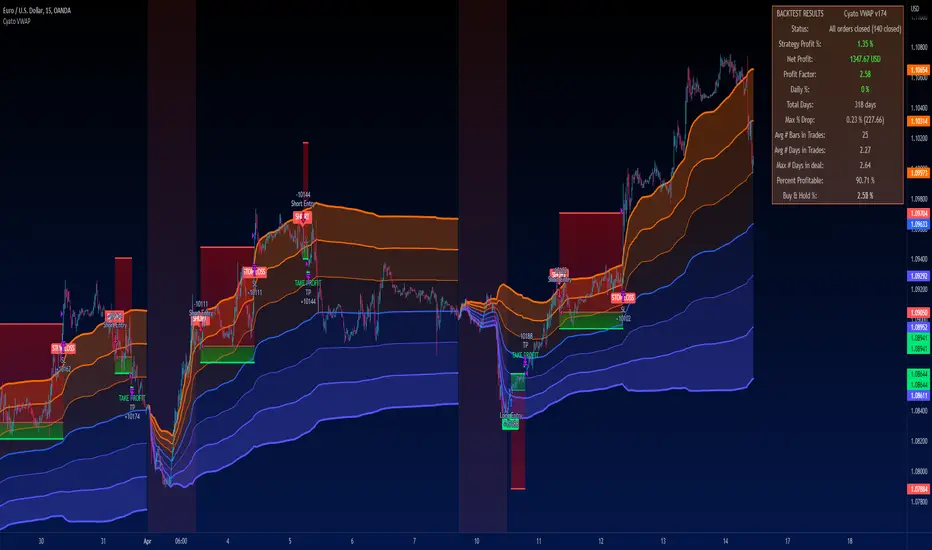

Cyatophilum VWAP Strategy

Use the Trend Mode to create Swing Trading strategies or Rotation Mode for Intraday Trading.

Configure your strategy using the Entry Condition Builder and Risk Management features, such as Trailing Stop & Take Profits, Safety Orders, and VWAP Exit conditions.

═════════════════════════════════════════════════════════════════════════

█ HOW IT WORKS

VWAP stands for Volume Weighted Average Price.

It is like a simple moving average that takes volume into account.

It is used by a lot of traders since it has everything one needs to know: price and volume.

The cummulated volume calculation resets every session, which interval can be configured.

From that we can calculate the MVWAP and the Standard Deviation Bands and create strategies around that.

█ HOW TO USE

Trend Mode

Trend Mode is the name for strategies built upon VWAP and price/MVWAP cross, most often for Swing Trading on high timeframes trending markets.

The side traded is often long and trying to beat Buy & Hold.

The trade exit can be triggered by a reversal signal (top chart), or a trailing stop (bottom chart) and take profit.

Rotation Mode

This is the mode for Intraday on low timeframes. It will work best on ranging markets.

We use the Standard Deviation Bands to buy/sell the price at overbougth/oversold levels.

The indicator allows to create complex entry conditions such as "Break out of 3rd bands AND break back in 2nd bands" within a certain amount of time.

We will use either the exit options to close the trade when prices reach an opposite band, or the risk management features explained below.

█ FEATURES

• VWAP settings

Configure the VWAP.

• Entry settings

Choose to go long, short, and if the strategy should reverse or not.

• Trend Mode

Choose to create entries from VWAP cross with price or MVWAP.

• Rotation Mode

Configure the 3 bands and build a condition for entry. The multiple inputs allow to add up different events required to trigger an entry, using 3 logical gates that can be linked together using a AND or OR condition. The events being: "break out", "Break back in" or "Just touches" any of the 3 bands. The condition must be met within a certain period of time to be valid.

• Exit settings

Options to exit trades at the end of every session or when the price reaches an opposite band.

• Stop Loss & Take Profit

Configure your stop loss and take profit for long and short trades.

You can also make a trailing stoploss and a trailing take profit.

• Safety Orders (DCA)

Create a strategy with up to 100 safety orders.

Configure their placement and order size using the price deviation, step scale, take profit type (from base order or total volume), and volume scale settings.

Graphics

A Configuration panel with all the indicator settings, useful for sharing a strategy.

A Backtest Results panel with buy & Hold Comparator.

█ ALERTS

Configure your alert messages for all events in the indicator settings.

Then click "Add Alert". In the popup window, select the option "alert() function calls only", give the alert a name and you are good to go!

█ BACKTEST RESULTS

The backtest settings used in this snapshot are the following:

- Initial Capital: 10 000€

- Order size: 10% equity

- Commission: 0.1€ per order

- Slippage : 10 ticks

Please read the author instructions below for access.

Script sur invitation seulement

Seuls les utilisateurs approuvés par l'auteur peuvent accéder à ce script. Vous devrez demander et obtenir l'autorisation pour l'utiliser. Celle-ci est généralement accordée après paiement. Pour plus de détails, suivez les instructions de l'auteur ci-dessous ou contactez directement cyatophilum.

TradingView ne recommande PAS d'acheter ou d'utiliser un script à moins que vous ne fassiez entièrement confiance à son auteur et que vous compreniez son fonctionnement. Vous pouvez également trouver des alternatives gratuites et open source dans nos scripts communautaires.

Instructions de l'auteur

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

Clause de non-responsabilité

Script sur invitation seulement

Seuls les utilisateurs approuvés par l'auteur peuvent accéder à ce script. Vous devrez demander et obtenir l'autorisation pour l'utiliser. Celle-ci est généralement accordée après paiement. Pour plus de détails, suivez les instructions de l'auteur ci-dessous ou contactez directement cyatophilum.

TradingView ne recommande PAS d'acheter ou d'utiliser un script à moins que vous ne fassiez entièrement confiance à son auteur et que vous compreniez son fonctionnement. Vous pouvez également trouver des alternatives gratuites et open source dans nos scripts communautaires.

Instructions de l'auteur

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/