OPEN-SOURCE SCRIPT

Crypto Breadth | AlphaNatt

\Crypto Breadth | AlphaNatt\

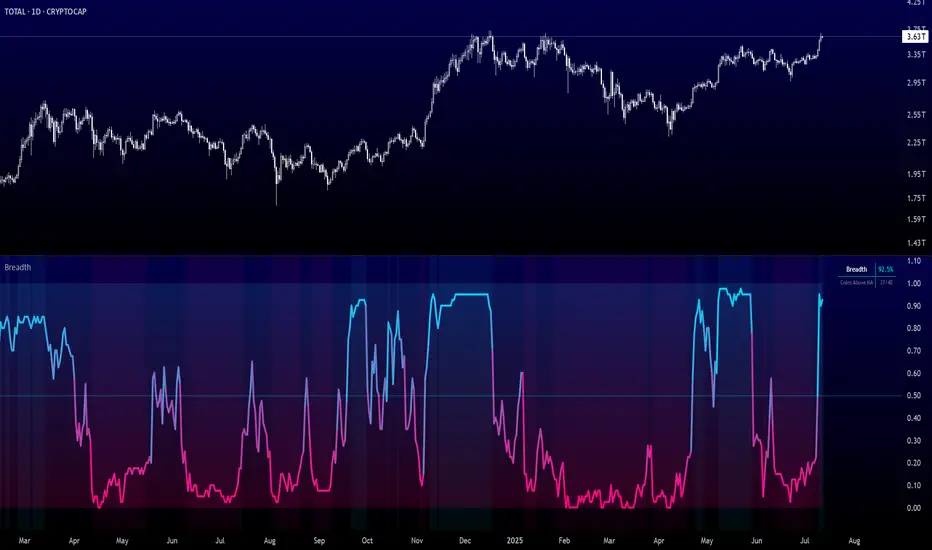

A dynamic, visually modern market breadth indicator designed to track the strength of the top 40 cryptocurrencies by measuring how many are trading above their respective 50-day moving averages. Built with precision, branding consistency, and UI enhancements for fast interpretation.

\📊 What This Script Does\

* Aggregates the performance of \40 major cryptocurrencies\ on Binance

* Calculates a \breadth score (0.00–1.00)\ based on how many tokens are above their moving averages

* Smooths the breadth with optional averaging

* Displays the result as a \dynamic, color-coded line\ with aesthetic glow and gradient fill

* Provides automatic \background zones\ for extreme bullish/bearish conditions

* Includes \alerts\ for key threshold crossovers

* Highlights current values in an \information panel\

\🧠 How It Works\

* Pulls real-time `close` prices for 40 coins (e.g., XRP, BNB, SOL, DOGE, PEPE, RENDER, etc.)

* Compares each coin's price to its 50-day SMA (adjustable)

* Assigns a binary score:

• 1 if the coin is above its MA

• 0 if it’s below

* Aggregates all results and divides by 40 to produce a normalized \breadth percentage\

\🎨 Visual Design Features\

* Smooth blue-to-pink \color gradient\ matching the AlphaNatt brand

* Soft \glow effects\ on the main line for enhanced legibility

* Beautiful \multi-stop fill gradient\ with 16 transition zones

* Optional \background shading\ when extreme sentiment is detected:

• Bullish zone if breadth > 80%

• Bearish zone if breadth < 20%

\⚙️ User Inputs\

* \Moving Average Length\ – Number of periods to calculate each coin’s SMA

* \Smoothing Length\ – Smooths the final breadth value

* \Show Background Zones\ – Toggle extreme sentiment overlays

* \Show Gradient Fill\ – Toggle the modern multicolor area fill

\🛠️ Utility Table (Top Right)\

* Displays live breadth percentage

* Shows how many coins (e.g., 27/40) are currently above their MA

\🔔 Alerts Included\

* \Breadth crosses above 50%\ → Bullish signal

* \Breadth crosses below 50%\ → Bearish signal

* \Breadth > 80%\ → Strong bullish trend

* \Breadth < 20%\ → Strong bearish trend

\📈 Best Used For\

* Gauging overall market strength or weakness

* Timing trend transitions in the crypto market

* Confirming trend-based strategies with broad market support

* Visual dashboard in macro dashboards or strategy overlays

\✅ Designed For\

* Swing traders

* Quantitative investors

* Market structure analysts

* Anyone seeking a macro view of crypto performance

Note: Not financial advise

A dynamic, visually modern market breadth indicator designed to track the strength of the top 40 cryptocurrencies by measuring how many are trading above their respective 50-day moving averages. Built with precision, branding consistency, and UI enhancements for fast interpretation.

\📊 What This Script Does\

* Aggregates the performance of \40 major cryptocurrencies\ on Binance

* Calculates a \breadth score (0.00–1.00)\ based on how many tokens are above their moving averages

* Smooths the breadth with optional averaging

* Displays the result as a \dynamic, color-coded line\ with aesthetic glow and gradient fill

* Provides automatic \background zones\ for extreme bullish/bearish conditions

* Includes \alerts\ for key threshold crossovers

* Highlights current values in an \information panel\

\🧠 How It Works\

* Pulls real-time `close` prices for 40 coins (e.g., XRP, BNB, SOL, DOGE, PEPE, RENDER, etc.)

* Compares each coin's price to its 50-day SMA (adjustable)

* Assigns a binary score:

• 1 if the coin is above its MA

• 0 if it’s below

* Aggregates all results and divides by 40 to produce a normalized \breadth percentage\

\🎨 Visual Design Features\

* Smooth blue-to-pink \color gradient\ matching the AlphaNatt brand

* Soft \glow effects\ on the main line for enhanced legibility

* Beautiful \multi-stop fill gradient\ with 16 transition zones

* Optional \background shading\ when extreme sentiment is detected:

• Bullish zone if breadth > 80%

• Bearish zone if breadth < 20%

\⚙️ User Inputs\

* \Moving Average Length\ – Number of periods to calculate each coin’s SMA

* \Smoothing Length\ – Smooths the final breadth value

* \Show Background Zones\ – Toggle extreme sentiment overlays

* \Show Gradient Fill\ – Toggle the modern multicolor area fill

\🛠️ Utility Table (Top Right)\

* Displays live breadth percentage

* Shows how many coins (e.g., 27/40) are currently above their MA

\🔔 Alerts Included\

* \Breadth crosses above 50%\ → Bullish signal

* \Breadth crosses below 50%\ → Bearish signal

* \Breadth > 80%\ → Strong bullish trend

* \Breadth < 20%\ → Strong bearish trend

\📈 Best Used For\

* Gauging overall market strength or weakness

* Timing trend transitions in the crypto market

* Confirming trend-based strategies with broad market support

* Visual dashboard in macro dashboards or strategy overlays

\✅ Designed For\

* Swing traders

* Quantitative investors

* Market structure analysts

* Anyone seeking a macro view of crypto performance

Note: Not financial advise

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Free Analysis Platform 👉 alphanatt.com

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Free Analysis Platform 👉 alphanatt.com

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.