OPEN-SOURCE SCRIPT

Bid/Ask Volume Tension with Rolling Avg

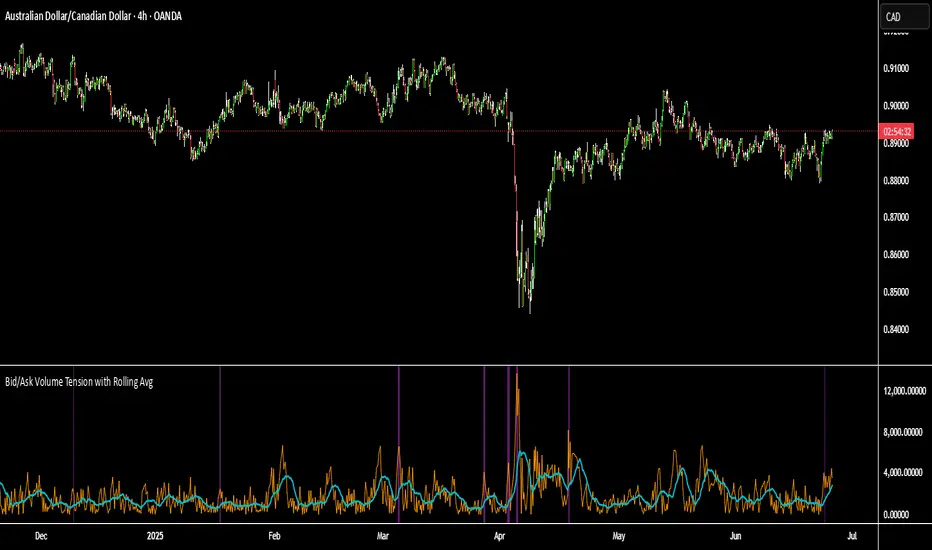

📊 Bid/Ask Volume Tension with Rolling Average

This indicator is designed to help traders identify pivotal moments of buildup, exhaustion, or imbalance in the market by calculating the tension between buy and sell volume.

🔍 How It Works:

Buy volume is approximated when the candle closes higher than or equal to its open.

Sell volume is approximated when the candle closes below its open.

Both are smoothed using an EMA (Exponential Moving Average) for noise reduction.

Tension is calculated as the absolute difference between smoothed buy and sell volume.

A rolling average of tension shows the baseline for normal behavior.

When instant tension rises significantly above the rolling average, it often signals:

A build-up before a large move

Aggressive order flow imbalances

Potential reversals or breakouts

🧠 How to Use:

Watch the orange line (instant tension) for spikes above the aqua line (rolling average).

Purple background highlights show when tension exceeds a customizable multiple of the average — a potential setup zone.

Use this indicator alongside:

Price action (candlestick structure)

Support/resistance

Liquidity zones or order blocks

⚙️ Settings:

Smoothing Length: Controls the responsiveness of buy/sell volume smoothing.

Rolling Avg Window: Defines the lookback period for the baseline tension.

Buildup Threshold: Triggers highlight zones when tension exceeds this multiple of the average.

🧪 Best For:

Spotting pre-breakout tension

Detecting volume-based divergences

Confirming order flow imbalances

This indicator is designed to help traders identify pivotal moments of buildup, exhaustion, or imbalance in the market by calculating the tension between buy and sell volume.

🔍 How It Works:

Buy volume is approximated when the candle closes higher than or equal to its open.

Sell volume is approximated when the candle closes below its open.

Both are smoothed using an EMA (Exponential Moving Average) for noise reduction.

Tension is calculated as the absolute difference between smoothed buy and sell volume.

A rolling average of tension shows the baseline for normal behavior.

When instant tension rises significantly above the rolling average, it often signals:

A build-up before a large move

Aggressive order flow imbalances

Potential reversals or breakouts

🧠 How to Use:

Watch the orange line (instant tension) for spikes above the aqua line (rolling average).

Purple background highlights show when tension exceeds a customizable multiple of the average — a potential setup zone.

Use this indicator alongside:

Price action (candlestick structure)

Support/resistance

Liquidity zones or order blocks

⚙️ Settings:

Smoothing Length: Controls the responsiveness of buy/sell volume smoothing.

Rolling Avg Window: Defines the lookback period for the baseline tension.

Buildup Threshold: Triggers highlight zones when tension exceeds this multiple of the average.

🧪 Best For:

Spotting pre-breakout tension

Detecting volume-based divergences

Confirming order flow imbalances

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.