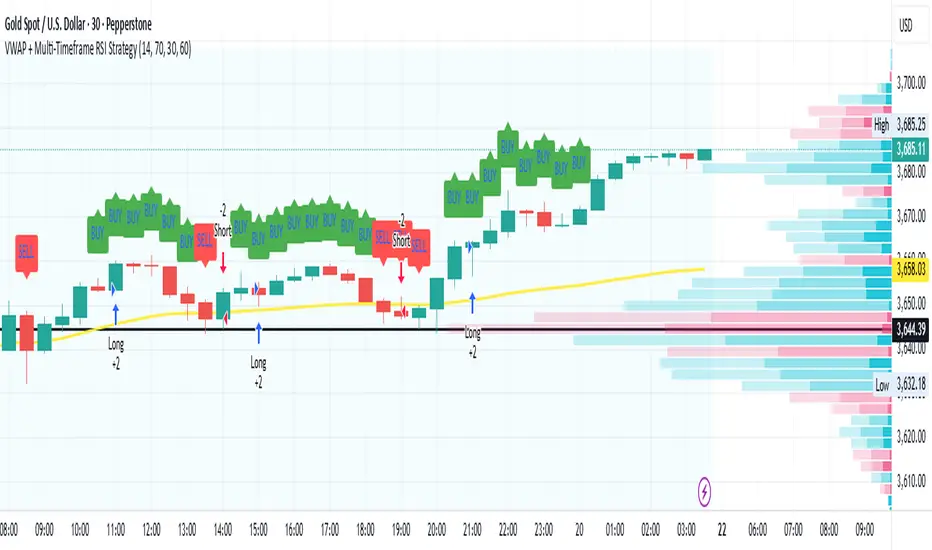

VWAP + Multi-Timeframe RSI Strategy

This strategy combines VWAP trend direction with confirmation from RSI on a higher timeframe. The idea is to only take trades when both intraday momentum and higher-timeframe trend are aligned, increasing accuracy.

LONG Entry:

Price above VWAP (bullish environment).

RSI on the current timeframe is below overbought (room to rise).

RSI on the higher timeframe (default H1) is above 50 (bullish confirmation).

SHORT Entry:

Price below VWAP (bearish environment).

RSI on the current timeframe is above oversold (room to fall).

RSI on the higher timeframe is below 50 (bearish confirmation).

Exit Rule:

Stop-loss near VWAP.

Take-profit at ~2x risk or when major levels are reached.

Best Timeframes:

Use 15m or 30m chart with H1 RSI for intraday trading.

Use 1H chart with Daily RSI for swing trading.

⚡ The higher-timeframe RSI filter reduces false signals and aligns trades with institutional flow.

LONG Entry:

Price above VWAP (bullish environment).

RSI on the current timeframe is below overbought (room to rise).

RSI on the higher timeframe (default H1) is above 50 (bullish confirmation).

SHORT Entry:

Price below VWAP (bearish environment).

RSI on the current timeframe is above oversold (room to fall).

RSI on the higher timeframe is below 50 (bearish confirmation).

Exit Rule:

Stop-loss near VWAP.

Take-profit at ~2x risk or when major levels are reached.

Best Timeframes:

Use 15m or 30m chart with H1 RSI for intraday trading.

Use 1H chart with Daily RSI for swing trading.

⚡ The higher-timeframe RSI filter reduces false signals and aligns trades with institutional flow.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.