OPEN-SOURCE SCRIPT

Mis à jour Smash + Proba + BF

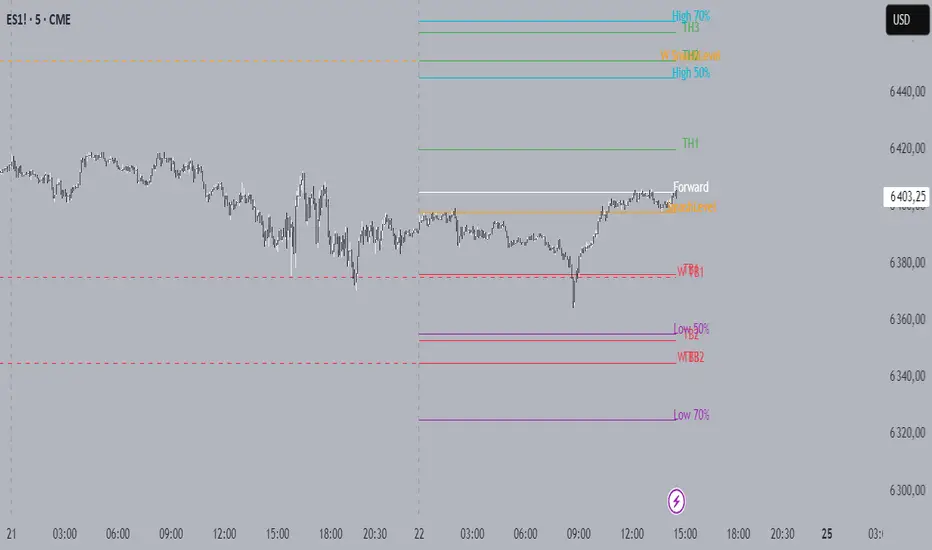

This script is designed to automatically display various levels that can be useful for trading.

These levels must be entered in the script as parameters in the form of lists separated by semicolons (";").

There are three groups of levels:

These levels must be entered in the script as parameters in the form of lists separated by semicolons (";").

There are three groups of levels:

- Smash: Levels provided in the Smashelito newsletter

- Proba: Probability levels (50% and 70%) of reaching certain price points, calculated using options data

- BF: Option-related levels provided by Krechendo Connect / BlackFlag

Example :

Notes de version

A comprehensive multi-timeframe support and resistance indicator that displays key trading levels across daily and weekly timeframes.Features

Daily Levels (Solid Lines)

Smash Level: Key breakout/breakdown level (Orange)

Target High 1-3 (TH1-TH3): Upside targets (Green)

Target Low 1-3 (TB1-TB3): Downside targets (Red)

Weekly Levels (Dashed Lines)

Same structure as daily levels but displayed across the entire current week

Semi-transparent styling for clear distinction from daily levels

Probability Levels

High 70%/50%: Upper probability zones (Aqua)

Low 50%/70%: Lower probability zones (Purple)

Book Flow (BF) Levels

Call Resistance: Key call option resistance levels (Lime)

Put Support: Key put option support levels (Red)

Dominant Buy/Sell: Order flow dominance levels (Green/Red)

HVL (High Volume Levels): Both regular and 0DTE versions (Blue)

1D Min/Max: Daily range extremes (Yellow)

Gamma Wall: Critical gamma hedging levels (Aqua)

Input Format

Enter levels separated by semicolons (;) in the format: Level1;Level2;Level3;etc.

Usage

Perfect for traders who need to track multiple support/resistance levels across different timeframes and market dynamics. The indicator automatically updates and extends lines as new bars form, providing real-time level tracking with clear visual differentiation between daily and weekly levels.

Notes de version

# Smash + Proba + BF Levels IndicatorA comprehensive multi-timeframe support and resistance indicator that displays key trading levels across daily and weekly timeframes.

## Features

### Daily Levels (Solid Lines)

- **Smash Level**: Key breakout/breakdown level (Orange)

- **Target High 1-3 (TH1-TH3)**: Upside targets (Green)

- **Target Low 1-3 (TB1-TB3)**: Downside targets (Red)

### Weekly Levels (Dashed Lines)

- Same structure as daily levels but displayed across the entire current week

- Semi-transparent styling for clear distinction from daily levels

### Probability Levels

- **High 70%/50%**: Upper probability zones (Aqua)

- **Low 50%/70%**: Lower probability zones (Purple)

### Book Flow (BF) Levels

- **Call Resistance**: Key call option resistance levels (Lime)

- **Put Support**: Key put option support levels (Red)

- **Dominant Buy/Sell**: Order flow dominance levels (Green/Red)

- **HVL (High Volume Levels)**: Both regular and 0DTE versions (Blue)

- **1D Min/Max**: Daily range extremes (Yellow)

- **Gamma Wall**: Critical gamma hedging levels (Aqua)

## Input Format

Enter levels separated by semicolons (;) in the format: `Level1;Level2;Level3;etc.`

## Usage

Perfect for traders who need to track multiple support/resistance levels across different timeframes and market dynamics. The indicator automatically updates and extends lines as new bars form, providing real-time level tracking with clear visual differentiation between daily and weekly levels.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.