Hidden Breaker

DESCRIPTION

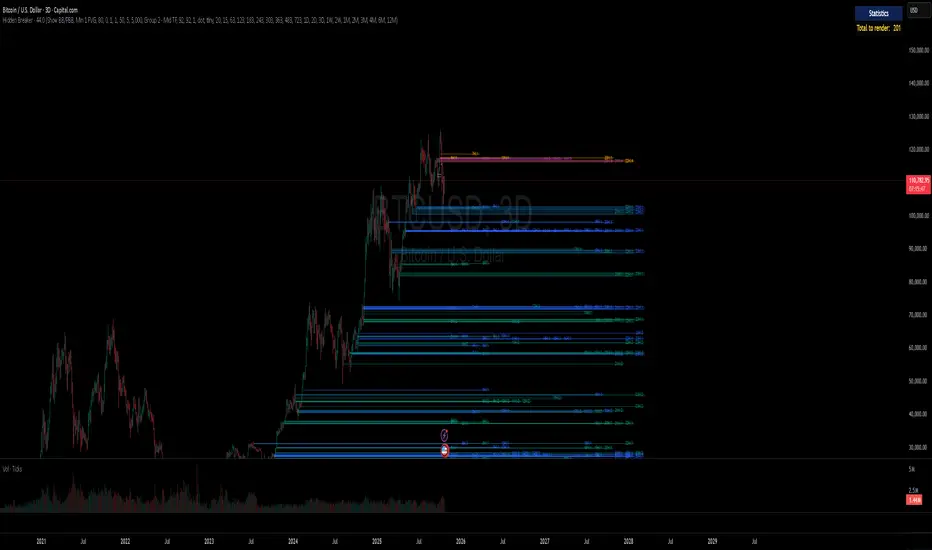

The Hidden Breaker identifies Order Blocks and tracks their transformation when they interact with Fair Value Gaps. It displays both standard Order Blocks and those modified by FVG (Breaker Blocks) across multiple timeframes within a single chart view.

METHODOLOGY ORIGIN

This indicator is based on concepts from the MoneyTaur trading methodology, which focuses on identifying Order Blocks hidden behind Fair Value Gaps from the multi-timeframe perspective.

WHAT MAKES THIS UNIQUE

- Box Management System: User-controlled box allocation through dynamic filters, ensuring all detected blocks remain visible within Pine Script's 500 box limit. Users can manage which blocks to display through price range and filter adjustments.

- Creates unified columnar visualization

- Processes 70+ timeframes (incl custom)

- Tracks each block's complete lifecycle

KEY FEATURES

Order Blocks (OB): Detects engulfing candle patterns between candle bodies with customizable deviation tolerance.

Breaker Blocks (BB): Order Blocks (candle body) that crossed Fair Value Gaps by 100% without being touched by wicks.

Partial Breaker Blocks (PBB): Candle bodies that didn't fit 100% within an FVG or were partially mitigated by wicks. Min BB size in % after passing FVG is adjustable within filter.

Multi-Timeframe Analysis: Processes 70+ timeframes without repainting

Visual Organization: Displays blocks in columns by timeframe for easy comparison. Spacing is adjustable within menu.

FVG Counter: Shows interaction count (1-5) for each block

Statistics Table: Real-time monitoring of detected blocks

Price Range Filter: Manages Pine Script's 500 box limit effectively

HOW IT WORKS

The indicator uses a three-stage detection process:

Stage 1 - Order Block Detection:

Identifies engulfing patterns where one candle body fully engulfs the body of the previous opposite candle. The system allows for small price deviations. The detected zone spans from the open to close of the engulfed candle.

Stage 2 - FVG Interaction:

Monitors for Fair Value Gaps that occur when the candle's low is above the high from two candles ago (bullish gap) or when the high is below the low from two candles ago (bearish gap). When such a gap overlaps an existing Order Block, the system evaluates:

Checks whether the OB’s body is fully contained within the FVG range (passed 100% through it without wick contact) — shown as 1H | 1, where 1H is the timeframe and 1 the FVG count.

The percentage of the OB body retained within the FVG after zone adjustment is filter-controlled.

Directional bias is inherited from the FVG.

Blocks with multiple FVG interactions (counted 1–5+) allow filtering of BBs based on their FVG overlap frequency.

Stage 3 - Single or Multi-Timeframe Processing:

Collects data from multiple timeframes simultaneously, processes it without repainting, and displays horizontal boxes with timeframe labels arranged in vertical columns, where each timeframe occupies its own designated horizontal space for clear visual separation.

DETECTION CRITERIA

Order Block: Engulfing with body-to-body alignment within adjustable deviation tolerance

Breaker Block: OB that intersects with subsequent FVG. When filter is set to 100%, shows only BBs where the body fully passed through FVG without wick touches.

Partial Breaker Block (PBB): An Order Block partially intersected by an FVG or partially mitigated by a subsequent candle, narrowing the original Breaker Block range.

FVG validation: Gap between candles 1 and 3

VISUAL GUIDE

Green: Bullish Order Blocks

Red: Bearish Order Blocks

Blue: Bullish Breaker Blocks

Orange: Bearish Breaker Blocks

Teal: Bullish Partial Breaker Blocks

Purple: Bearish Partial Breaker Blocks

Numbers: FVG interaction count (1-5)

Percentages: Remaining unmitigated area

SETTINGS

Block Type Selection: Choose to display OB only, BB/PBB only

Deviation (%): Tolerance for engulfing pattern detection

Min Engulfing Impulse (%): Minimum required price movement for valid engulfing

FVG Filter: Set minimum FVG count required (1-5)

Min BB Size after FVG (%): Minimum remaining size of an BB after passing an FVG

Hide if Mitigated More Than (%): Visibility threshold for partially mitigated blocks

Price Range Filter (%): Limit Block detection to specific price ranges from current price

Price Range Axis (%): Offset reference point for price range

Timeframe Groups: Select from 6 predefined groups or custom timeframes

Max Bars to Scan: Historical lookback period (100-10000)

Replay Mode: used for historical backtesting and visual analysis for higher TF data.

TIMEFRAME GROUPS

Group 1: Minutes & Short Hours (5m-4H)

Group 2: Extended Hours (5H-23H)

Group 3: Days (1D-19D)

Group 4: Weeks (1W-12W)

Group 5: Months (1M-12M)

Group 6: 19 Custom timeframes

USAGE NOTES

Select appropriate timeframe groups for your analysis style

Adjust deviation and impulse settings based on market volatility

Use FVG filter to focus on blocks with multiple gap interactions

Monitor the statistics table to ensure box count stays under 500. If approaching limit, narrow the price range filter

Each box shows its description aligned vertically by timeframe

TECHNICAL SPECIFICATIONS

Pine Script Version 6

Default scan range: 5000 historical bars

Maximum 500 boxes per chart (Pine Script limitation)

Non-repainting calculations

Compatible with all markets and timeframes

Optimized memory management for multi-timeframe processing

TERMS AND CONDITIONS

This indicator and its documentation do not constitute financial or investment advice.

Users should make independent trading decisions and accept full responsibility for their outcomes.

Use of this tool implies that you understand the risks of financial markets and agree that the author is not liable for any loss or damage arising from its use.

This indicator is designed solely as a visualisation tool to assist with chart analysis.

It does not teach, promote, or automate any specific trading strategy, concept, or methodology.

All visual elements — such as OBs, BBs, PBBs, FVGs, and related interactions — are intended to support manual study and backtesting, not to generate trading signals.

Past performance does not guarantee future results. By using this tool, users agree to these terms.

Script sur invitation seulement

Seuls les utilisateurs approuvés par l'auteur peuvent accéder à ce script. Vous devrez demander et obtenir l'autorisation pour l'utiliser. Celle-ci est généralement accordée après paiement. Pour plus de détails, suivez les instructions de l'auteur ci-dessous ou contactez directement LiquidityForgeSMC.

TradingView ne recommande PAS d'acheter ou d'utiliser un script à moins que vous ne fassiez entièrement confiance à son auteur et que vous compreniez son fonctionnement. Vous pouvez également trouver des alternatives gratuites et open source dans nos scripts communautaires.

Instructions de l'auteur

Clause de non-responsabilité

Script sur invitation seulement

Seuls les utilisateurs approuvés par l'auteur peuvent accéder à ce script. Vous devrez demander et obtenir l'autorisation pour l'utiliser. Celle-ci est généralement accordée après paiement. Pour plus de détails, suivez les instructions de l'auteur ci-dessous ou contactez directement LiquidityForgeSMC.

TradingView ne recommande PAS d'acheter ou d'utiliser un script à moins que vous ne fassiez entièrement confiance à son auteur et que vous compreniez son fonctionnement. Vous pouvez également trouver des alternatives gratuites et open source dans nos scripts communautaires.