OPEN-SOURCE SCRIPT

Annual Lump Sum: Yearly & Compounded

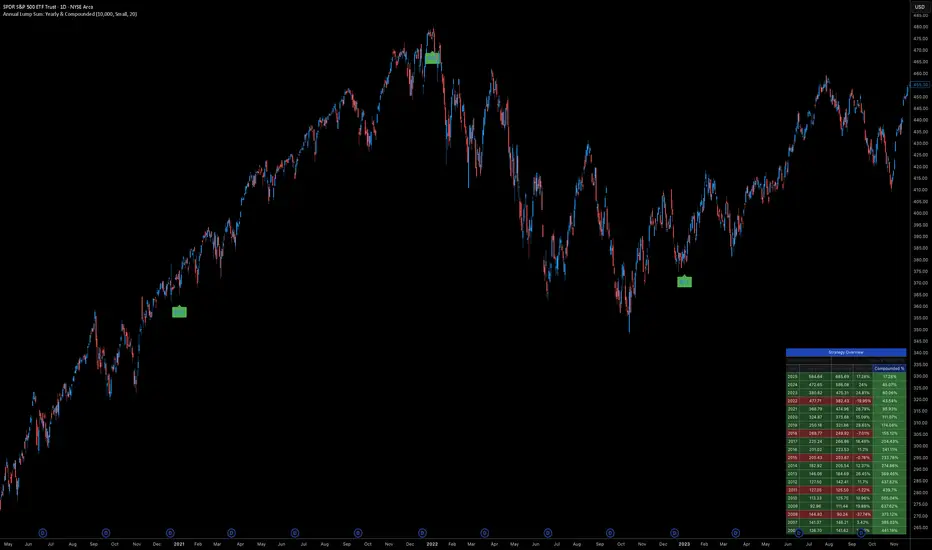

Annual Lump Sum Investment Analyzer (Yearly vs. Compounded)

Overview

This Pine Script indicator simulates a disciplined "Lump Sum" investing strategy. It calculates the performance of buying a fixed dollar amount (e.g., $10,000) on the very first trading day of every year and holding it indefinitely.

Unlike standard backtesters that only show a total percentage, this tool breaks down performance by "Vintage" (the year of purchase), allowing you to see which specific years contributed most to your wealth.

Key Features

Automated Execution: Automatically detects the first trading bar of every new year to simulate a buy.

Dual-Yield Analysis: The table provides two distinct ways to view returns:

Yearly %: How the market performed specifically during that calendar year (Jan 1 to Dec 31).

Compounded %: The total return of that specific year's investment from the moment it was bought until today.

Live Updates: For the current year, the "End Price" and "Yields" update in real-time with market movements.

Portfolio Summary: Displays your Total Invested Capital vs. Total Current Value at the top of the table.

Table Column Breakdown

The dashboard in the bottom-right corner displays the following:

Year: The vintage year of the investment.

Buy Price: The price of the asset on the first trading day of that year.

End Price: The price on the last trading day of that year (or the current price if the year is still active).

Yearly %: The isolated performance of that specific calendar year. (Green = The market ended the year higher than it started).

Compounded %: The "Diamond Hands" return. This shows how much that specific $10,000 tranche is up (or down) right now relative to the current price.

How to Use

Add the script to your chart.

Crucial: Set your chart timeframe to Daily (D). This ensures the script correctly identifies the first trading day of the year.

Open the Settings (Inputs) to adjust:

Annual Investment Amount: Default is $10,000.

Table Size: Adjust text size (Tiny, Small, Normal, Large).

Max Rows: Limit how many historical years are shown to keep the chart clean.

Use Case

This tool is perfect for investors who want to visualize the power of long-term holding. It allows you to see that even if a specific year had a bad "Yearly Yield" (e.g., buying in 2008), the "Compounded Yield" might still be massive today due to time in the market.

Overview

This Pine Script indicator simulates a disciplined "Lump Sum" investing strategy. It calculates the performance of buying a fixed dollar amount (e.g., $10,000) on the very first trading day of every year and holding it indefinitely.

Unlike standard backtesters that only show a total percentage, this tool breaks down performance by "Vintage" (the year of purchase), allowing you to see which specific years contributed most to your wealth.

Key Features

Automated Execution: Automatically detects the first trading bar of every new year to simulate a buy.

Dual-Yield Analysis: The table provides two distinct ways to view returns:

Yearly %: How the market performed specifically during that calendar year (Jan 1 to Dec 31).

Compounded %: The total return of that specific year's investment from the moment it was bought until today.

Live Updates: For the current year, the "End Price" and "Yields" update in real-time with market movements.

Portfolio Summary: Displays your Total Invested Capital vs. Total Current Value at the top of the table.

Table Column Breakdown

The dashboard in the bottom-right corner displays the following:

Year: The vintage year of the investment.

Buy Price: The price of the asset on the first trading day of that year.

End Price: The price on the last trading day of that year (or the current price if the year is still active).

Yearly %: The isolated performance of that specific calendar year. (Green = The market ended the year higher than it started).

Compounded %: The "Diamond Hands" return. This shows how much that specific $10,000 tranche is up (or down) right now relative to the current price.

How to Use

Add the script to your chart.

Crucial: Set your chart timeframe to Daily (D). This ensures the script correctly identifies the first trading day of the year.

Open the Settings (Inputs) to adjust:

Annual Investment Amount: Default is $10,000.

Table Size: Adjust text size (Tiny, Small, Normal, Large).

Max Rows: Limit how many historical years are shown to keep the chart clean.

Use Case

This tool is perfect for investors who want to visualize the power of long-term holding. It allows you to see that even if a specific year had a bad "Yearly Yield" (e.g., buying in 2008), the "Compounded Yield" might still be massive today due to time in the market.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.

Script open-source

Dans l'esprit TradingView, le créateur de ce script l'a rendu open source afin que les traders puissent examiner et vérifier ses fonctionnalités. Bravo à l'auteur! Bien que vous puissiez l'utiliser gratuitement, n'oubliez pas que la republication du code est soumise à nos Règles.

Clause de non-responsabilité

Les informations et publications ne sont pas destinées à être, et ne constituent pas, des conseils ou recommandations financiers, d'investissement, de trading ou autres fournis ou approuvés par TradingView. Pour en savoir plus, consultez les Conditions d'utilisation.